1. Expect Volatility

“The stock market is the only market where things go on sale and all the customers run out of the store.” – Cullen Roche

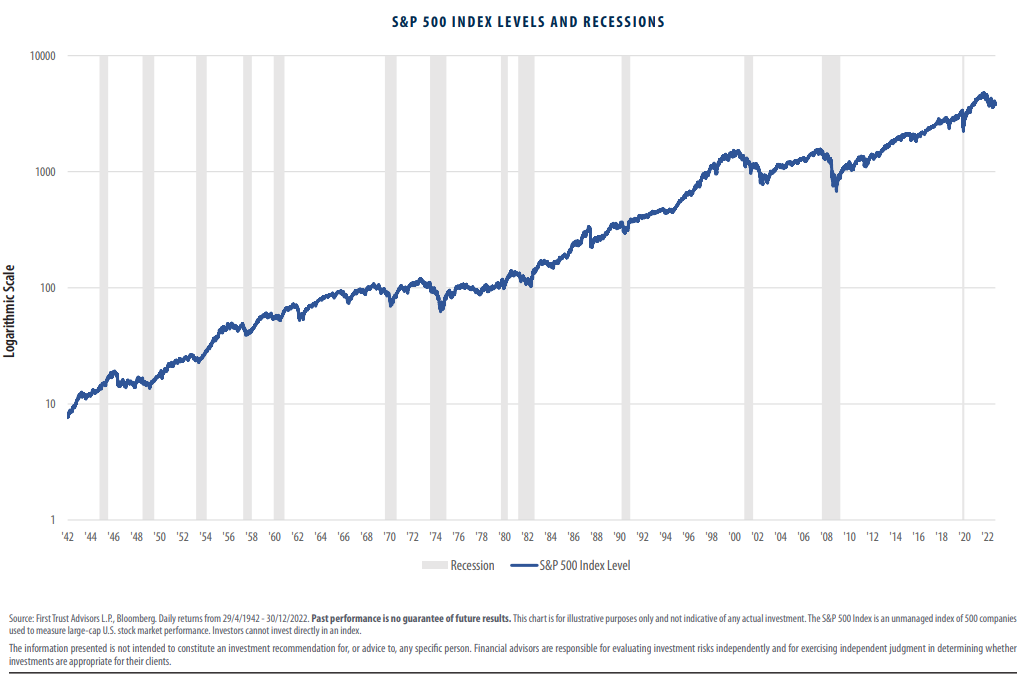

Volatility and recessions are a normal (albeit unpleasant) part of the long-term investing experience. Since 1942, the S&P 500 (a market-cap weighted index of the 500 largest American companies) has declined by 20% about once every 5 years. Despite this volatility and many recessions and crises, patient equity investors have been rewarded with annual returns north of 10% per year over this same time period. As surely as stocks have pulled back, they have rebounded and marched onwards and upwards. They have done so because stocks are fractional ownership interests in real, operating businesses; their value goes up over the long term because human innovation drives economic growth, and businesses earn more money.

Unless you need to sell, the best way to capture the attractive long-term returns in equities is to patiently wait for their prices to rebound. The long-term investor should recall this large body of historical evidence, especially when equity prices have pulled back and fear is widespread.

Source: First Trust Portfolios Canada

2. Stay the course and stick to your plan.

"The idea that a bell rings to signal when investors should get into or out of the market is simply not credible…I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has." – Jack Bogle

Of course, it would be great to get out of the market before it drops, and then re-enter at a lower price before it begins to march upwards again. Unfortunately, this cannot be consistently done. Further complicating this, to properly execute this you would need to be right twice in a row: when to exit the market and when to get back in. As the adage goes, what really matters is time in the market, not timing the market. (As an aside: I think dollar cost averaging through scheduled tranches is prudent when putting a lump sum of cash to work).

Instead of trying to forecast the economy or time the market, I think it is wise to invest with a planning-led approach. This involves identifying what you are working towards financially, by when and for whom. After considering your goals, your entire balance sheet, and your intestinal fortitude we can clearly back into the appropriate investment strategy for you. Stocks are a great long-term investment vehicle, but we want to first be sure that your short-term liquidity needs are met with safe and secure interest-bearing investments. This allows us to stay the course and patiently wait out market declines.

