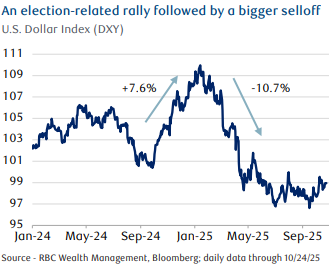

The U.S. Dollar has had a volatile year. Today we will examine reasons for this and the longer-term challenges ahead.

After a sharp slide in first half of 2025, the Dollar has settled into a narrower range. Foreign demand for U.S. assets was more resilient than expected. Concerns of capital outflows following the Trump administration’s tariff salvo in April have, so far, not materialized.

The magnitude of the dollar’s earlier weakness warrants some context.

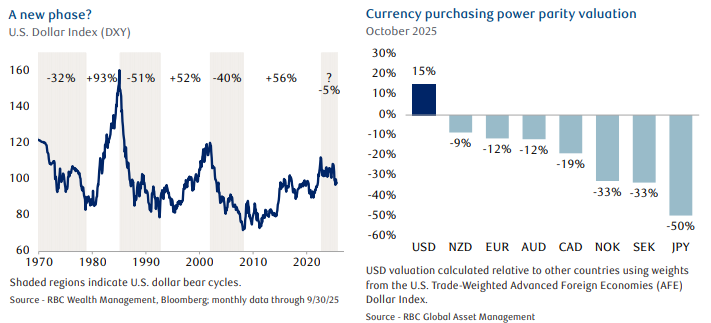

The U.S. dollar tends to move in decade long cycles. Strong dollar cycles have generated average gains of 65%. Weaker dollar phases have seen average declines of around 40%.

The U.S. dollar tends to move in decade long cycles. Strong dollar cycles have generated average gains of 65%. Weaker dollar phases have seen average declines of around 40%.

The latest bull cycle began in early 2008 and peaked in September 2022. Since that point, the DXY (U.S. Dollar Index) has fallen about 13%, suggesting that the currency may be transitioning into a new phase.

Even after this year’s depreciation, RBC Global Asset Management estimates that the U.S. dollar remains notably overvalued relative to major peers. Although valuations have limited sway on short-term market moves, they tend to revert to long-term trends.

A strong turn in the U.S. dollar’s structural movement would likely be a more conducive environment for equity markets outside the United States. Periods of broad dollar strength have typically aligned with U.S. equity outperformance. During periods of dollar weakness however, equity markets outside the U.S. have tended to perform well or take the lead.

If the U.S. dollar is transitioning to secular weakness, those dynamics could reverse— turning a longstanding headwind into a tailwind for investors.

Recent market behaviour underscores this point.

Broad-based dollar weakness in H1 2025 lifted the MSCI World (ex-USA) Index to a 19.5% total return, compared to the S&P 500’s 6.2% advance over the same period. Periodic shifts in relative growth and interest rate differentials between the U.S. and other economies can still generate countertrend rallies. Meanwhile, the dollar’s reserve-currency status should continue to underpin steady demand that could at times support its value beyond what fundamentals imply.

Nevertheless, valuations remain an important guidepost for assessing long-term expectations.

The combination of the U.S. dollar starting from a position of broad overvaluation and the elevated weight of U.S. assets in many portfolios reinforces the strategic merit for maintaining meaningful allocations to global ex-U.S. equities. Foreign exchange regime shifts can introduce uncertainty—but also opportunity.

For long-term investors, a trend transition toward dollar weakness could reopen a window for global equity diversification to reassert its value as a source of both return potential and currency diversification.

As always, please let me know if you have any questions or comments.