Long term outlook has not changed and that the short term volatility has been a huge buying opportunity.

Let’s take a look at how markets have behaved following past outbreaks. Although no two outbreaks are the same, we can learn a lot about how resilient markets have been:

| Epidemic | Month End | 6mth % Change of S&P | 12mth % Change of S&P |

| SARS | April 2003 | +14.59% | +20.76% |

| Avian Flu | June 2006 | +11.66% | +18.36% |

| Swine Flu | April 2009 | +18.72% | +36.96% |

| Cholera | November 2010 | +13.95% | +5.63% |

| MERS | May 2003 | +10.74% | +17.96% |

| Ebola | March 2014 | +5.34% | +10.44% |

| Zika | January 2016 | +12.03% | +17.45% |

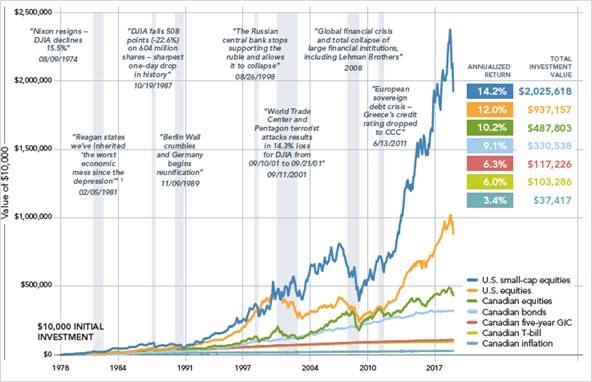

Many events have affected markets in the past; however, over the long term, markets have historically bounced back. Investors who stayed the course increased their wealth — and as you can see, the longer they stayed invested, the better:

Is it time to invest …YES!