Authors:

- Soo Boo Cheah, MBA, CFA Managing Director & Senior Portfolio Manager RBC Global Asset Management (UK) Limited.

- Joanne Lee, MFin, CFA Senior Portfolio Manager RBC Global Asset Management Inc.

- Taylor Self, MBA, CFA Portfolio Manager RBC Global Asset Management Inc.

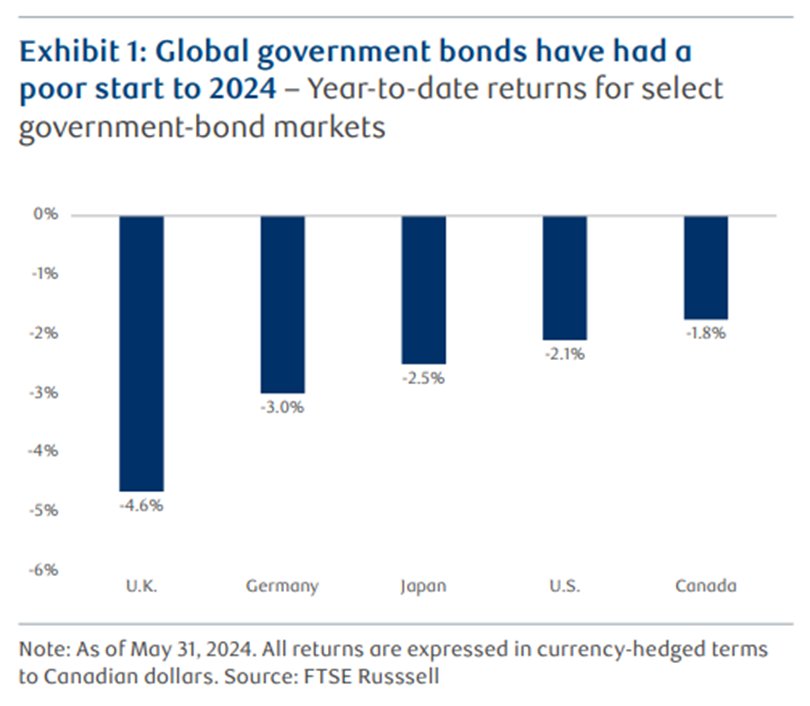

Global government-bond yields have risen since the last edition of the Global Investment Outlook, reflecting tempered investor expectations for central banks to cut interest rates. In the U.S., too-high inflation has been more persistent than expected and economic growth in the first half of 2024 better than forecast. Because of rising yields, government bonds in all major markets have posted losses so far this year (Exhibit 1).

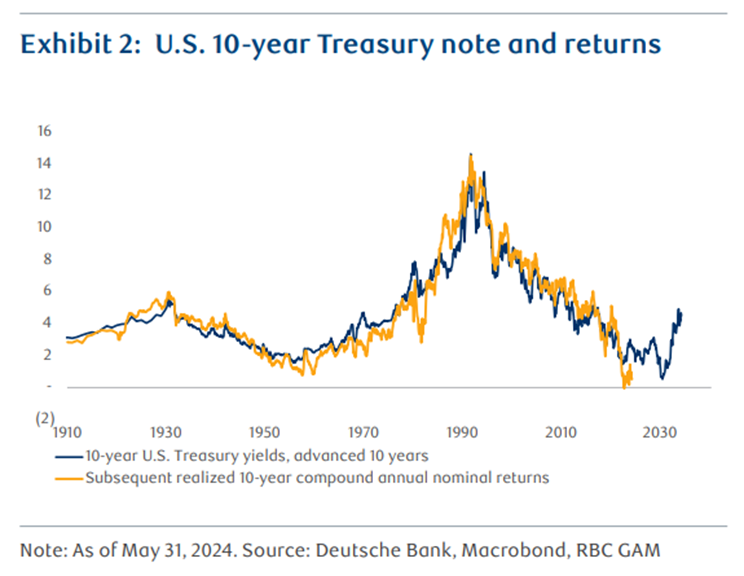

Does this portend another year of negative total returns for bonds? We don’t believe so. Some of this year’s poor performance is due to timing: Bond yields fell sharply just before the turn of the year and have since risen. Since last October, when yields reached multi-year highs, bonds have recorded positive returns as yields are now lower. Higher and more volatile yields mean simply that bond returns have become more variable than investors have grown accustomed to since the financial crisis. However, higher yields also provide investors with higher expected bond returns. Over the long run, a bond’s current yield to maturity is a good guide for future returns (Exhibit 2), so investors can expect returns of around 4.50% per year on the U.S. 10-year government bond if held to maturity. Over the next 12 months, we forecast that bond returns will likely be better than that as we expect most central banks to cut interest rates.