A strong investment strategy does not meaningfully change with the markets, but it allows you to meet your goals while being prepared for a variety of macroeconomic outcomes.

3. Zoom Out

“In the end, what counts is buying a good business at a decent price, and then forgetting about it for a long, long, long time.” – Warren Buffett

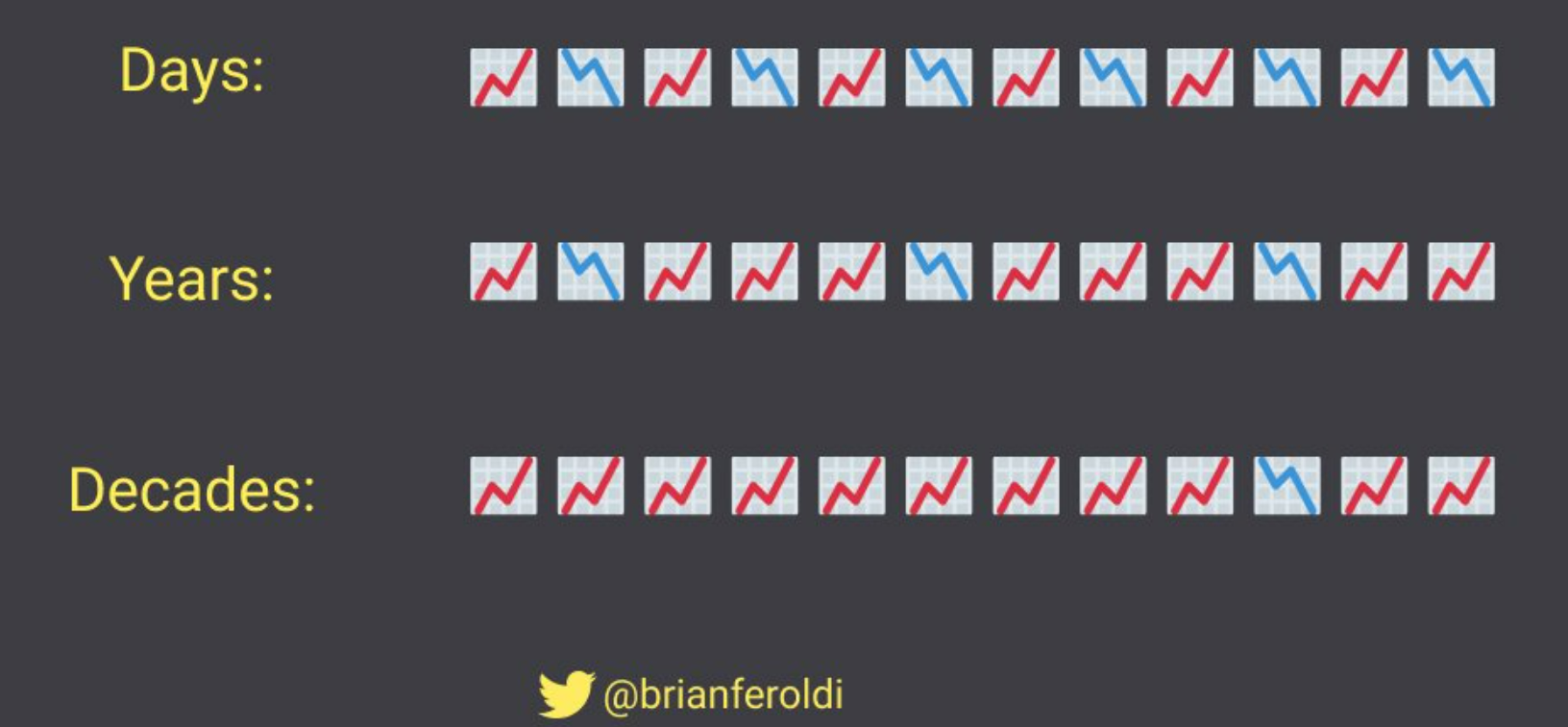

Disciplined, long-term investors can patiently tune out the short-term market noise and focus on the inevitable long-term growth of the economy and corporations. As Ben Graham taught many years ago: in the short-term, the market is a voting machine, but in the long-term, it is a weighing machine. Graham suggested that markets are wildly unpredictable in the short term since they are driven primarily by emotion, but in the long-term market prices follow the earnings and true value of the underlying businesses.

