Reasons for confidence

Despite gloomy projections heading into 2023, another push higher in interest rates, and geopolitical upheaval, the world economy managed to exceed expectations. The U.S. economy, as the major engine for global growth, continued to prove its mettle, performing stronger than the rest of the world on the back of steadfast household spending, reinforced by steady job creation and income gains.

Firmer-than-anticipated economic growth enabled corporate profits to exceed subdued forecasts. Not unlike those for the first two quarters of the year, Q3 earnings for large-cap U.S. and European companies came in better than expected, with roughly 80 percent and 60 percent, respectively, of companies reporting positive surprises.

A favourable mix of surprises

Upside growth, downside inflation

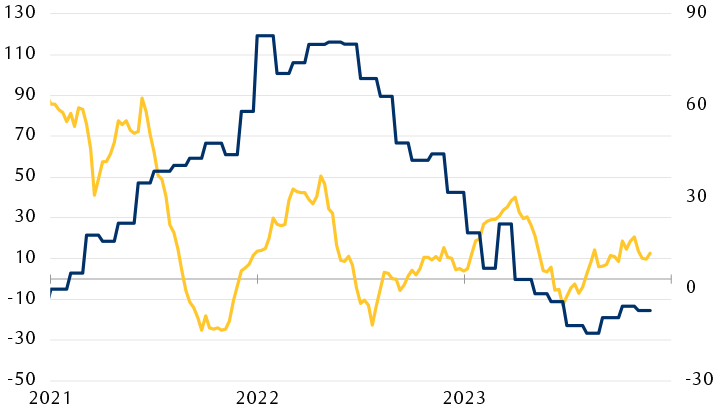

Line chart showing global economic and inflation surprise indices (Citi Economic Surprise Index – Global and Citi Inflation Surprise Index – Global) since January 2021. In 2023, economic data has broadly surprised positively, while inflation data has generally surprised on the downside.

Note: Surprise indexes measure how economic data compares with consensus expectations.

Source - RBC Wealth Management, Bloomberg; data through 11/24/23

Finally, inflation receded considerably from worrisome levels in most economies thanks to a combination of lower energy prices, base effects from year-over-year comparisons, and slower demand for goods and services. This has allowed most major central banks, including the Federal Reserve, to shift to a more balanced stance on the trade-offs between the path of interest rates, inflation, and growth.

Reasons for prudence

Cautious optimism and resilience remain apt descriptors for the global economy, but we believe growth prospects will continue to be tested by a mix of persistent headwinds. A significant source of uncertainty stems from the progressive impact of the rate hikes that have already been deployed by many central banks around the world.

As price pressures have subsided to more palatable levels, it looks like we may have finally reached a plateau in interest rates. Although central bank officials in the U.S., Canada, and Europe have signaled a desire to pause rate hikes, they have also been guiding markets to expect interest rates to linger at higher levels for longer, given inflation is still at above-target levels.

Higher rates and a reduced willingness of banks to extend loans suggest to us that credit conditions for households and businesses are likely to remain challenging in the near term. Restrictive borrowing costs and tougher access to credit tend to act as drags on economic activity. After consistent positive revisions this year, the current consensus projections are for global and U.S. real GDP growth to moderate to 2.7 percent and 1.2 percent in 2024, on a year-over-year basis, respectively, from 2.9 percent and 2.4 percent this year.

Loan growth looks set to slow further

Line chart showing U.S. bank lending standards and commercial and industrial loan growth since 1997. Changes in bank lending standards tend to lead loan growth by roughly a year, with the recent significant tightening in lending standards pointing to a further slowdown in loan growth in the quarters ahead.

Note: Bank lending standards is the net percentage of banks tightening or loosening standards

Source - RBC Wealth Management, Bloomberg; data through 10/31/23

These forecasts partially reflect the view that the effects of higher interest rates will continue to permeate the economy by tapping the brake on private sector activity. Signs of strain from the monetary tightening campaign are starting to show up in various pockets of the economy. Most major economies are generating fewer jobs relative to a year ago, while wage gains have decelerated, job openings have fallen, and corporate default activity has begun to pick up. The good news is that most of these metrics are worsening from very healthy starting points, but the risk is that they could continue to trend in the wrong direction heading into next year.

