September has brought some relative calm to the markets following the summer's bout of volatility. All eyes are on the much anticipated first US rate cut expected this week as well as the quickly approaching US Presidential election in November. In Canada, a continued decline in inflation and a cooling economy prompted the Bank of Canada to make its third consecutive interest rate cut earlier this month. This is a welcome cut for many homeowners with Mortgages coming due for renewal or first time homebuyers looking to enter the market. We discuss all of these topics in our latest Financial Focus post.

Economic Update

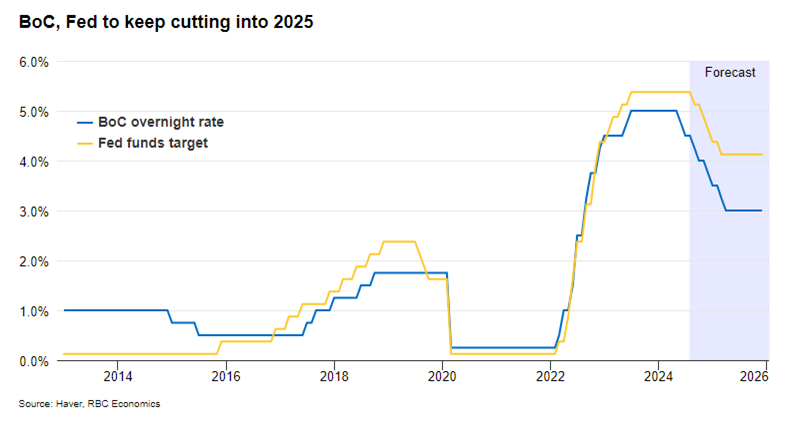

In the US, softening labour markets (unemployment has risen from historic lows) coupled with lower inflation (2.5% headline CPI) sets the stage for the Federal Reserve to begin it's easing cycle. We believe the Fed will cut by 25 basis points at the September meeting, but the market is still split on a potential 50 basis point cut. Either way, we expect further gradual easing into 2025. The chart below illustrates the different path of rate cuts for the US and Canada. Forward Guidance: Our Weekly Preview - RBC Economics.

In contrast, Canada has cut it's overnight rate for the 3rd time in September as inflation has steadily declined (2.5% CPI in July), although GDP has increased (fueled by government spending) per-capita growth continues to decline and the unemployment rate has risen (up 1% in a year to 6.4% in July). Newcomers to Canada and young workers are bearing the brunt of this slowdown, with unemployment rates among these groups at much higher levels of 12.6% and 14.2%, respectively.

Canadian households are also facing a formidable challenge: a wave of mortgage refinancings. Many homeowners secured ultra-low mortgage rates during the pandemic and are now seeing their fixed-rate terms expire, with a considerable number of renewals still on the horizon. RBC Economics has estimated that approximately 25% of all existing mortgages will reset in 2025, and a third will follow in 2026. While a decline in interest rates will help, some analysts predict mortgage payments could rise between 20% to 40% depending on the extent of rate cuts, creating a drag on consumer spending.

Election Update

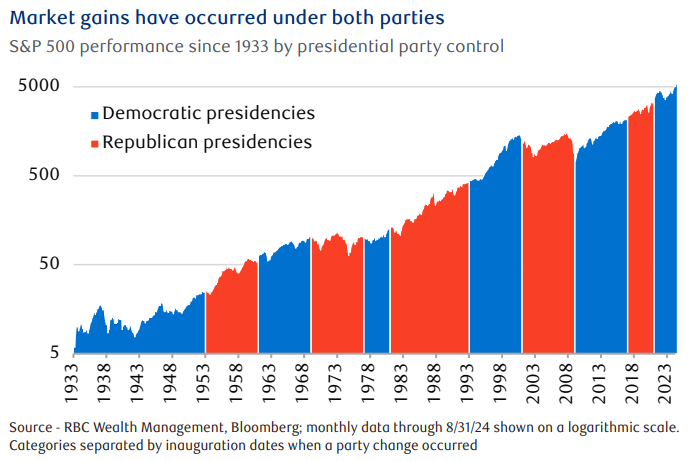

In case you missed last month's blog we talked about the realities of the US presidential power. Whether Harris or Trump wins the presidency we believe the checks and balances built into the system will prevent either party from fully executing their agendas. This has historically worked in the stock market's favour. This month, RBC Wealth Management has released the article Harris and Trump on the Issues where we review the key policy differences that matter most to the economy and stock market. We review taxes, tariffs, regulations, and end sector and market impacts. Presidents don't govern the stock market and there has been market gains under both parties (see the chart below). Staying disciplined and invested (not making drastic changes based on election outcome) will help keep you on the trajectory towards achieving your long-term financial objectives.