-

Our portfolio moves in July and August were defensive in nature. We created cash to take advantage of potentially heightened volatility over the coming months.

-

Despite the differences between Trump and Harris, both intend on boosting the economy through increased deficit spending.

-

With stimulative monetary and fiscal policy, history suggests the economy and markets have the support they need to continue growing over the foreseeable future.

A quick note on our portfolios

After the strong market run we’ve had in 2024, it’s worth stepping back and level-setting on where our group stands today, particularly as we begin a historically bumpy time of the year. We are exiting the summer months in a strong position. Our managed portfolios continue to outperform their category averages across the board.

Despite this positivity, our most recent portfolio moves have been defensive in nature. In both July and August, we rebalanced several of our positions – either through outright sales (in cases where we lost faith in the underlying company) or by trimming solid stocks that have outperformed. Much of these funds have been reallocated to other areas we believe have room to run. A significant portion has also been kept in cash. The latter reflects the fact that we anticipate market volatility over the months ahead and believe it would be prudent to have some cash on hand to take advantage. We expect any downturn would be temporary in nature because, as we discuss in the rest of this article, our overall view of markets is cautiously positive over the foreseeable future.

Economic data points to more room for growth, albeit with mixed signals

Our long-term readers will be familiar with our often-repeated principle: investors should be optimistic about stocks as long as the US economy – the driver of the global economic bus – is not in recession. Our best intelligence tells us we are in the mid to late part of the economic cycle, indicating we have a good amount of time before we need to worry about the next downturn. This is a positive for markets. That said, there is currently a higher degree of uncertainty in this assessment than usual. As noted by RBC Global Asset Management’s Chief Economist, the different types of data we use to measure the economy are more dispersed than they normally are. Growth is healthy but slowing, the labour market remains strong but is starting to show cracks, household finances are getting weaker, and yet consumer expectations for the future are improving.

In other words, it’s hard to get a confident grasp on where everything stands because the data is pointing in different directions. This would normally have us erring on the side of caution. As we touch on below, the direction of US policy is keeping us optimistic despite these mixed signals.

Why US policy makes us optimistic, for now.

We are entering a period where both monetary (i.e. interest rates and money supply) and fiscal (i.e. tax and spending) policies are becoming accommodative for growth. All else equal, this should give both the economy and markets the support they need over the next year or so.

The trajectory of the Federal Reserve (which sets monetary policy for the US economy) has been well covered by the media. Suffice it to say, it is almost surely going to begin lowering interest rates in the near term. This provides a safety blanket to the economy and will help slow the cycle down, potentially delaying a recession for some time.

The likely direction of fiscal policy is less appreciated by markets, in our view. The upcoming presidential election creates a dichotomy with both candidates trying to differentiate themselves from the other. They do have at least one thing in common, however: they both intend on supporting the economy through increased deficit spending, albeit in different ways. As we covered in our last newsletter, Trump plans to institute comprehensive tax cuts, boost military spending, and provide incentives for domestic manufacturing. Harris has since released further information about her platform, revealing that it is also stimulative. Despite higher corporate taxes and introduction of a wealth tax, she plans on extending the Trump tax cuts for most households while also eliminating taxes on tips and hospitality. Importantly, she plans to spend a lot more than Trump through various means – increasing subsidies on prescription drugs, small businesses, health insurance, and providing support for first time home purchases, to name some examples. In either case, both candidates are running on stimulative policy agendas that, if enacted, will likely increase the budget deficit.

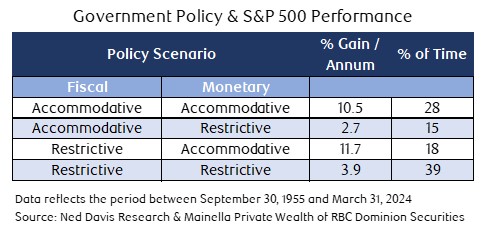

This should be good for stocks in the short run. The table below breaks down the performance of the S&P 500 during different fiscal and monetary policy climates. As it shows, scenarios in which both types of policy are accommodative have been quite profitable for markets, resulting in average yearly performance over 10%. This should give investors reason for optimism regardless of who ends up taking the White House.

Granted, the above assumes the candidates will be able to implement their policy platforms. This is not a given. There is a high likelihood congress will be split, which will act as a natural check against whoever ends up taking the Presidency. This may ultimately prove to be a blessing for two reasons. First, because the market tends to do well in the stability that comes with policy gridlock. Second, because it is more likely that a split government would be forced to address the ballooning deficit. This would entail short-term economic pain. However, as we mentioned in the past, the deficit is a significant source of long-term risk that is currently under-appreciated and will eventually have to be dealt with. In any case, the table above shows that restrictive fiscal policy regimes have still been quite positive for markets when they are coupled with accommodative monetary policy, which the Federal Reserve is likely to maintain for some time.

What to focus on

As always, we caution against getting too caught up in the day-to-day machinations of markets and policy. Successful investing requires a focus on the big picture. With the US economy doing reasonably well and being supported by policymakers, it is likely that we will avoid a serious recession for the foreseeable future. History suggests this should be favorable for investors moving forward.