Policymakers in Europe and Canada have delivered their first interest-rate cut this cycle while those in the UK should follow suit before the end of the summer. The U.S. Federal Reserve (Fed) is likely to start lowering rates a little bit later, probably in the fall. Lower inflation means that policymakers can shift their focus toward supporting growth and labour markets, which have softened everywhere. This means rate cuts.

Policymakers tentatively admit that interest rates have likely peaked but are reluctant to endorse the suggestion that substantial easing of monetary policy is in the offing, which would be a boon for bond returns. For their part, investors expect central bankers to deliver between 75 and 125 basis points of cuts over the next year in Canada, Europe, the U.S. and the UK. Such decreases appear paltry compared with the several hundred basis points of rate hikes delivered over the past several years. Policy rates priced in forward markets two and three years from today are still well above those that prevailed before the pandemic. Measured against estimates of so-called neutral rates (the rate of interest at which monetary policy neither stimulates nor restricts growth), it appears that investors expect monetary policy will remain in restrictive territory for the next decade.

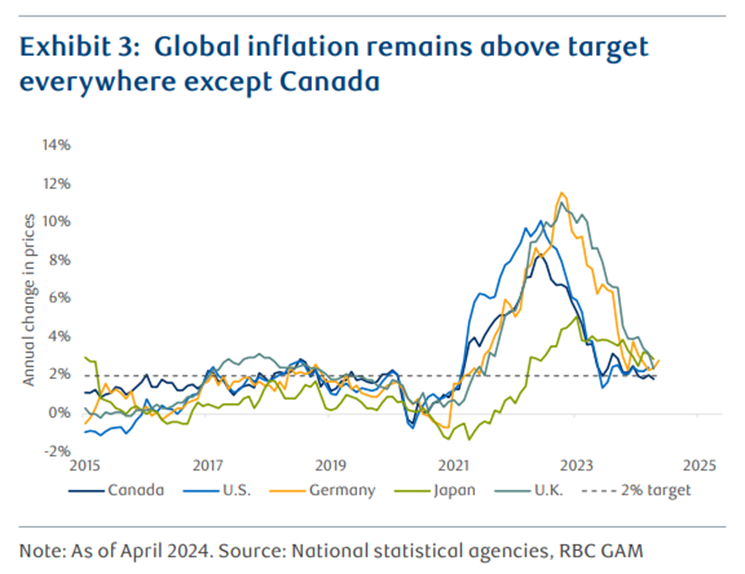

In effect, market expectations imply that there is no risk of recession or need for easy monetary policy over the next 10 years. This seems unlikely. We can agree that the immediate risk of recession has receded. RBC GAM no longer expects a recession in the U.S. over the next year, and in the near term it doesn’t appear that most economies need substantial help from monetary policy. While inflation has fallen precipitously, it remains above target in all regions even after accounting for methodological differences (Exhibit 3). Unemployment has risen, but from levels that were probably too low to be sustained without generating yet more inflation. Over the course of a decade, however, it is almost certain that many economies will experience at least one recession and that central bankers will cut rates more than currently expected. To us, this makes bonds attractive.

High expectations for policy rates through the long term could also be explained by the idea that perhaps the interest rates that economies would find restrictive have risen since the pandemic. Higher government deficits and greater investment needs to battle climate change – alongside the higher debt-servicing costs that accompany those burdens - can slow rather than accelerate growth. We are not as convinced about higher neutral fed funds rates as the market appears to be. We are more convinced that the market should price in a larger premium to lend over long time frames - the so-called term premium. Over time, we expect the Treasury yield curve to steepen, with 10-year securities offering investors higher yields than 2-year bonds, something that hasn’t happened since July 2022.

We think that with inflation having slowed at the fastest pace in three decades and unemployment rising, central bankers can conclude that current policy rates are indeed restrictive. As inflation falls further, we think most central banks will provide some cuts to markets, pushing down bond yields, particularly on bonds maturing over the next two to three years.

The fly in the ointment for this story of restrictive interest rates, falling inflation and coming rate cuts is the relative success of the U.S. economy in shrugging off sharply higher rates. Policymaking at the national level does not happen in a vacuum. The recent stickiness of price pressures and above-trend growth in the U.S. reduces the confidence of other central bankers that price pressures in their own economies have abated more quickly due to policy or simply reflect the waning impact of pandemic-related supply shortages. What is more, growth has been picking up in Europe, which has experienced particularly sluggish activity, and this trend may obviate the need for sharp interest-rate cuts to support the economy.

To be sure, we don’t anticipate a return to the pre-COVID period of exceptionally low interest rates. What we do expect is a return to more normal conditions, even without a recession. Inflation closer to policymakers’ targets and rising unemployment suggest that at least some monetary accommodation is appropriate.

We think most central banks will ease policy as the year progresses. Disinflation should continue in most countries and, after surprisingly high U.S. inflation to start the year, inflation has started easing again in the U.S.

(This article is reprinted from the Summer 2024 Global Investment Outlook, published by RBC Global Asset Management Inc.).

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2024. All rights reserved.