Good afternoon,

While summer rolls out and September approaches, we inch along bumpily in markets, occasionally touching new highs. The heat goes on, for now at least. More below, but first a quick flashback:

Circa June 1990. The old banker they called “Switchblade’ strolled by my office on his way to Monday morning coffee and tossed the file onto my desk. Barely breaking stride, he turned and left, saying: “It’s a piece of #&%.“ He was right.

I’d worked all weekend on the commercial loan file as part of my early training, but I didn’t believe much of what I was writing, pressured into recommending it by mentor who was weak on credit skills. (About as weak as my backbone that weekend, I suppose.)

Months later, I was working a problem loan on which Switchblade (“Switch” for short) had to approve strategy. The debtor was a slick-fingered Vancouver businessman who had some sort of “special relationship” with a higher-up in the bank. Local senior staff warned me to play nice, but that didn’t sit well with me, and I recommended we treat him like any other borrower.

This time, Switch came back with a twinkle in his eye this time and said: “He’s got a nicer car than me. Go get it.”

Switch wouldn’t last long around here these days with all the sensitivity training, and young, oft-tattooed bankers with stretchy jeans and nose bling. But the old coot was usually right, notwithstanding his bad manners. He was raised up in the ranks with frontier bankers who tended to keep a pistol in one drawer and a whisky in the other. He made regular use of the latter, and it eventually got the better of him, but that’s another story.

Here’s a few interesting charts:

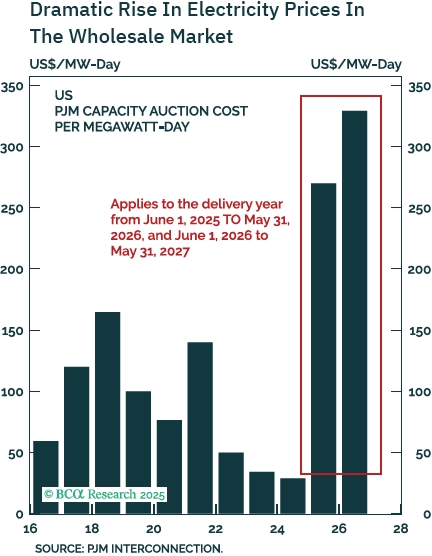

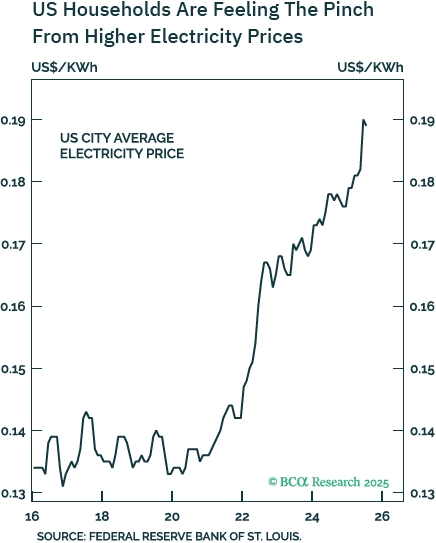

Maybe we don’t want data centres in our neighbourhood? (see charts below): “Data centers consumed 4.4% of U.S. electricity generation in 2023 and are leading to a surge in electricity usage. The Department of Energy expects that number to potentially triple over the remainder of the decade. Electricity prices have increased dramatically on the wholesale market. According to PJM, a company that operates the electric grid across the Eastern U.S., about three-quarters of the price hike can be traced to data center demand. In July, the average U.S. household’s electricity bill rose by 6.2% over the past year, more than twice the pace of overall inflation.”

Snarky Side question: I wonder what percentage the electricity to be generated in the site C dam is going to be used up with cat videos, conspiracy theories, and chummy A.I. bots?

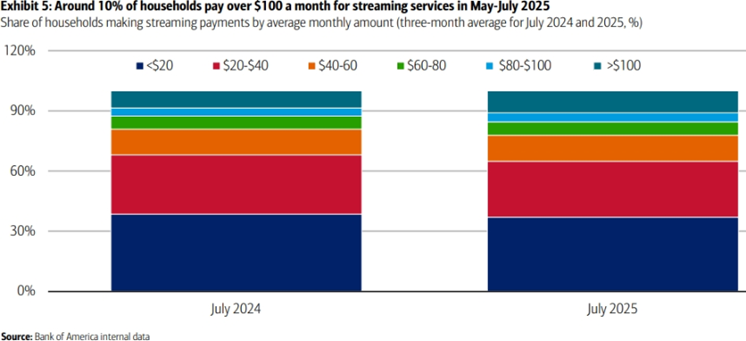

Streaming is getting expensive (see chart below from Bank of America): “We find that two-thirds of households paid less than $40 a month on streaming TV and music in the May-July 2025 period. On the other hand, around 16% of viewers paid over $80 per month. In our view, this relatively large distribution of payments may represent opportunities for streaming providers to boost future growth by attracting more light users to scale up.”

