GOING ON DEFENCE

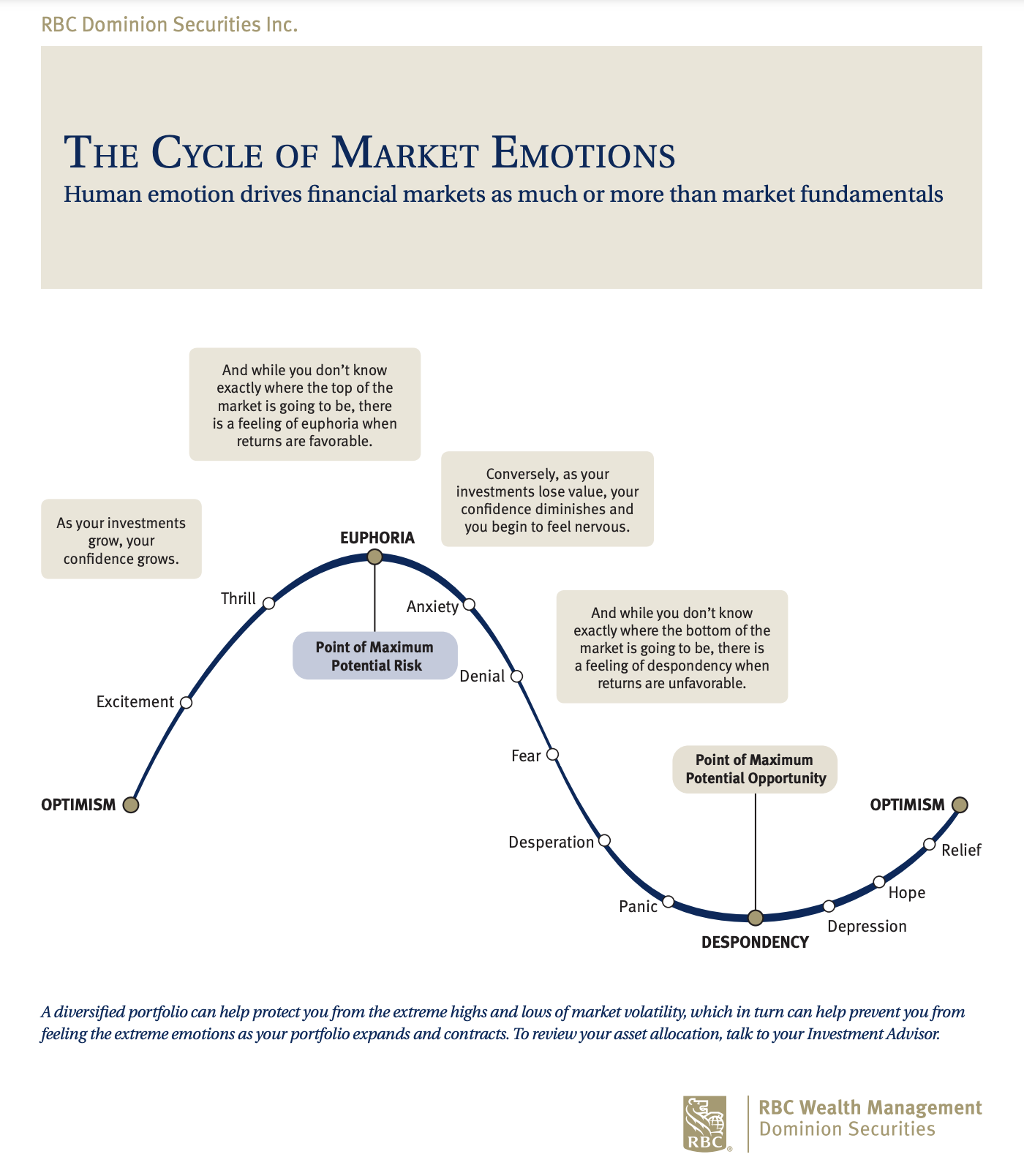

As we shared in the September edition of this blog, we believe the market is approaching the euphoria stage shown in the graphic below. As a result, we think it is prudent to shift to a more defensive positioning by adding to defensive, dividend-paying companies, which is what we have been doing recently and will continue to do at least until the end of the year.

The intent is to keep our powder dry, if you will, so we can take advantage of new opportunities as they present themselves. The markets have moved upward almost uninterrupted since President Trump’s “Liberation Day” in April. Our view is that a correction is overdue, so we are carefully repositioning our portfolios to be more defensive and increase our ability to take advantage of volatility.

Last month we also shared with you the Warren Buffett Indicator, which compares the value of the market to the size of the US economy. At that time, the value of the former was more than double (217%) the latter. This as an unusually high ratio, suggesting stretched valuations vs. actual economic output. At time of writing on November 6th, it has increased to 219%, a new record.

Prudence is warranted – even though we know that over the long run, the market has consistently shown resilience.

THANK YOU, BLUE JAYS

The Toronto Blue Jays know something about resilience. They showed us throughout the 2025 regular season, in which they posted the most comeback wins – 45 – in the Major Leagues. It was a pattern they continued in their incredible World Series run, in Game 7 of which they attracted 18.5 million viewers in Canada. Almost half our population tuned in to the most-watched televised event in this country since the men's gold medal hockey game at the 2010 Vancouver Winter Olympics. On multiple occasions in the postseason, the Jays were down and came back to win, either within a given game or in the following contests.

