I WON’T DO IT

In last year’s September edition of Marche Monthly, I wrote:

“Our equity portfolios are up approximately 20% so far this year. Our fixed income portfolios are also outperforming. Last year, we were putting as much money to work as possible. Now that the market is doing so well, we are being extra careful.

“A significant driver of recent performance is declining interest rates. Related, a key pillar of our long-time equities strategy is to own stocks that pay dividends.

“And yet – as always – we exercise caution.”

I am presenting it again this September because, you guessed it, a very similar state of affairs exists here in 2025.

Our portfolios have had a strong year so far. But caution is warranted, because this market is getting long in the tooth. We may begin to underperform in the short term, because this is the point in the cycle where there is excessive risk-taking – something I simply will not participate in.

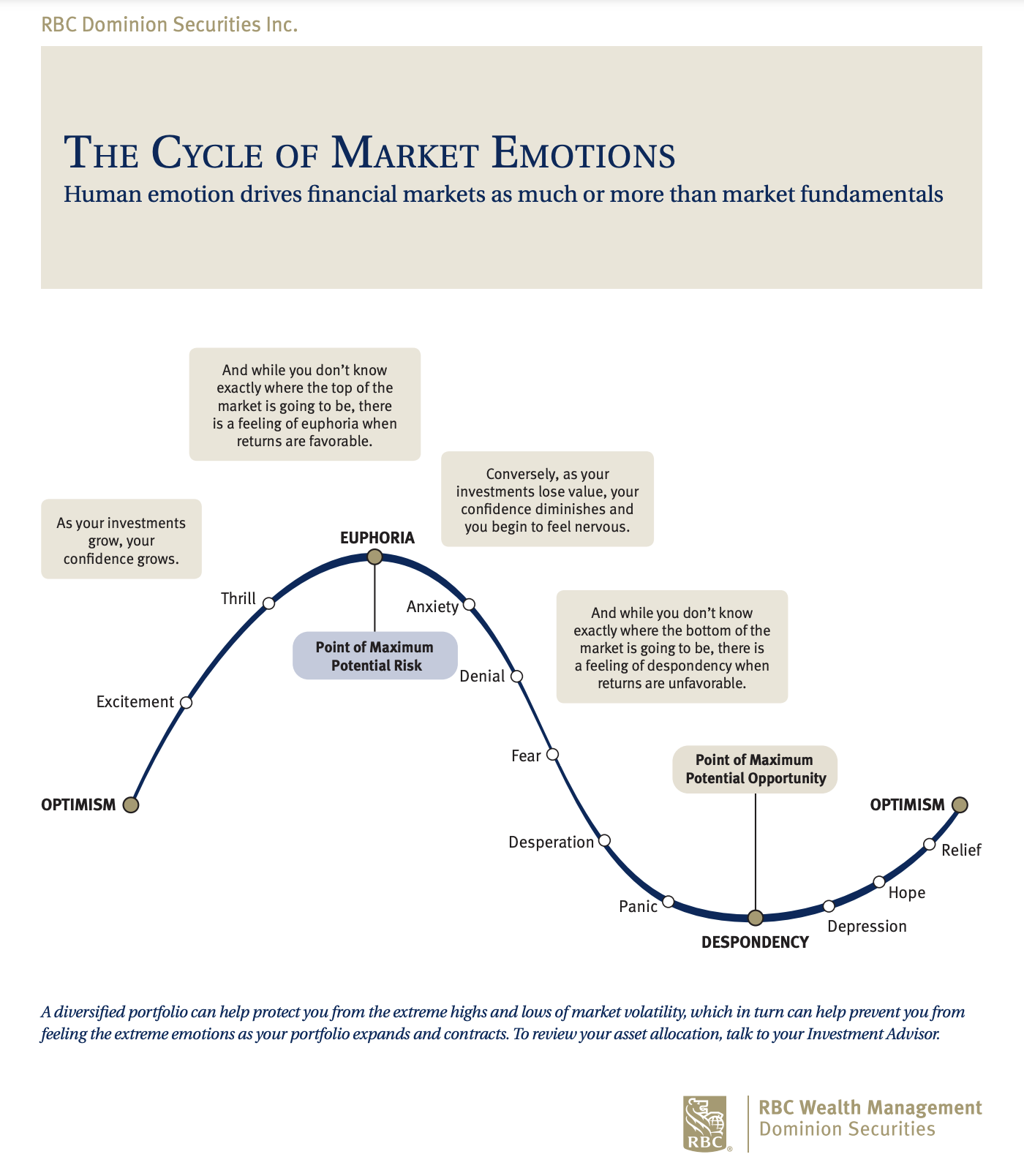

You may recall the Cycle of Market Emotions, which we have discussed in this blog in the past; please see the graph below. My view is that we are now approaching Euphoria – which as you can see, is the point of maximum potential risk.

The S&P 500 index, which we consider to be the authoritative indicator of how the markets are doing overall, has almost doubled in the past three years. Much of that has been driven by AI stocks, and now we are starting to see other pockets of the market – quantum computing and bitcoin, for example – that are driving it in a disproportionately powerful way.

The market is now at its most expensive since the dotcom bubble burst in 2000.