Snarky Side Question: Why do we need two graphs when they both look essentially identical? “Oh, hey look. Two data sets the same. Let’s make a set of twin graphs. I like rainbows.”

Snarky follow-up Canadiana: Umm… also these are way cheaper than Canadian streaming service bills. Gee thanks CRTC.

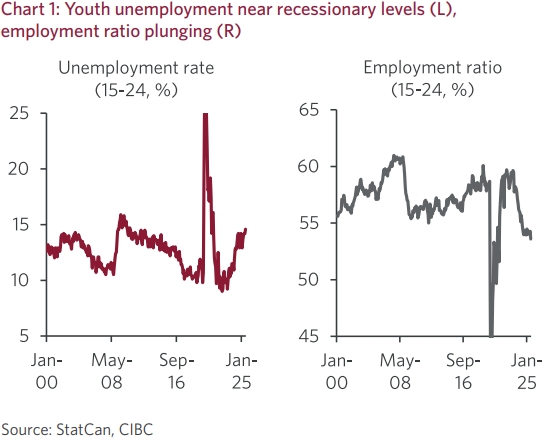

Canada youth unemployment (see chart below from CIBC Economics): “The troubles faced by young people finding work are not new, with their jobless rate having risen steadily since 2022. But the most recent step up has taken unemployment to levels typically only seen during recessionary periods (Chart 1, left), and has come in contrast to a surprisingly resilient labour market for other age groups. Moreover, there’s no evidence that the 15-24 unemployment rate is being exaggerated by increased labour market participation. Indeed, if anything the employment-to-population ratio shows an even more worrying trend (Chart 1, right).”

Snarky Side Comment and Question:

Beware nihilism: Implied in these data is the fact that the two sets of figures don’t add up to 100%. The difference is important, (though more for adults than youth). For example, in January 2000, about 13% of youth were unemployed and about 56% were employed, for a total of about 69% either working or hoping to find a job (56+13=68). The remaining 31% are neither working nor looking for work. And more importantly, this is after removing students from the statistics altogether. So around 31% of non-student youth aged 15-24 are neither working nor even looking for work. So this is a serious concern.

Dang that’s not a happy thought at all.

Unfunny Snark: And…. Refer above regarding site C dam, and ponder what percentage of the unemployed, disengaged youth are addicted to watching dancing kittens on TikTok.

Also kittens are inferior to puppies.

Oh-oh! Quick! Find some happy thoughts!

Insert here:

Happy Thought: Dogs are superior, and they nearly always make your day go better! And unlike cats, dogs smile.

Funny Video of Dogs Cooling Off: (try not to think about Site C dam usage while eating up internet data watching puppies. It’s worth it in that case (though not with cats): https://youtu.be/YbIBycUNqS0?si=7ixxz3gUepboP3D7

And here’s some tips on keeping our dog cool in the summer heat (don’t try this with your cat. Your cat already wants to kill you in your sleep). How to Cool Down a Dog

Here’s RBC Wealth Management's latest investment newsletter.

Nothing new about September slides

Equity investors have long dreaded September. But we provide some context as to why stocks tend to sag in the month. And rather than turning tail just because the calendar has flipped, we explain why investors should keep their eye on the long-term ball when it comes to portfolio positioning.

Regional developments: Canada removes all USMCA retaliatory tariffs on U.S. goods to encourage trade negotiations; Fears of a dovish Fed hit long bond prices; French political turmoil stirs markets; Strong rally in China’s equity market met with new investment curbs

More here: Global Insight Weekly.

Actual happy thoughts:

It’s weird out there, I’ll admit. But democracy is a messy sport. As my dear friend Eugene used to say, “if you leave the kids out in the field with a ball, eventually rugby happens.”

So maybe we should take a measure of comfort when everyone is bickering. It’s not ideal, but it’s preferred over the utter silencing of critics. It’s when there is no dissent allowed, no barking opposition in the nightly news – when everyone quiets their critiques and falls in line -- it’s then that we really need to worry.

Meanwhile, as the brilliant political historian Stephen Kotkin recently said (I’m paraphrasing).

“Around the world at US embassies every day you will find two crowds of people. The first and loudest, is a noisy herd of chanting protestors with signs and complaints, many of them legitimate to an extent. But around the corner at the gate, there’s another crowd, lined up halfway down the block, patiently waiting for their turn to apply for a visa to travel to the USA., and take the opportunity to enjoy life there.”

It’s not lost on me that the most vibrant economy in the world for the last 150 years or so has also been the loudest bunch of argumentative schoolyard clowns imaginable.

So here we are.

Enjoy your weekend!

Mark