Portfolio Update: These are the good times

The market has been good to our managed portfolios this year. We are meaningfully outperforming category averages across the Canadian investment universe tracked by Morningstar. Our prudence in fixed income has paid off; our focus on quality and low sensitivity to interest rates helped our holdings outperform. Meanwhile in stocks, our identification of the long-term themes driving the economy boosted our holdings nicely. Our regular readers will recall that these include: (1) a shifting geopolitical order; (2) aging demographics; (3) a new era of technological progress; and (4) normalized interest rates. To our benefit, investments corresponding to these themes have outpaced the rest of the market. We believe this will continue for the foreseeable future. Though there will be periods of volatility, we continue to believe we are in the midst of a new upward-trending market cycle.

In short, things are going well. But good wealth managers sometimes need to deliver messages people don’t want to hear. This is particularly the case when markets (and emotions) are at highs and lows. We’re at a relative high right now. So it’s our job to remind our clients that, during times like these, investors tend to get caught up in over-optimism and take more risk than they planned for. We’re here to make sure they stick to the plan. That said, despite all the positive things going for us, there is an area of our portfolio that requires attention. We discuss further in the rest of this article.

Spotlight on Canada: Not so good.

The elephant in the room is Canada. The latter represents a weak spot in our portfolios, underperforming comparable markets in the US, Europe, and other developed countries. Unfortunately, we do not see the situation changing soon. We are therefore incrementally reducing our exposure to Canadian stocks, particularly to those that are most sensitive to domestic economic activity. Given the core role Canada plays in our portfolios, we offer our reasoning below.

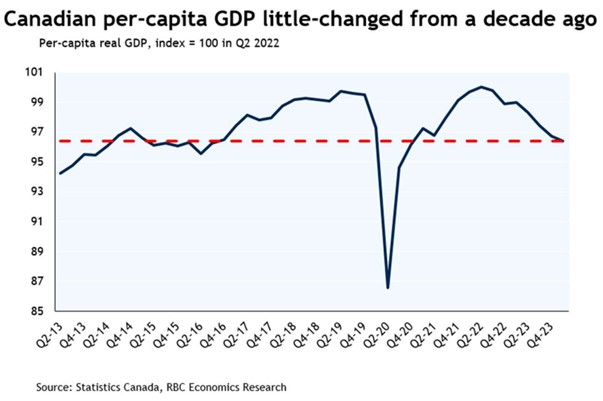

Canada’s economy has stalled. Though the country as a whole has avoided a recession, digging deeper shows Canadians themselves are hurting. The chart below presents Canada’s real GDP per capita, which takes the overall measure of the Canadian economy (adjusted for inflation) and divides it by the population, thereby providing a sense of the average Canadian’s economic position. The chart shows Canadians have been in a recession for years now, brought back to the same position they were in a decade ago.

The situation is unlikely to improve in the short term as many homeowners will have to renew their mortgages over the next two years at much higher rates than they locked in 3-4 years ago. This is happening at a time when household debt is notably stretched, representing 179% of income (for reference: the equivalent figure in the US is 97%).

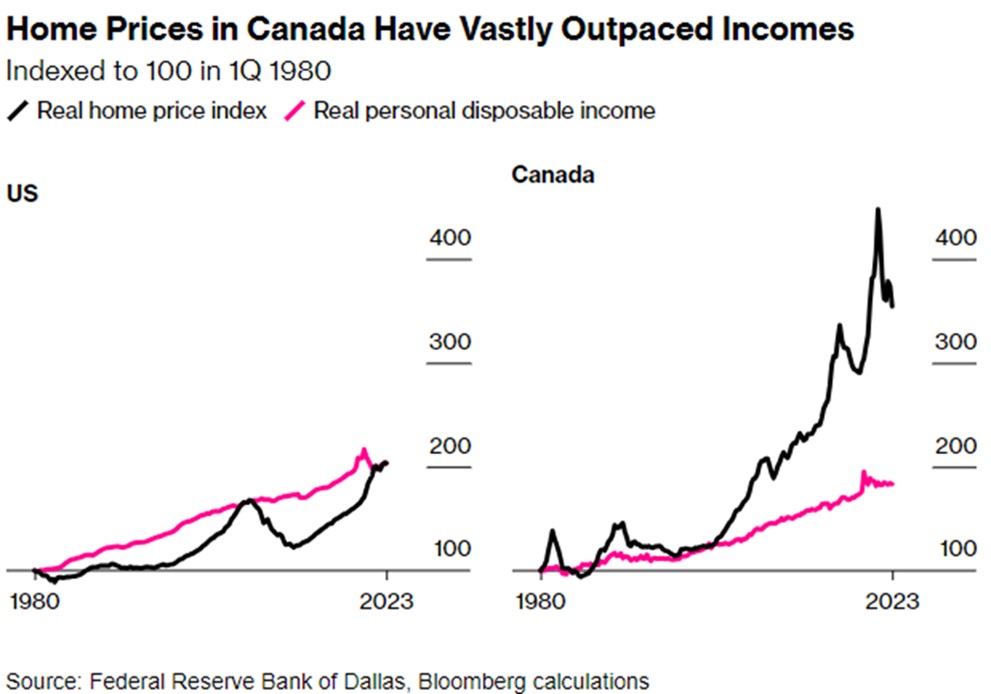

Core issues need to be addressed for the situation to improve. One of these is productivity, which has fallen alongside an overly ambitious immigration policy that has outpaced the economy’s ability to create quality employment. But the bigger issue is housing. The chart below illustrates this neatly by comparing our situation with that of the US. It shows that home prices in Canada have largely dislocated from income. We are unsure how long this situation can be sustained.

Besides directly impacting housing affordability, the above creates a big problem. Asset bubbles like this suck capital away from other productive areas, leaving the country short on investments geared towards the future. This is exactly what’s happening in Canada. To this point: Canadians spend more on housing improvement and transfer costs (i.e. renovating the kitchen and paying real estate agents) than they do on machinery, equipment, and intellectual property combined. This does not leave us excited about Canada’s growth prospects over the coming years and is the main reason we are lowering our allocation to Canadian equities.

Opportunities still exist

Despite the gloomy picture painted above, it’s important that Canadian investors do not overreact; there are still good reasons to retain some Canadian stocks in portfolios. First and foremost, many such companies provide a great source of stable, tax-efficient dividends. Next, our country is home to a lot of inexpensive, expertly run resource and materials firms that will do very well during the next bout of global growth. Finally, there are many companies that will thrive despite Canada’s economy. These include defensive businesses (think Dollarama, which tends to do well when the economy struggles) as well as those with strong international businesses (i.e. CP Rail, Thomson Reuters, and the like). There is one caveat, however. A tough economic backdrop means that it takes more work to spot the opportunities available. Our clients can count on the fact that we remain on the lookout on their behalf.