We have the right strategy – the same one we have had for many years and which I have written about in this blog many times. We remain confident in that strategy. And we are confident that in the long run, we will continue to achieve above-average results. A key component of achieving those above-average results is to exercise caution at appropriate times, especially in times like right now – when others are not.

THE WARREN BUFFETT INDICATOR

Everything we have done very strategically over the past number of years is now reflected in our performance, which, despite the market doing so well, is in fact outpacing that market. As a disciple of Warren Buffett and his many famous maxims, I remind myself especially of this one: "A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful."

Mr. Buffett – the world’s most famous investor and one of its richest people (net worth: $160-billion USD as of this past May) – has given us a huge wealth of wisdom and tools to help us invest prudently. That includes the “Warren Buffett Indicator,” which compares the value of the market to the size of the US economy.

Right now, the value of the former is more than double (217%) the latter. This is an unusually high ratio, suggesting stretched valuations vs. actual economic output. As one article has put it, “Think of [the Warren Buffett Indicator] as a price tag for the whole stock market compared to America’s economic “paycheque;” when the price tag is double the paycheque, expectations are sky-high and disappointments can sting more.”

All of this suggests caution and a doubling down on Buffett fundamentals we have always practiced:

-We only provide investment solutions we understand fundamentally.

-As part of this approach, we focus on owning companies which:

--Have a track record of creating shareholder value

--Have management that treats shareholders as partners

--Are trading below intrinsic value

--Have a simple, easy-to-understand business model

We tend to manage concentrated portfolios composed of quality businesses we want to own for many years. We believe this approach will maximize long-term performance, improve after tax returns and keep costs to a minimum.

For more information on our equities strategy, or to review our fixed income strategy, click here.

SHUT DOWN SILVER LINING

Funding covering roughly a quarter of the budget for the US federal government expired on October 1st, causing a partial shutdown that will disrupt a range of government services.

We have seen this before, as partisan divisions once again create a standoff over a budget agreement. It is important to note that not all federal services “shut down.” Essential operations, including Treasury payments and mandatory spending programs like Social Security, continue uninterrupted. Federal workers, however, are typically placed on temporary leave and receive backpay when government financing is restored.

US government shutdowns vary in length, often producing some short-term turbulence – which, as our clients and regular readers of Marche Monthly know, we embrace.

Why? Because volatility sometimes gives us the opportunity to buy assets that we believe are priced below their intrinsic value. They are selling at a discount, in other words, which allows us greater upside when there is a return to the upward trajectory that defines long-term markets.

The past demonstrates that stocks tend to weaken just before, during, and shortly after a government shutdown ends, and that any weakness is typically short-lived. Regardless of how long any volatility lasts, be sure that we are always ready to capitalize by putting money to work, if it is prudent to do so.

HANGING IN

Here in Canada, our economy is holding up, despite ongoing trade disruptions that have weighed on exports, business investment, and overall growth. Canadian GDP rebounded by 0.2% in July, after contracting for three consecutive months. However, the overall Canadian economy shrank by 0.4% in the second quarter, with falling exports and weak business investment as key factors.

High interest rates have until now acted to discourage consumer spending and housing activity; in last month’s edition of this blog, I stated my belief that the US Federal Reserve and the Bank of Canada would lower interest rates (the BOC after taking too long to do so). Both central banks did indeed on September 17th.

HOME PRICES – FOR YOU OR SOMEONE IN YOUR FAMILY

RBC Economics now forecasts a modest expansion in the third quarter. Sentiment has also perked up, with strong equity market performance helping to lift household net worth in the second quarter, while housing has been made at least somewhat more affordable by softening home prices and lower interest rates.

On that note, we urge all clients to have a close look at the First Home Savings Account, whether they are considering a first home for themselves, or are looking to help younger generations.

TAX LOSS SELLING?

Because we are having a strong year, one tool of year-end tax planning is essentially unavailable to us: tax-loss selling.

This is a strategy in which we sell investments that have incurred a loss, thereby offsetting taxable capital gains. This year, as in most years, we have no meaningful tax loss opportunities in our portfolios.

That said, we have many tools at our disposal to minimize the impact of taxes on our individual and incorporated clients, helping them preserve and grow their wealth as efficiently as possible. These tools include alternative investments that can generate high, tax-exempt rates of return, and allow money in a corporation that would otherwise be taxable to pass to beneficiaries on a mostly tax-free basis.

If you would like to learn more about these opportunities, please contact me.

Enjoy the fall!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

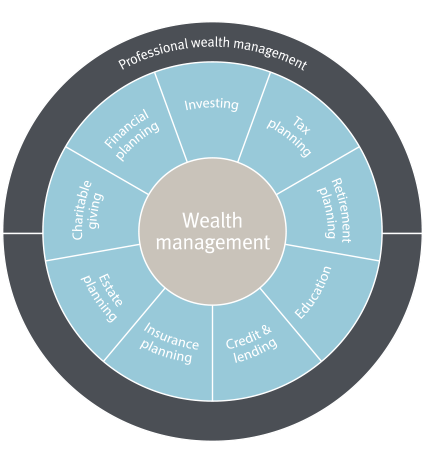

WHAT WE DO