As the Chinese economy stabilizes and regains its footing, we see opportunities in key segments of China’s equity market. But heading into 2024, we view Japan’s equity market more favorably due to the Japanese government’s incentives for domestic investors to increase exposure and a range of other structural drivers and catalysts. In fixed income, we prefer Asian investment-grade corporate bonds, as the lower U.S. Treasury yields that we expect in 2024 should provide a tailwind for the sector.

Asia Pacific equities

We are cautiously optimistic on China and remain Overweight Japan.

The Chinese economy appears to be stabilizing and is showing signs of recovery. Industrial profits are improving, the inventory destocking cycle appears to be nearing its end, credit growth is speeding up, and the decline in exports is slowing. In an encouraging step, the central government recently launched additional fiscal stimulus in the form of new bond issuance totaling RMB 1 trillion (US$137 billion). This action indicates readiness to decrease the fiscal burden on local governments and shift more fiscal responsibility to the central government, which has room to take on more debt to support the economy due to its low-debt balance sheet.

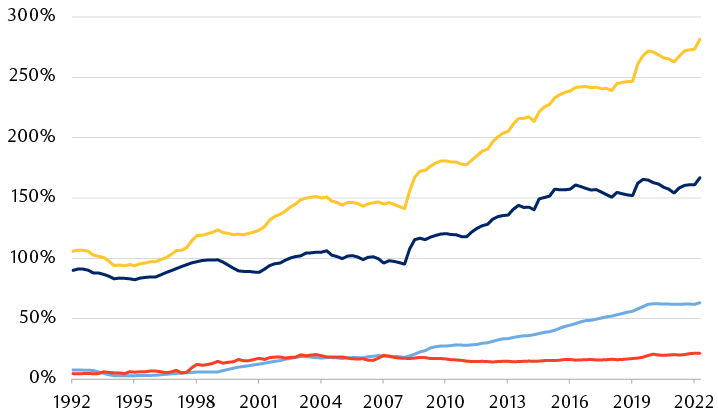

Beijing has room to increase its debt level to support the economy

China debt-to-GDP ratio breakdown

The line chart shows China’s total debt-to-GDP ratio, and the ratio broken down by categories of non-financial corporations, households, and the central government, for the period of December 1992 through March 2023. The country’s overall debt-to-GDP ratio was 282% at the end of March 2023. But the central government’s debt-to-GDP ratio was low, at 21.4%.

Source - China Center for National Balance Sheet, RBC Wealth Management; quarterly data through March 2023

However, we believe the recovery is not yet on a firm foundation as not all economic indicators are turning positive. Economic data may fluctuate in the coming months as policy stimulus gradually takes effect, and as consumer and corporate confidence gradually recover. The state of the property market is still a significant concern for investors, as housing transactions remain soft despite recent policy easing measures. We concur that the housing market slowdown continues to pose challenges to China’s economy, but in our view, it’s important to note that its negative impact will likely be less in 2024 compared to the past few years.

We think the combination of economic recovery and policy stimulus could offer some downside protection against further declines in Chinese equities. However, investor sentiment is still fragile, and many foreign investors are hesitant to commit long-term assets to the Chinese market. Therefore, Chinese equities may continue to trade within a limited range until the arrival of major catalysts such as the end of the U.S. interest rate hiking cycle, strong fiscal and monetary stimulus, or confirmed improvement in corporate earnings.

Despite these uncertainties, we believe there will be opportunities to earn excess returns (“alpha”) in Chinese equities in 2024, particularly in industries where China has competitive advantages or which can benefit from policy tailwinds, such as advanced manufacturing and health care.

Overall, we think the outlook for Japan equities is brighter, and two factors should keep fund flows into the Japanese market resilient in 2024. First, the launch of the revamped Nippon Individual Savings Account program (a tax-exempt investment scheme for residents) will see the annual per-resident cap on investment increase to JPY 1,200,000 by January 2024, from the current limit of JPY 400,000. Second, corporate pension reforms set to be finalized by the end of 2023 could lead to increased equity allocations.

RBC Global Asset Management expects that Japanese real GDP growth will moderate to 0.7% y/y in 2024 from an estimated 2.0% y/y in 2023, and that inflation will moderate as well, to 1.5% y/y in 2024 from an estimated 3.1% y/y in 2023. Meanwhile, the yen, which has been one of the worst-performing developed-market currencies against the U.S. dollar in 2023, is expected to strengthen towards the 145 level from its current range around 150 by the end of 2024 according to the RBC Capital Markets forecast.

