In line with our and market’s expectations, the Bank of Canada (BoC) opted to hold the overnight rate steady at 5% at today’s meeting, extending a pause after also foregoing a hike in September.

The central bank (also as expected) maintained a clear hiking bias with the policy statement, saying that “inflationary risks have increased” and that they are “prepared to raise the policy rate further if needed.”

Still, we don’t anticipate there will be additional hikes. Data over the summer showed persistent signs that the economy has already been softening. That was also acknowledged by the BoC in today's statement, alongside a mention of slowing trends in labour markets as hiring demand cools and the unemployment rate edges higher.

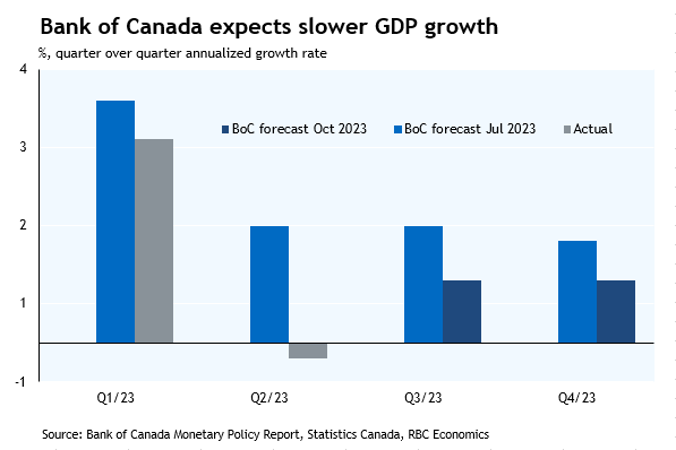

GDP growth already surprised well to the downside in Q2, contracting 0.2% (annualized) relative to the 1.5% increase the BoC expected in July. And the BoC now expects GDP to increase just 0.8% per-quarter over the second half of the year – down from prior projections. Importantly, the softening will also look a lot more substantial on a per-capita basis once controlling for high population growth.

The BoC in their statement today noted “little downward momentum” in their preferred core inflation measures. Sticky inflation expectations (especially among Canadian consumers), slow-to-normalize corporate pricing behaviour, and elevated wage growth were highlighted as key uncertainties contributing to inflationary risks moving forward.

Still, the accompanying monetary policy report attributed essentially all the increase in headline inflation rates since June to higher energy prices (something the BoC has very little influence over). September CPI growth also surprised on the downside to break a string of upside surprises, and the softening growth backdrop still makes a moderation in price growth going forward the most likely outcome.

Bottom line: With CPI readings still running well above the 2% target, the BoC is firmly focused on getting inflation under control. Slower than expected progress is a concern. But evidence continues to build that interest rates are already restrictive enough to continue to cool the economy and alleviate price pressures. Indeed, consumers in the coming quarters are expected to further cut spending as more of them contend with rising borrowing costs. A weaker global economic backdrop is also expected to slow export and investment activities with Canadian businesses, who are already facing tighter financial conditions following a rise in longer-maturity bond yields. The BoC will be cautious about starting to ease off the monetary policy brakes too quickly - we expect the overnight rate will be held at 5% through the first half of next year, with modest rate cuts to follow starting in Q3 2024.

For more economic research, visit thoughtleadership.rbc.com/economics

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.