Investment takeaway

The story for much of 2023 has been a macro environment that has generally surprised in a constructive way. Sustained economic growth and central banks that are now less motivated to hike again provided a more supportive environment for equity markets to scale the proverbial “wall of worry.”

We acknowledge that receding inflation and sturdy labour markets have made it easier for investors to envision a more upbeat outlook for major economies. However, we are mindful that it is difficult to distinguish between the typical growth slowdown preceding a “soft landing” and one that eventually lands in a deeper economic downturn.

Meanwhile, the longer rates are kept at restrictive levels, the greater the likelihood that they start to materially weigh on the economic activity as consumers and businesses would increasingly feel the pinch of the more expensive cost of borrowing and refinancing over time.

Consensus estimates are currently projecting low double-digit profit growth for major equity indexes in 2024. While these full-year numbers are usually revised lower as the new year progresses, our sense is that as long as the world economy maintains an upward trajectory, this should allow companies to surpass (lowered) earnings estimates over the coming quarters.

For most portfolios, we continue to view an “up-in-quality” approach to allocations as sensible. Within equities, this can be expressed through a preference for companies with more consistent cash flows, lower debt levels, and/or growing dividends—quality and defensive attributes that can help strengthen resilience in equity portfolios if economic conditions begin to undershoot market expectations.

The additional upward repricing of interest rates in 2023 has dented returns in fixed income markets. But the silver lining of the substantial pullback in bond prices (higher bond yields) over the past 20 months is that expected returns and the overall risk-reward profile in bonds have improved greatly. Even though bond yields have fallen somewhat recently, we continue to see a compelling case for allocating into fixed income, with many bond markets offering ample opportunities to deploy capital and lock in all-in yields ranging from mid-to-high single digits. Historically, the end of rate hike cycles has typically brought with it a more favourable environment for fixed income securities.

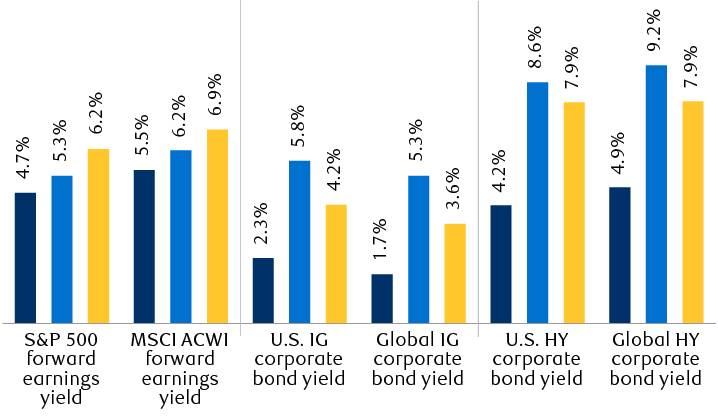

Return potential in bonds remains attractive

Valuations across major asset classes*

Column chart showing the current forward earnings yield for the MSCI All-Country World Index and the S&P 500 and the yield to worst for the Bloomberg U.S. Corporate Index, the Bloomberg Global Agg Credit Index, the Bloomberg U.S. Corporate High Yield Index, and the Bloomberg Global Corporate High Yield Index, compared to January 1, 2022, and the average since 2002. On a relative basis, the yield advantage that equities commanded over corporate bonds has sharply diminished over the 20 months.

*Earnings yield is the inverse of the forward price-to-earnings ratio. Bond yield refers to yield to worst for the Bloomberg U.S. Corporate Index, the Bloomberg Global Agg Credit Index, the Bloomberg U.S. Corporate High Yield Index, and the Bloomberg Global Corporate High Yield Index.

Source - RBC Wealth Management, Bloomberg; data through 11/24/23