Additional reasons we continue to like Japan equities include both positive structural changes and short-term catalysts. On the structural end, we view the end of the deflation era, the ongoing friend-shoring and onshoring trends, and efforts by the Tokyo Stock Exchange to encourage companies to raise return on equity and expand shareholder returns as positive developments. Japan stands to benefit in the near term from its relative economic stability as recession risks linger for the U.S. and EU, as well as from heightened interest in the country as a proxy investment for Chinese stocks and as a value play. A post-pandemic resurgence of tourism from China should also benefit the economy. Finally, it is worth highlighting that Japan is one of the last developed economies with relatively easy monetary policy. We remain Overweight Japan equities and prefer this market to other developed equity markets in the region. Risks to our thesis include the potential for weak external demand and volatility in the yen.

Asia Pacific fixed income

Investment-grade credit remains resilient; sector selection is key.

Persistently tight Asia investment-grade spreads. Asia investment-grade (IG) credit spreads relative to U.S. Treasuries are tight, around 169 basis points, underscoring fixed income investors’ flight to quality. This is likely to persist over the next few quarters, in our view, and reflects investor confidence in the resilience of Asia IG securities into 2024, as well as overall institutional credit investors’ continued overweight Asia IG positioning versus underweight in Asia high-yield credit.

Lingering concerns in China, but also bright spots. The collapse of China’s high-yield (HY) property sector has rippled through the domestic economy, as well as both onshore and offshore China property bond markets. Since China’s full reopening in early 2023, the economic recovery has been uneven, hampered by geopolitical risks and weak investor confidence. Policy support has so far been insufficient to stem the liquidity crisis that many real estate developers with high-yield credit are facing. While the overall macroeconomic backdrop is subdued, we view some sectors within China as attractive from a credit perspective. One such bright spot is the internet sector. China’s tech giants still enjoy resilient cash flow generation, and strong liquidity positions underpin their solid credit profiles. We believe strong standalone fundamentals should position these companies to capture the growth upside of a regulatory environment that is becoming less strict. This is already evident in recent strong operating momentum in the sector.

China property high-yield USD index has declined for most of the year

Year-to-date nonannualized total return

The line chart shows year-to-date total return performance in non-annualized percentage terms of the China Property High-yield USD-denominated Bond Index for the period of December 2022 through November 8, 2023. It shows total return increasing in early 2023, before gradually declining for the rest of the year.

Source - RBC Wealth Management, Bloomberg; data through 11/8/23

Potential opportunities in Korea Financials. Korea’s financial sector has been facing pressure from high domestic inflation, rising interest rates, a growth slowdown, and a cooling property market. These factors have caused Korean Financials-sector USD-denominated bonds to underperform Asia peers. The Korean government’s support measures have eased some of these problems to a certain extent, and we view the Korean banks’ capitalization levels as strong enough to withstand losses even if they face a spike in nonperforming loans. We see the underperformance of Korean Financials sector USD bonds as an opportunity to buy on weakness, especially for strongly capitalized banks. In particular, we favor the subordinated bonds, which provide higher spreads to senior bonds.

Emerging Market Asia corporate bond issuance likely to remain subdued in 2024. We expect 2024 new issuance in Emerging Market (EM) Asia corporate debt to be similar to 2023 levels, which have been around decade lows. This is due to external deleveraging, which is most pronounced in Asia within the EM corporate universe. These corporations’ large-scale funding needs remain muted as macro uncertainty is holding back large capex and investment plans. At the same time, domestic funding channels such as banks and local bonds are accessible at more attractive levels; this is especially true for China corporates. We further expect new issuance to be skewed toward investment-grade securities, reflecting overall market risk aversion. In our view, 2024 should be another year in which EM Asia corporates’ redemption of outstanding bonds outstrips new issue supply, and this dynamic should continue to underpin the market.

We continue to prefer investment-grade credit for 2024. Lower forecasted U.S. Treasury yields into 2024 should provide an overall tailwind for Asia credit, even though the path to lower interest rates is likely to be bumpy, in our view. Asia IG has shown its resilience in recent market volatility. Asia HY is out of favor, and we view the asset class as less attractive amidst macro uncertainties and concerns regarding idiosyncratic risks. We prefer to keep duration short for Asia IG due to spread valuations—we like the attractive coupon carry for this resilient segment, but also seek to limit the potential performance impact should valuations reverse.

View the full Global Insight 2024 Outlook here