Good afternoon.

It’s an essay.

You’re welcome.

There’s the kowtow, and then there’s the "grand kowtow." The latter involves slowly kneeling and bowing so deeply that one’s forehead hits the floor – three times. This ritual was once mandatory for foreign envoys meeting with the Chinese Emperor, who considered himself the centre of all creation. The expression is repeated three times, for a total of 9 head-bangs onto the floor as a sign of deep humility (or humiliation). It was also the subject of much controversy when England’s Lord Macartney refused to fully embrace it on his initial ambassadorial visit to China in 1793.

The image above shows a 12 year-old English boy who was among Macartney’s group, doing a slightly prouder version, kneeling as he would have done in front of his own king as a compromise.

This infamous meetup , rightly or wrongly, is considered the opening volley leading to China’s “Century of Humiliation,” (circa 1839 to 1949) which was then followed by the terrible-horrible no-good-very-bad-to-worse 4-decade-long self-imposed economic disaster, known as communism -- that ickiest, stickiest of sticky thought-boogers which the Chinese decided was A-okay to import from the west.

Maritime versus Continental Powers

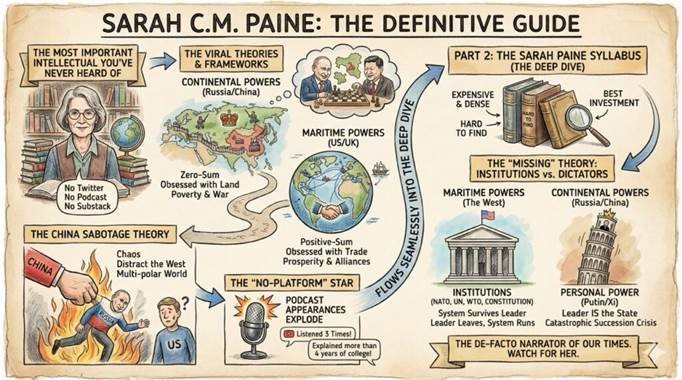

Dr. Sarah C. M. Paine, a retired historian and professor at the U.S. Naval War College has published a series of works and lectures in which she spellbindingly contrasts maritime and continental powers.

Maritime powers — historically Britain, the U.S., Japan, and the Netherlands — relied on big motes and commerce. Oceans and great navies defend them. A rules-based international system compounds their wealth. This approach treats oceans as shared commons, promoting win-win outcomes through alliances, sovereignty, and institutions like the WTO, and NATO. Since the Industrial Revolution, maritime orders have dominated the earth, with 90% of global goods travelling by sea. The system has created great trade-driven prosperity, vastly outperforming territorial conquest, lifting (literally) billions out of poverty. Unevenly, yes. Imperfectly, yes. But undeniably. Without Adam Smith, there would be no Jane Austen, no stander-upper to Hitler in Europe, etc.

Land-based Strongmen: On the other hand, the continental (land-based) powers—such as Russia, China, and historical Germany—faced vulnerable land borders, requiring large armies (not least to suppress their own people) and tended toward zero-sum thinking. Their ideas of growth concern land-based conquest, spheres of influence, resulting in economy-destroying war and overextension. Paine views this land-based mindset as inferior, producing isolation, economic stagnation, and collapse, as seen in Russia’s invasions or China’s debt-trap diplomacy.

Here’s an excellent visual and point-form summary of Paine’s work, written at a sort of fifth grade level (just right for me!): https://barbarosozturk.com/blog/sarah-sally-c-m-paine-the-historian-that-is-about-to-get-internet-popular/

A here’s a visual teaser (below):

Paine worries that the maritime system is at risk. Maritime powers integrate national power (diplomacy, economy, military) toward sustainable objectives, investing decades in navies, education, and alliances while adapting through open debate in democratic systems, thus avoiding catastrophic errors. Continental autocracies, conversely, favor short-term populist tactics: dictators mobilize for quick gains, suppress dissent, double down on mistakes, and prioritize personal power over national prosperity.

But since the Russians invaded Ukraine, and ascent of He Who Must Not be Named, there’s been a greater trend back toward “spheres of influence,” geographically adjacent clumps of great power dominance, and where the strong lean hard on the vulnerable.

Some reading:

Examples from Sarah C.M. Paine’s Books:

The Japanese Empire: Grand Strategy from the Meiji Restoration to the Pacific War (2017)

The Wars for Asia, 1911-1949 (2012)

The Sino-Japanese War of 1894-1895: Perceptions, Power, and Primacy (2003)

Other Authors:

- An absolutely outstanding and very readable work on the relationship between China and the US, is John Pomfret’s: The Beautiful Country and the Middle Kingdom.

- A very personal take on Pomfret’s experience with some of the earliest days after the Cultural Revolution, see his earlier book: “Chinese Lessons.”

- A detailed description of the blatantly thuggish oligarchic machinations in Putin’s Russia, see Bill Browder’s “Red Notice.”

- For a historical detailing of Russia’s propensity to enter into ridiculous wars and justify itself regardless of the outcomes, see “Russia, The Story of War,” by Gregory Carleton.

