Good afternoon,

I mentioned snowbirds last week but could have added that more than a few have also grown tired of it. Data below, from Bloomberg, shows growing Trump fatigue among Canadians with the means to travel.

Canadians took 28% fewer trips to what some have described as a surreal, SpongeBob Tariff Pants world they’ve endured while travelling south. We visited our southern neighbour 22.9 million times in 2025, which is 9 million fewer than the prior year as the Trump administration’s trade war hit a nerve.

Also, the share of Canadian exports destined for the U.S. dropped to 67.3% in October—the lowest level since 1997, outside the pandemic.

Ice-Cream Grows on Trees. A young lady got me thinking this week with this opener:

“I’m just so curious what New York will look like in four years. Thoughts? I know big cities often tend left, but it just blows my mind that such a huge centre of business and trade voted in a socialist. Maybe it will be like Montreal - - all the businesses will move out, and people will reminisce about its glory days.”

And then my Dogbert tail wagged involuntarily.

I mean, it worries me, but these young people tend to wear socialism like Covid masks – all churned up with hot moist spit, but quickly disposable when it’s time for dinner. Why? Because nobody wants their favourite restaurant to feel like a trip to ICBC.

The Magic is right there in the Cities: Yes, it’s true that big cities need to lean on the kind of order that governments lend, and this tends toward being over-managed leftishly, but I had an epiphany last time I was in Toronto. Big cities, especially right downtown, are just teaming with delicious food, entertainment, beautiful architecture, and transportation miracles. They’re so much fun! So many young people. So many of them (lately) leaning left, contrastingly flock to these cities. Why? As saviors? These cities starkly contrast ultra-focused versions of every possible inequality -- the most expensive real estate on earth, the wealthiest owners, the richest second class (their parents?) and the poorest of the poor pouring out into the streets around them. It’s all ambience in their rescue fantasy. If they read Les Mis they’d remember that Jean Valjean became a generous entrepreneur, not a collectivist tyrant.

But, unconsciously, I suspect, they’re actually in these cities to veritably bathe in all the sweet delights of… wait for it… sitting atop the food chain of a free marketplace. Situated literally in the most competitive landscape on earth, (“If you can make it there…”), those hungry restauranteurs and street vendors vie for their attention! The t-shirt shops, tattoo artists and others stand in the sidewalks and doorways and yell – come on in! And none of this even surprises these royal-minded young people. Yet it’s the very manifestation of that capitalism they pretend to hate.

Last year, one young lady in Toronto sort of jumped onto the page for me. She was riding a bike, delivering Skip the Dishes at around 11:15 pm on a weeknight. I surmise she was probably a student. Probably just getting by. Probably from Asia (she was speaking Chinese). Hungry. Not so likely to show up for the young socialists club. Too busy making the city function. She’s a cog, but she’s going somewhere, that’s for certain. And her parents should be proud of her.

The young socialists flock to these cities in droves and just sort of lick the ice cream. In truth they must LOVE it. They can order a hot sandwich or pretty well any cultural delicacy on earth for about $10. At midnight if they so choose. Shut down a couple of restaurants and they’ll leave.

Charts:

Oil Shocks: Since 1979, there have been eight notable instances of regime change in medium-to-large scale oil-producing nations, each with significant implications for global oil prices and supply dynamics (Figure 3). Oil prices tended to rise about 5% in the first month, but over a three-month period from the, they averaged a 30% increase, eventually stabilizing at levels around there.

Mind you, the argument in Venezuela is to bring production back up, and in line with American interests.

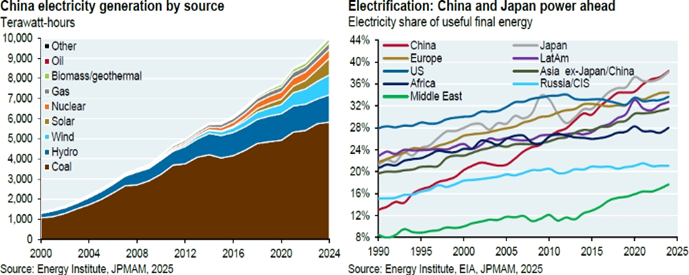

China’s electrification by mountains of coal (see charts below): “China has been steadily climbing the innovation food chain across a range of industries. China’s ability to scale the moat may rely in equal parts on innovation and brute force power capacity. It’s mostly coal-generated, but China is electrifying its energy consumption at the fastest pace in the world.”

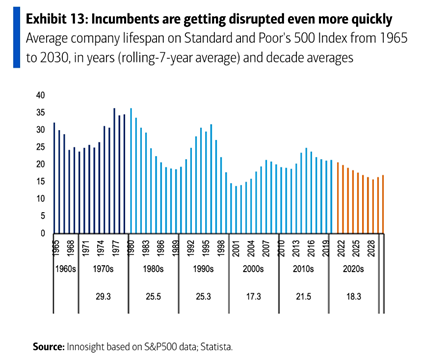

The average lifespan of an S&P 500 company is getting shorter (see chart below): “The growing impact of disruptive companies can have downstream effects on incumbent companies. Roughly a third of the S&P 500 has been replaced since 2015. In 1958, the average seven-year rolling lifespan of a company on the S&P 500 was 61 years. By the 1980s, it had dropped to 30 years, by 2016 it was 24 years, and by 2021 it was 16 years. If we continue on this road, by 2027, companies could last just 12 years as they become increasingly disrupted.”

Here’s RBC Wealth Management's latest investment newsletter.

Setting the stage for a sustainable Chinese equity rally

Last year, once again, saw positive market results despite many naysayers. Can this rally extend into 2026 in the face of long-term challenges? In this article, we examine China’s policy stance, economic fundamentals, and equity market implications to find answers.

Regional developments: Consumer spending in Canada remains resilient; President Trump pressures the Federal Reserve and lenders for lower rates; Europe’s biggest stock by market cap hits all-time high; Japanese prime minister plans snap election

Full story here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend!

Mark