The One Big Beautiful Bill Act (OBBBA), U.S. President Trump’s mega-legislation implements sweeping changes across the U.S. economy.

Let’s examine the highlights, and overall economic impact.

Individuals:

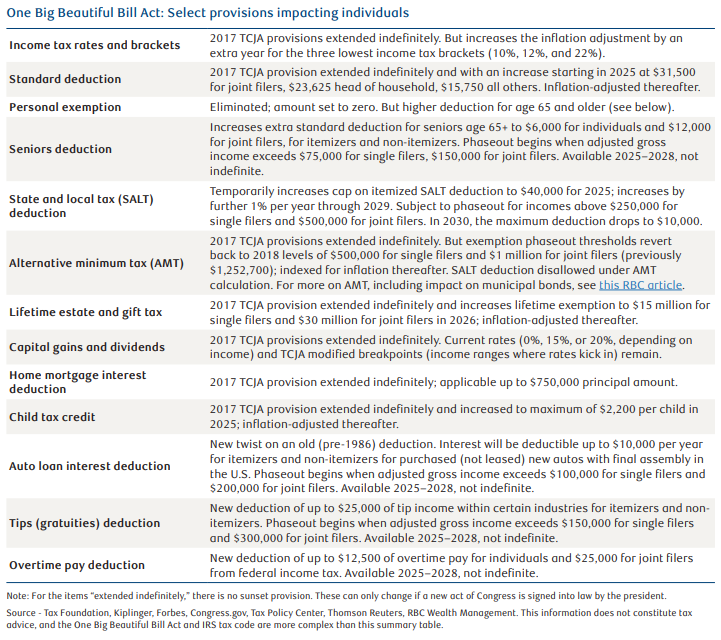

The One Big Beautiful Bill Act (OBBBA) did what was unthinkable when the Tax Cuts and Jobs Act (TCJA) passed during President Donald Trump’s first term back in 2017. Many of the TCJA provisions which were set to expire at the end of 2025, were extended indefinitely when the OBBBA passed Congress and was signed into law.

This affects the following:

- Income tax rates and brackets

- Lifetime estate and gift tax

- Capital gains

- Dividend tax rates

These and other indefinite provisions will change when new congressional legislation passes and is signed into law by the president.

The OBBBA also introduces temporary measures for the 2025–2028 tax years:

- A boost in the tax deduction for seniors aged 65 and older

- New tax deductions for tips and overtime pay

- Auto loan interest payment deduction

Section 899, known as the “revenge tax”—was stripped from the bill. After aggressive lobbying by industry and foreign groups, Treasury Secretary Scott Bessent negotiated a compromise with G7 countries.

The individual taxpayer OBBBA provisions, along with pro-business measures, helped boost the U.S. stock market as the bill worked its way through the House of Representatives and Senate.

Business

The OBBBA includes favourable pro-business measures::

- Expensing of domestic research and development (R&D) and equipment (short-lived assets) costs was reinstated and extended indefinitely. This reverses the TCJA’s five-year requirement. The nonpartisan Tax Foundation correctly notes that this essentially eliminates a tax penalty for capital investment, boosting long-term GDP growth by 0.7 %.

- Bonus depreciation for improvements made to qualified properties (warehouses, data centers, factories, other facilities, for example) was 60 % in 2024 and was set to phase down incrementally to 0 % by 2027. The OBBBA reinstates bonus depreciation at 100 % for properties placed in service after January 19, 2025. This rate is indefinite, so the level won’t change until new legislation passes and is signed by the president.

The Tax Foundation wrote, “Permanent 100 % bonus depreciation would reduce federal revenue by $432.4 billion over a decade ($242.7 billion dynamically) but boost long-run GDP by 0.4 %.” Companies in the Industrials sector and those tied to the artificial intelligence buildout are the most obvious near-and medium-term beneficiaries of these changes.

Clean Energy:

Clean Energy:

The industry that took the biggest hit in the OBBBA was clean energy.

The RBC Capital Markets Global Commodity Strategy team said the bill will “drastically shift near-term investments and the broad energy landscape.”, as it reduces clean energy incentives that were included in the Inflation Reduction Act signed by former President Joe Biden. OBBBA also expands subsidies for oil production, pipeline projects, and coal.

The new legislation speeds up terminations and phaseouts of many renewable energy tax credits, including for wind and solar projects.

Our commodity team anticipates “an acceleration of clean energy projects in the twelve months following bill passage, likely stressing an already full project pipeline and vulnerable supply chains.”

But it seems like this news was priced into many clean energy stocks ahead of time.

The NASDAQ Clean Edge Green Energy Index was weak earlier in the year and declined alongside the broader market in the spring, only to rebound sharply since the market’s April 8 low, significantly outpacing the S&P 500.

Can Tariff Revenue Offset Annual Deficits ?

Deficit projections associated with the OBBBA vary significantly, whether from the official Congressional Budget Office score, estimates from congressional committees, the Trump administration’s forecast, or estimates from nonpartisan organizations.

One of the discrepancies comes from how economic growth is forecast over the budget period, as this impacts the amount of revenue collected. Estimates for inflation and the cost of debt servicing during the budget period are also swing factors.

Another uncertainty is the savings associated with the controversial cuts to Medicaid and the Supplemental Nutrition Assistance Program (formally food stamps), along with any potential costs that may be incurred from people losing those benefits.

It’s best to view the potential deficit impact in terms of a broad range.

RBC Global Asset Management Inc.’s Chief Economist Eric Lascelles estimates the OBBBA could cause the cumulative deficit over the next decade to rise between $2.8 trillion and $4 trillion over and above what would have occurred had the legislation not passed. This range includes the more credible estimates in Washington.

Lascelles notes that tariff revenue could offset a sizeable chunk of this. He said the deficit “shouldn’t actually increase by several trillion dollars over the 10- year time horizon.” Even so, the $37 trillion level is a worrisome starting point.

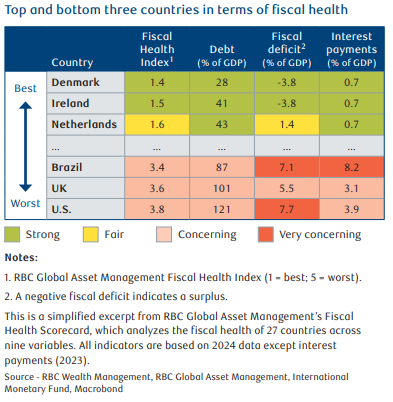

According to Lascelles’ Fiscal Health Index, the U.S. is currently in the worst position among major developed and emerging economies, with a public debt level that is “already fairly burdensome from a debt-servicing perspective.”

In hindsight, for many years investors had the luxury of being able to ignore high federal debt levels, as there were little to no consequences for U.S. financial markets and the dollar.

The debt buildup after the global financial crisis in 2008–2009, and the pandemic in 2020–2021, has seen the annual budget deficit averaging a whopping 6 % of GDP. The U.S. government’s fiscal outlook should no longer be ignored.

Economic Impact:

Brass Tacks – it all comes down to this: what is the likely impact on the economy?

Over the short term, there could be a small drag on growth. The Treasury Department will need to rebuild its cash reserves, which should temporarily reduce liquidity and act as a mild headwind.

Lascelles points out “the main thrust of the budget bill—tax cuts—should permit the U.S. economy to grow somewhat more quickly in 2026, and then be larger than otherwise in subsequent years (though not growing any more quickly).

Do not expect an enormous amount of extra growth. Much of the bill represents the extension of expiring policies. This avoids an economic deceleration rather than enabling an acceleration.

As always, please let me know if you have any questions or comments.