And if you’re still feeling thirstily autodidactic, I have a bunch more of these books to recommend, and a couple more five-syllable words. Just ask. (Seriously).

It’s Friday. Graphs were $1.49 at the Graph Superstore.

The impact of government funding and price controls on… prices: Data shows that government mandated (and funded) stuff is even more expensiver.

The price goes up, though not the quality, given that they tend to also want a monopoly. See graph (left) for some US data for 2000-2025.

Good luck New York city.

Some analysts suggest that that silver is overbought. The chart below suggests that “momentum traders” (speculators) were a major driver of silver’s price increase over the past months, which increases the risk that they may move on to something shinier at some point.

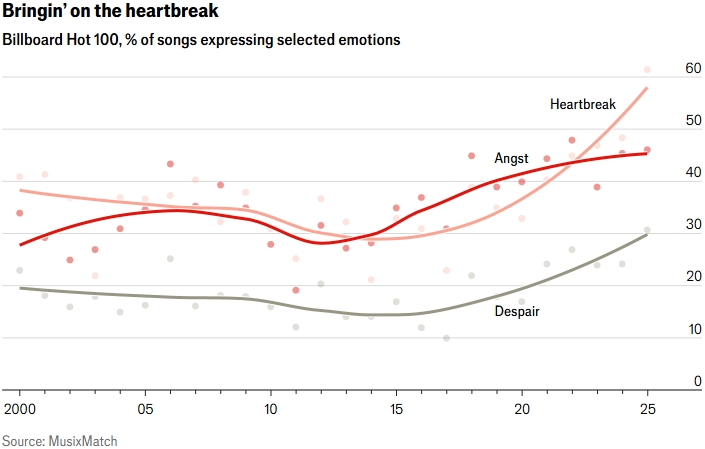

Popular music is getting sadder and angstier (see chart below from The Economist): “Melancholy is the mood of the moment. This conclusion comes from examining song lyrics. MusixMatch gathered lyrics from the Billboard top 100 songs for each week over the past 25 years. The share of hits with lyrics invoking “angst” has increased by 13 percentage points in the past two decades. This puts “angst” neck and neck with “heartbreak”, which has also been on the rise, over the past five years. “Despair” also began to increase sharply after 2020. Now a quarter of songs in the top 100 have lyrics that hint at misery—think of moody hits by Billie Eilish and Sam Smith.”

Basically, the whole earth is morphing into a country song, but without cowboys and trucks.

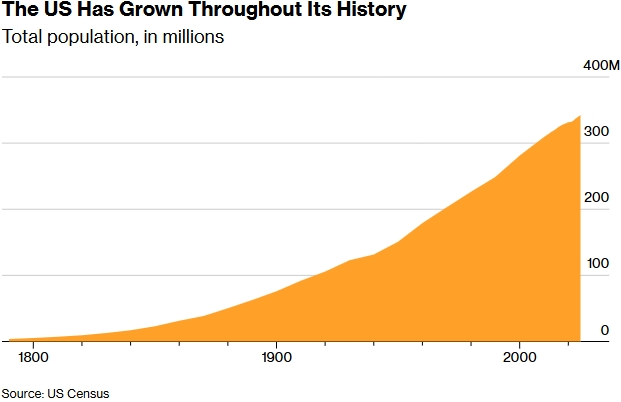

U.S. is flirting with its first-ever population decline (see chart below from Bloomberg): “A country’s population is an essential element of its economic mass. The shrinking population of China, which in 2025 recorded its lowest birth rate since Communist rule began in 1949, is one good reason it may never overtake the U.S. as the world’s largest economy. Japan’s population peaked at 128 million in 2010, and its decline has dragged on growth for years. Europe’s worsening demographics have long fed its narrative of economic malaise.”

- “The U.S. has for years mostly stood apart from that conversation. In 2023, when the U.S. Census last issued long-run forecasts for the population, the main prediction was that it would decline for the first time in 2081. But the way things are going, this year the U.S. is at best poised to record a lower population growth rate than Germany, where an aging population has contributed to its reputation as the “sick man of Europe.”

AI bots are learning how to shop (see chart below from the Financial Times): “Sales driven by AI platforms will account for about 1.5 per cent of U.S. retail ecommerce this year. Agentic chatbots threaten to transform the online shopping experience, which has been dominated by search engines and retail websites since the 1990s. The new technology poses particularly acute questions for Amazon and rival Walmart.

So, AI is sending everyone to Walmart, pop songs are getting sadder, and nobody is having babies?

Coincidence?

Hmmm…

Lastly, here’s our weekly investment news piece.

RBC Wealth Management's latest investment newsletter.

Crosscurrents buffet U.S. dollar and Treasury market

Global and domestic headlines have put the focus squarely on U.S. sovereign assets. We look at what steps investors should take in this time of shifting economic messages.

Regional developments: Bank of Canada maintains its key interest rate at 2.25%; From “Liberation Day” to the S&P 500 hitting 7,000; Euro strength not an issue so far, plus key results from the corporate earnings season; Possible intervention to prop up the yen?

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend singing sad songs at Walmart!

Mark