-

Market highs can feel like a barrier to getting invested. Counterintuitively, history shows investing at all-time highs often leads to strong returns, driven by robust earnings and market momentum.

-

Today's valuations are a legitimate cause for hesitation. But today's companies are more efficient, with higher profit margins and resilient management, justifying much of their premium valuations.

-

As opposed to market timing, a focus on diversification, quality, and a long-term approach can help mitigate risks and position portfolios for success.

We’ve been getting the title question a lot lately, particularly from those who haven’t had significant exposure to equities and are worried they’ve missed the boat. With markets hovering near all-time highs, the instinct to wait for a dip is understandable. After all, we’ve all heard the mantra “buy low, sell high.” So why would anyone want to buy high? It’s a fair question, but as we’ll unpack, the answer might surprise you. Here we'll share why we remain optimistic despite these roadblocks and finish by touching on the approach we use to navigate today's uncertainty for our clients.

Two roadblocks: (1) All-time Highs and (2) Expensive markets

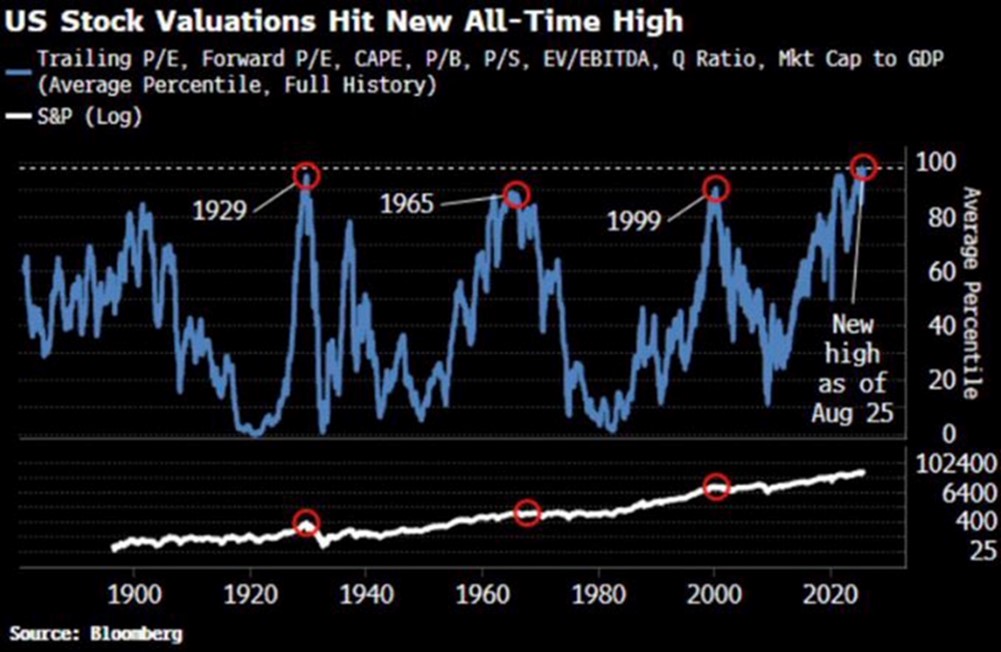

Let’s start with the obvious: markets are near all-time highs. The S&P 500 and other major indices have been setting records, which can feel daunting for those sitting on the sidelines. Adding to this difficulty is just how expensive the market is today. The Bloomberg chart below, which averages a range of valuation metrics like price-to-earnings and price-to-book ratios, shows that current valuations are at or above historical peaks. In fact, by some measures, the market is as expensive as it’s ever been.

For those who haven’t participated in the remarkable equity run over the past five years, this creates a real hesitation. The fear of buying at the top, only to see a correction, is natural. Yet, as we’ll explore, history and the quality of today’s companies paint a different picture—one that suggests now may still be a compelling time to invest.

Buying at all time highs happens to have worked well in the past

Counterintuitively, investing at market peaks has historically delivered strong results. A fascinating chart from the folks at Exhibit A / The Compound (see below) illustrates this: forward returns after all-time highs have often outperformed returns from other periods. Why? Because all-time highs typically coincide with robust earnings growth and market-friendly conditions, which fuel investor confidence and sustain momentum longer than you might expect.

This dynamic makes timing the market notoriously difficult. Trying to wait for the “perfect” entry point often leads to missed opportunities. As we’ve seen time and again, disciplined, long-term investing tends to outperform attempts to outsmart the market’s ups and downs.

Today’s companies are just better

Beyond historical trends, today’s companies are fundamentally stronger than their predecessors. One of our favorite metrics—revenue per employee—highlights this efficiency. A chart comparing companies across sectors today versus 1991 shows that businesses now generate significantly more inflation-adjusted revenue per employee. This speaks to how much sharper management teams have become at optimizing resources. Simply put, companies are able to do more with their resources.

It's also worth noting that the largest companies—the likes of Amazon, Google, and Apple—have shifted toward recurring revenue models, reducing their exposure to economic cycles. This stability is a key reason we’re comfortable paying a premium for these names since it takes some of the guesswork out of projecting future sales. Add to this their higher profit margins, which, according to FactSet, are approximately 13% today compared to a 50-year average of 8%. In short, these companies aren’t just generating more revenue; they’re keeping more of it. This helps explain much of today's higher valuations.

Lastly, on a more qualitative note, today’s management teams have proven themselves to be worth a premium. As Tom Lee, lead strategist at Fundstrat, points out, the companies we're investing in today have thrived despite many extraordinary challenges -- a once-in-a-century pandemic, supply chain disruptions, surging inflation, interest rate spikes, global trade reordering, and geopolitical tensions like the U.S./Israel-Iran conflict, to name a few. These are not untested stewards of capital—they’ve demonstrated themselves to be resilient and adaptable. It makes sense to pay more for proven results.

Your approach is what matters

The above notwithstanding, investing in today's markets still warrants caution. Investors need to be choosy and stay nimble. That’s why our clients rely on us to design portfolios that align with their goals, comfort levels, and understanding. Over the years, we’ve found a few best practices that consistently deliver:

-

Be Diversified: Spreading investments across industries and asset classes helps cushion against inevitable turbulence.

-

Focus on Quality: High-quality companies with strong balance sheets and proven management reduce the risk of permanent losses and shield you from the worst downturns.

-

Think in Years: Short-term volatility is no one’s friend, but with a disciplined strategy and a long-term horizon, success is far more likely.

Markets may be high, and valuations may be stretched, but the strength of today’s companies and the historical success of investing at peaks give us confidence. Our research indicates that a thoughtful, diversified approach remains the best path forward. We’re here to help you navigate this landscape, ensuring your portfolio is positioned for both opportunity and resilience. If you’re wondering whether now’s the right time to invest, let’s talk—we’d be pleased to craft a strategy that works for you.