Importantly, a long-term orientation allows investors to minimize poor emotionally driven decisions. In particular, long-term investors won’t react to market pullbacks during economic and geopolitical events to sell low, and then buy back later at a higher price. Other hidden biases are also easier to manage by staying disciplined and thinking long-term. (Recency, overconfidence, herding, etc.)

By adopting a long-term orientation, investors can align their thinking with what really matters: owning a collection of great businesses that are expected to grow earnings and dividends as fast as, or faster than, the economy.

Source: Brian Feroldi

Quick Hits

-

Equity markets had a positive start to 2023, but there has been some noise about a debt-ceiling-induced US default. While RBC Wealth Management’s Global Portfolio Advisory Committee sees a U.S. default as exceedingly unlikely, the political brinkmanship may bring higher volatility to both equity and fixed income markets. Please reach out if you'd like to read their special report.

- We had our annual RBC DS Portfolio Management conference from January 11-13. This conference featured a wide range of thought-provoking speakers both within RBC and through our trusted external partners. Speakers included analysts, portfolio managers, strategists and executives. After watching many of these presentations I’ve compiled my “highlight reel” below for your review:

- BCA Research presented on macroeconomic themes.

- Their geopolitical comments reinforced 3 strategic themes: Great Power Rivalry, Hypo-Globalization (“friendshoring”), and Nationalism. These themes could be challenged by a Ukraine ceasefire, resumption of EU-Russia energy trade, de-escalation of the U.S.-China trade/tech war, a reaffirmation of status quo in Taiwan Strait, and U.S.-Iran strategic détente. All or some of these could happen in 2023 but few of them are yet likely to happen based on concrete evidence as things stand. Note that war is inflationary because it quickens national activity, discourages private entrepreneurship and trade, and destroys supply.

- Howard Marks reiterated the main point from his most recent memo- he thinks markets are experiencing a regime change, where interest rates are unlikely to be as low as they were in the past decade.

- Canadian Housing remains a risk.

- Mortgage rates have increased, and average amortization has been lengthening following the recent spike in variable rate mortgages. If unemployment rates remain low (as they are now), things are ok…but this may change.

- Darko Mihelic of RBC Capital Markets is concerned with people that bought a home in early 2022 and are now underwater with their payment up hundreds of dollars.…he calls this “the pig in the python” to be digested over time.

- Nigel D’Souza of Veritas Research isn’t worried about further price correction until “Months of inventory” spikes higher.

- Rafi Tahmazian, Portfolio Manager at Canoe Financial and Martin Grosskopf, Portfolio Manager at AGF Investments had an intriguing discussion about energy. They approached the discussion from different sides of the spectrum- Martin manages sustainable investing strategies, while Rafi focuses on more traditional oil and gas. They talked about their outlook for the energy sector, with a focus on the legacy fossil fuel industry, renewable energy, and the energy transition.

- Rafi: “we do not have enough supply and we are all addicted to oil”. At present, the oil & gas market looks attractive with limited supply that has been under attack for the last decade, and it will take years and significant investment to increase. He thinks it is very early stages for renewables, but we need to get better at using hydrocarbons. He also highlighted the pathways project that the Oil producers and the Canadian government are working on. This project will take every ounce of carbon produced by the oil sands and pump it into a “huge empty sea” below Cold Lake in Alberta. If this happens, there could be a notable re-rating of Canadian oil companies as their cleaner production drives interest from European investors.

- Martin: thinks energy production will continually shift towards renewables. Since the conventional energy system is drastically altering the biosphere, renewable investment will increase by necessity. (Especially in solar, wind, nuclear, hydrogen, etc.) However, this transition will take time and requires significant spending and many structural changes. Demand coupled with global incentives makes the directionality of renewable energy production quite clear, setting up a multi-decade secular growth opportunity in his view. While Martin acknowledges the near-term cash flow opportunities in the conventional energy landscape, he also considers it a declining annuity.

- Currently, I think it’s prudent for investors to have conventional energy exposure in their portfolios. There is a tight demand/supply situation, and oil & gas remains a critical input to the world we live in today and for the foreseeable future. However, I would also caution against chasing energy here. These companies are linked to a volatile commodity that can experience meaningful price swings in both directions.

