ON TRACK

We consider the S&P 500 index to be the authoritative indicator of how the markets are performing overall. Since 1928, September has been the S&P 500’s weakest month, with an average monthly decline of 1.2%, underperforming all other months. September returns were also negative 55% of the time over this period.

We expect that any September weakness will indeed be a short-term phenomenon. The fact is that corporate earnings fundamentals continue to look solid, are the long-term foundation for equity markets’ performance, and that our clients’ portfolios are doing well. And we must always point out that our long-term returns are determined by the quality of the businesses we own and the price we pay for them.

HELP FOR THE YOUNGER GENERATION

Jobless numbers, at 7.1%, are the highest since 2016, aside from the Covid period. Young people have been hit especially hard – the jobless rate for those between the ages of 15 and 24 being 14.5% in August, the highest since 2010 (also except for the Covid period).

Another factor making it difficult for young people today is the cost of housing, in particular of buying a home. From their perspective, there is some good news in the fact that Canadian home prices are down almost 20% since their peak in March 2022. So: Is now the time for young people, who tend to be first-time buyers, to get into the market?

We have the privilege of working with multiple generations in many of our client families. For the younger generations among them, there is a tax-free savings and investment tool introduced by the federal government in 2022, designed to give first-time home buyers a boost.

It is the First Home Savings Account (FHSA), and we urge all clients to have a close look at it, whether they are considering a first home for themselves, or are looking to help younger generations.

Just more than half of first-time home buyers are using it, and I believe that a much greater proportion should be. As a personal example, my daughter recently turned 18 and she immediately opened an FHSA. That is how important I think this new vehicle is. If you would like to discuss how opening an FHSA can fit into your overall planning – and its pluses and minuses vs. a TFSA (Tax-Free Savings Account), please let me know.

Related, intergenerational wealth planning is just one thing we offer – as part of the all-inclusive cost of managing your portfolio – that many advisors do not. Are you ready for a conversation on important intergenerational matters, or do you know someone whose advisor is not offering such opportunities?

OUR PORTFOLIOS

Further hope for youth may come in the form of lower interest rates, which could help not just the employment rate, but also our clients’ portfolios. Reduced rates make it cheaper for businesses to borrow, expand and hire, and they also make it less costly for consumers to support those businesses by spending at them. And, they make the income from bonds and dividend-paying stocks in our portfolios more attractive.

I have in the past shared my view that the Bank of Canada can take too long to lower interest rates. I am feeling the same way now, and I expect the BOC will indeed reduce rates in its next meeting.

There has also been softening in the US employment numbers, adding to expectations that the US Federal Reserve will cut rates as early as this month.

The takeaway is that resilient corporate earnings and optimism over potential rate cuts have helped support global equity markets. But with September’s historical tendency towards weakness and market valuations that seem to reflect an optimistic outlook, we believe “invested, but watchful” remains the appropriate posture for our clients’ portfolios.

If you have any questions, please let me know.

LOOKING FORWARD

Despite any volatility in the market, we remain confident with the stocks and bonds we own in your portfolio and continue to trust their ability to thrive in any economic environment. As well, we are constantly monitoring the markets and are always positioned to find investments that are trading below their intrinsic value, a key pillar of our long-time investing philosophy.

In the equity portion of our portfolios, we are pleased to say that, as we predicted in last August’s blog, our bank and insurance stocks have performed well.

That said, the biggest contributors to our gains so far this year are technology and financial companies. We continue to expect this portion of our portfolios to outperform in the short term as (as suggested above) interest rate cuts make their dividends more attractive and increase the price that investors are willing to pay for their shares. Rate cuts should help our economy and housing market, and also make bonds more attractive – thus we expect bonds and dividend stocks alike to contribute more positively to our performance than they have in the past couple of years.

THE WELLNESS BINDER

One of the many privileges of working so closely with multiple generations of our clients is that we are witness and support to the challenges they face when helping their ageing parents.

Caring for an ageing parent – or planning for your own future – can be complex and overwhelming. Here are two ways in which we can help, both in association with Elder Caring Inc.

First, qualifying clients can receive a complimentary 60-minute Elder Wellness Consultation with Audrey Miller of Elder Caring Inc., leading experts in ageing and caregiving. This session helps clients navigate healthcare systems, explore living options, manage costs of care, and prevent caregiver burnout.

Second is The Elder Caring Wellness Binder, also from Elder Caring Inc. The binder is a comprehensive planning tool designed to support healthy aging and caregiving. It helps individuals and families organize critical personal, medical, legal, and financial information in one place – ideal in the event of hospitalization or increasing care needs. It includes detailed sections for medical history, daily routines, powers of attorney, insurance, online accounts, and end-of-life preferences. The binder also offers guidance on navigating home care, residential options, caregiver burnout, and transitions to long-term care. Designed for proactive planning, it fosters peace of mind for both care recipients and their support networks.

Both the consultation and the binder really are remarkable resources.

You may be supporting a loved one. You may be planning for yourself. Either way, now is always a good time to have one of these consultations. Are you interested in learning more about a 60-minute Elder Wellness Consultation, or can we send a wellness binder to you? Just let us know.

TAX PLANNING

Labour Day has come and gone (can you believe it?), and as we turn the corner toward year-end, we are heightening our focus on finding tax planning opportunities. Because our portfolios have performed well so far this year, there are not an abundance of opportunities, but as always, we will be looking relentlessly for every way to minimize your taxes. If you or your accountant would like to discuss strategies in detail, please let me know.

Enjoy the rest of summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

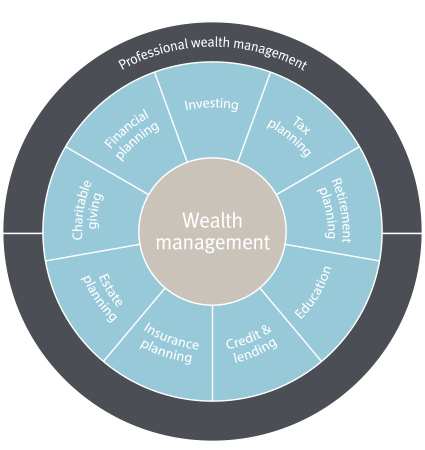

WHAT WE DO