Voters have spoken and Donald Trump was elected the 47th president of the United States. The Senate has flipped from Democratic to Republican control, while the House remains uncertain. It also appears Trump has won the popular vote (something Republican winners don’t always do). If republicans take the house, a Republican sweep could pave the way for more fiscal support, allowing the government greater flexibility to increase spending or implement tax cuts. For stock markets historically, a Republican sweep has been favorable. Since 1992 the S&P500 has averaged a 13% return under such conditions.

The initial market reaction reflected investor expectations for a second Trump term similar to the first, marked by looser regulations, lower taxes, and tariffs that may boost corporate profits, economic growth, and inflation.

-

U.S. Equities are higher. Rising growth expectations are likely to boost corporate earnings and companies will benefit from lower corporate tax rates. Business optimism around growth and reduced regulatory burden also leads to more business investment spending. Small/Mid cap companies, fossil fuel companies, pharma and financials are all experiencing the "trump effect" since the election results.

-

Volatility is down. Trump’s early lead and sustained momentum eased market fears of a delayed outcome, pushing the CBOE Volatility Index (VIX) to its lowest level since late September.

-

The U.S. dollar strengthened. The dollar posted its largest gain since 2020 against a basket of peers. This is on the back of divergence in global monetary policy and economic growth rates.

-

Cryptocurrency is higher. Bitcoin surpassed its previous record high from March, driven by expectations of Trump’s support for cryptocurrency.

-

U.S. government bond yields are higher. Treasury yields widened the gap between yields on regular issues and those with inflation protection, suggesting traders anticipate higher inflation pressures under Trump’s presidency. These higher yields relative to two months ago make fixed income more attractive, but volatility could remain elevated in the near term.

We don’t expect Trump to enact every proposal from his campaign trail. Reflecting on his first term, when Republicans controlled both chambers from 2017 – 2018, the economy grew, and the stock market performed well. While Trump’s stance on tariffs and immigration could present economic challenges, his focus on deregulation, support of the oil sector and possible tax cuts may offset these negatives. Neither Trump or Harris had outlined a significantly stimulative platform, so we don’t anticipate large increases in deficits or a surge in growth.

Trump’s approach may introduce some inflationary pressures, especially if tariffs are enacted. Tariffs can drive up costs, potentially increasing the pace of inflation, which could limit how much central banks are willing to cut interest rates. The rise in bond yields to the extent of inflation expectations rising could cap equity returns, and the fed could pause it's easing policy. Trump has also indicated he will want to renegotiate the US-Mexico-Canada Trade Agreement (USMCA). This potential for rising global trade tensions in general is not viewed favorably by equity markets.

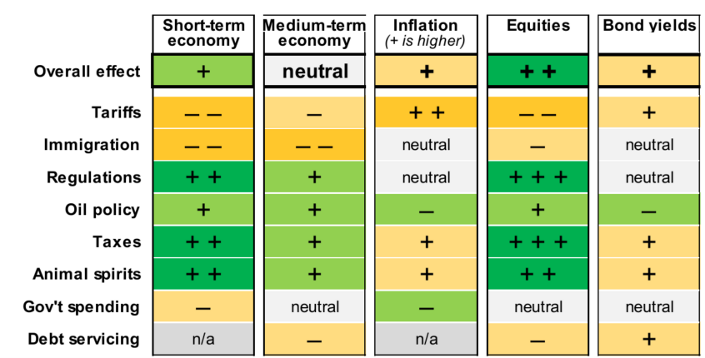

The table below from RBC GAM provides a high-level overview of expected economic implications from a trump victory. Green represents a net positive while yellow represents a net negative.

Long term, Elections come and go, investors should not deviate from their long-term investment plans. Just because a president tends to favor (or disfavor) certain industries doesn’t mean market performance will follow suit. Markets have historically risen under both Republican and Democratic administrations. Over the long term, markets continue to grow regardless of political outcomes. Staying invested and managing emotions are more likely to see growth in the years ahead.

Election Resources

Please find below some post-election resources by leading experts in the field:

-

In this video, RBC's Chief economist Eric Lascelles shares his thoughts on the post-election day landscape and provides some highlights on what to expect next

-

In this article, RBC Global Asset Management digs into some of the details and implications of a trump presidency.

-

In this article, Global Insight Weekly Kelly Bogdanova from Global Portfolio Advisory Committee summarizes the election outcome and why it is critical to not let emotions get in the way of sound investment decisions.