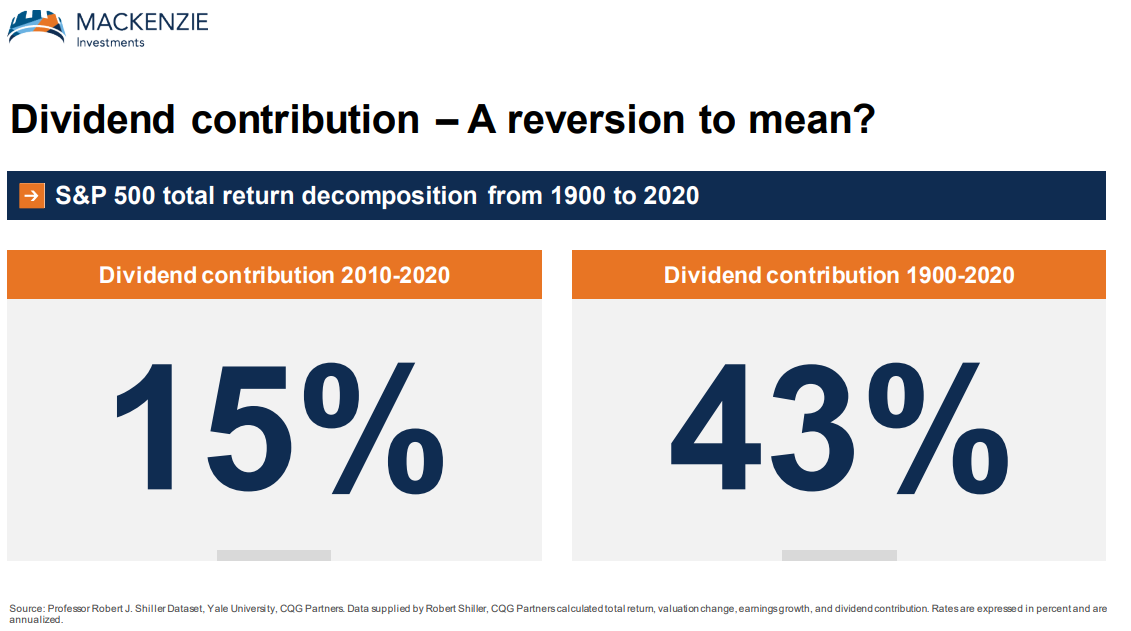

- Many of the 3rd party portfolio managers I listened to are advocating for dividend paying stocks.

- Rob Taylor, Chief Investment Officer at Canoe Financial: Rob is a “quality value” manager and is adamant that we are entering a new market regime with structurally higher inflation and interest rates. In the last decade, the market favoured long duration, high growth companies and a passive investing style. However, Rob believes that going forward it will be important to be active and he favours cash-cow businesses with pricing power, inflation protection, and sustainable dividends.

- Daniel Dupont, Portfolio Manager at Fidelity Investments: Dan is a very defensive manager that outperforms in rocky markets like 2022. He continues to hold very defensive and cheap names, especially high free cash flow generating companies.

- Kathrin Forrest, Investment Specialist at Capital Group: “One area that did really well last year was dividend-paying companies. Certainly, on the surface it’s a shorter-duration equity, your returns are closer to today, so they get less discounted by higher interest rates, that’s helpful. It’s also helpful because it’s an indication of resilience to the business. If you’re willing and able to pay a dividend on an ongoing basis that tells you something about the business, and I think that’s true. I would just draw the circle a little broader and wider and think about not just the dividend, but free cash flow generation and the resiliency, sustainability and strength of that, which then opens the opportunity set a little bit more”.

- Darren McKiernan, Portfolio Manager at MacKenzie Investments: Darren highlighted dividends have historically contributed meaningfully to overall equity returns, until the last 10 years. they have not contributed as much. Darren thinks that with the return of inflation this will change, and dividend investing will continue to shine. Since 1912, inflation has averaged 3.3%. dividends have averaged 4.2% growth. To me, this seems like a great way to tackle inflation over the long-term. Darren owns a variety of wide moat businesses across different industries, and a mix of dividend yielders and dividend growers.

- BCA Research presented on macroeconomic themes.

Source: Mackenzie Investments

Meanwhile...

Sources: thehilarious.ted & The New Yorker.

Please feel free to reach out if you have any questions. Have a great month.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2020 RBC Dominion Securities Inc. All rights reserved.