Good afternoon,

If inflation falls in the forest, does anybody hear it?

As the week winds down, a weaker April in markets fades into an early modest comeback in May, and on the year so far, we’re doing okay. But all eyes stay focused firmly on inflation, and its impact on policy interest rates. Or more accurately, the argument between rates and inflation – and chickens and eggs. And fiscal policy

Fed and Friends: It’s an unwieldy effort, and I wouldn’t want their job. Imagine the fed as a fully loaded logging truck being navigated by a committee of lab coat clad engineers, all looking like earnest clones of Mr. Magoo, squinting against the windshield. They lumber along, (so to speak), but there’s nothing precise about their effort. And momentum can be a costly enemy.

Fed and Friends: It’s an unwieldy effort, and I wouldn’t want their job. Imagine the fed as a fully loaded logging truck being navigated by a committee of lab coat clad engineers, all looking like earnest clones of Mr. Magoo, squinting against the windshield. They lumber along, (so to speak), but there’s nothing precise about their effort. And momentum can be a costly enemy.

Next, add in all the little feds -- in Canada, the UK, Europe, etc. – let’s call them “fed-ishes.” They feign independence but can’t afford to let the infamous crew of Magoos out of view. If there’s a criticism, many economists worry they all try to do too much – or believe they can. And mistakes can be costly.

Speaking of the Fed, have a look at this week’s Global Insights:

The Fed adjusts its focus, but the rate outlook remains blurry

The Fed keeps playing down upside risks to inflation, but did it just start playing up downside risks to labor markets? Ahead of key jobs data, how sensitive might the Fed be to any labor market weakness?

Regional developments: Canada’s Trans Mountain Pipeline Expansion now in service; Employment costs in the U.S. rise while consumer confidence weakens; Europe: Growth picks up, inflation progress slows; Volatile swings in the yen.

Full read here: Global Insight Weekly

Tatlin’s Tower: In a grand gesture of what they saw as the dawn of a new world, Soviet arts and sciences were mandated to symbolize cooperation. But apparently these ideas didn’t bleed well into architecture. Tatlin’s Tower was designed in early revolutionary Russia to straddle the Neva river in St Petersburg. The 1300 foot (400 meter) iron and glass Monument would surpass Paris’s Eiffel Tower in both scale and complexity. (See drawing and artists building a model below).

Inside the external metal structure, four geometric glass-walled volumes were intended to revolve at different speeds – in different directions!

- At the base a massive cube for lectures, legislative meetings, etc. was to rotate annually.

- Next a smaller pyramid would house the Comintern and rotate monthly.

- Further up, a cylinder for the propaganda ministry would rotate daily.

- And at the very top, broadcast equipment would revolve hourly.

- Get it? Revolutions upon revolutions… Also ponies. For everyone.

| The Central Power Tower Hour. In the rendering below, Tatlin’s tower is shown dominating the St. Petersburg skyline. The glass and iron structure was to be the symbol of collectivism.

Looks like a big wedding cake for the Iron Giant and Alice the Goon. |

Perhaps, inadvertently, what Tatlin’s Tower illustrated best was the often-unappreciated value of humility. There’s folly in assuming the supremacy of our ideas, especially big, newworldly ones that require mowing down anyone who disagrees.

Tatlin’s much later project was a one-man flying machine. A subtle rebellion perhaps? Had he given up on collectivist symbols? It never flew, so who knows?

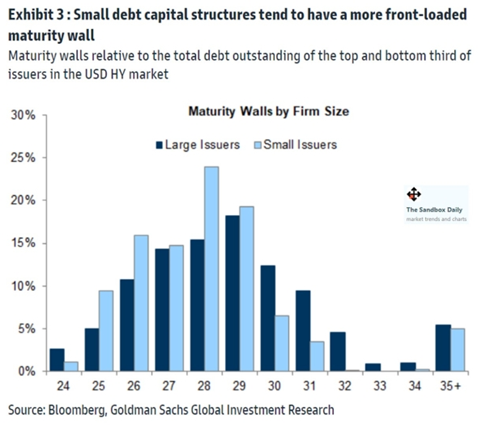

The Maturity Wall refers to the varying clumps of corporate debt maturing in the next few years, which will have to be renewed at whatever prevailing rates are at the time. Held especially in light of the new, higher interest rate environment, it’s a worry wall of sorts for markets. (See chart to the left).

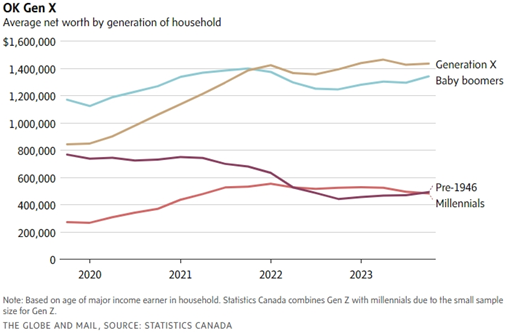

Hey what the…? According to the Globe & Mail, (see graph above), during the pandemic, Gen X, (born 1965 – 1980) “…overtook every other generation to become the wealthiest in Canada… driven by a combination of financial assets as well as real estate.”

I would love to see this data! Did they earn it or largely inherit it? Interesting.

I guess the cat’s in the cradle.

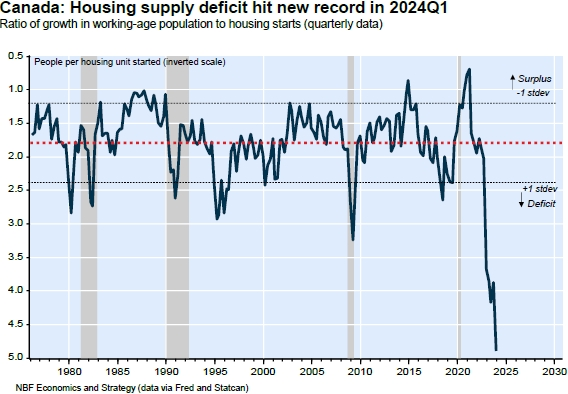

Canadian housing: Supply deficit hits new record (see chart above from NBF Economics and Strategy): “According to CMHC, although Canada’s working-age population grew by a record 300,000 during the quarter (a 3.7% annualized increase), housing starts were essentially flat at 61,000 units in the first quarter of 2024. This means that there is currently only one housing start for every 4.9 people entering the working-age population, compared to a historical ratio of 1.8 (that’s a 5.4 standard deviation).”

Oops.

Enjoy your weekend!

Mark