Of course, their ultimate World Series loss was a great disappointment for the players, management and fans alike. As we are investors in markets that can be volatile, the lessons we can learn from the Jays’ postseason run are still plain to see, perhaps even more so because of the defeat.

These three lessons stand out to me:

Never get too low

From third baseman Ernie Clement, after the Jays’ 18-inning defeat in Game 3 of the World Series, which tied for the longest Series’ game ever played: “I think this is a quote from Herb Brooks, but we are a team of uncommon men. I think a normal team would’ve folded today. And we’re not normal. I think we’re the best team in baseball and we got out of bed today with our hair on fire and ready to play.”

Lesson: The markets may decline in the short term, but unlike many other investors, we know that we own great businesses that will continue to perform well in any environment, regardless of what the market is doing.

Never get too high

From catcher Kevin Kiermaier, after the Jays evened the World Series at 2-2: “This is fun, man, but we’re not satisfied. It’s two games apiece now — that’s it. Just keep grinding.”

Lesson: We must always keep euphoria at arm’s length, no matter how big our latest victory.

Trust the process

From manager John Schneider, after defeating the New York Yankees in the ALDS: “We’ve been building toward this since February. It’s just about doing the little things right, over and over again.”

Lesson: We have consistently executed on our investing strategy for many years, it has proven itself time and time again, and we have every reason to stick with it.

Thanks again, guys. See you in the Spring.

THE BUDGET

Canada’s debt is going up. Again. The new budget projects an annual deficit of $78.3 billion, an almost doubling of the government’s projection last fall of $42.2 billion. Even though the budget projects that the deficit will decrease gradually to $56.6 billion in 2029-2030, ultimately it is still true that we are continuing to saddle our children, grandchildren and their future generations with the obligation to pay it back in the form of higher taxes.

(It is a tough time for younger generations; see here, for example, where we outlined some ways you can help, or they can help themselves, including with the First Home Savings Account [FHSA]).

From a personal and small business tax perspective, the budget contains no proposed changes to the general personal or corporate income tax rates, capital gains inclusion rates or other broad tax measures.

That said, there are new tax incentives, which combined, according to Prime Minister Carney, will give Canada the lowest marginal effective tax rate in the G7 for businesses that qualify. They are positioned by the government as the “Productivity Super-Deduction,” which allows businesses to deduct the cost of new capital investments more quickly, making it more attractive to invest in machinery, equipment, technology, and other productivity-enhancing assets. The incentives include a temporary 100% first-year write-off for manufacturing and processing buildings, expanded clean-technology credits, and enhanced SR&ED (Scientific Research and Experimental Development) provisions — together lowering the marginal effective tax rate on new investment to approximately 13.2%.

It is also good to hear that the number of employees in the federal public service will reduce by 40,000 by 2029. Although, it should be pointed out that one method of reduction being used, namely to allow any employee age 50 or more (and who joined the service before end of 2012), to retire now with a full pension, is a privilege for government workers that people living outside the Ottawa bubble will have difficulty understanding.

All of this said, we do not see anything in the new budget that will materially affect our clients or their portfolios.

EARNINGS

The US earnings season is now in full swing, with nearly one-third of S&P 500 companies reporting as of time of writing. Because of the US federal government shutdown, official US data has been limited, so corporate results and management commentary have become even more valuable in gauging the health of the economy. So far, earnings have exceeded expectations, with companies surpassing analysts’ estimates.

RATES

September inflation in the United States was somewhat lower than expected, giving the Federal Reserve confidence to lower its rate by 0.25%. Fed Chair Jerome Powell noted that another rate cut in December “is not a foregone conclusion,” given the Fed’s need to balance the risk of inflation going up and employment going down, all amid an uncertain data environment: because of the shutdown of the US federal government, official data is sparse.

The Bank of Canada also lowered rates by 0.25% for the second consecutive time, and we are not forecasting any other rate cuts in the short term.

TRADE

Canada has once again drawn attention from the US administration, as President Trump proposed an additional 10% tariff on Canadian goods in response to Ontario’s recent anti-tariff ad featuring quotes from Ronald Reagan. While details remain unclear, most Canadian exports continue to benefit from protections under the United States-Mexico-Canada trade agreement (USMCA), helping cushion the overall impact. We will be watching very carefully as USMCA renegotiations approach in 2026.

Everything above reinforces our view that amid a market at record highs and facing future volatility, the prudent route to take is to increase the defensive positioning of our portfolios by selectively selling some equities, as we have noted.

TAX LOSS PLANNING

Because our portfolios have performed well so far this year, there are not many opportunities for tax loss planning, but as always, we will be looking relentlessly for every way to minimize your taxes. If you or your accountant would like to discuss strategies in detail, please let me know.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

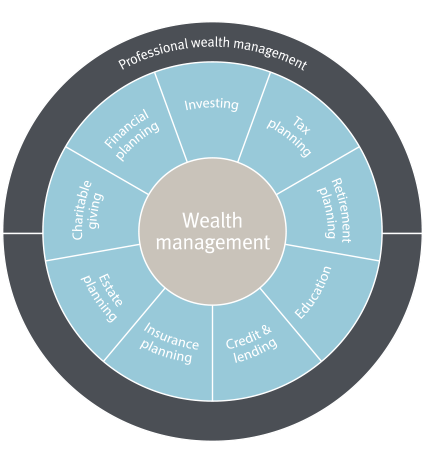

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO