With the regional economy struggling, the reforms agenda has been given new impetus. Recommendations to improve the effectiveness of the single market are due in the spring; it will be up to the new European Parliament, which will be elected midyear, to implement them. For equities, weakening macro and earnings momentum remain headwinds. We would become more positive when signs that the region’s relative economic growth momentum is improving become apparent. Our bias is to add to sovereign fixed income positions and increase duration given the weak economic environment.

European equities

Reforms in focus; we remain cautious until the next economic upcycle.

Weak momentum. After the recent sharp weakening in eurozone manufacturing and services activity, stabilization is possible over the next few months. The Industrials sector needs to rebuild depleted inventories, and consumer confidence could improve now that pricing pressures are abating. Nevertheless, we expect elevated interest rates to increasingly force belt tightening on the corporate sector.

The European Central Bank will likely keep interest rates on hold well into 2024. Though inflation has decelerated sharply to 2.9% and bank lending has waned markedly, wages are still growing at 4% year over year, a level inconsistent with the 2% inflation target. Slightly higher unemployment is likely necessary for wage growth to decelerate further.

Only once rates are cut can a sustainable economic recovery take hold. A consensus group of economists expects real GDP growth of 0.7% in 2024, marginally up from 2023’s 0.5% estimate. The potential for a muted recovery is due to the region’s increasing lack of competitiveness and the reining in of fiscal stimulus.

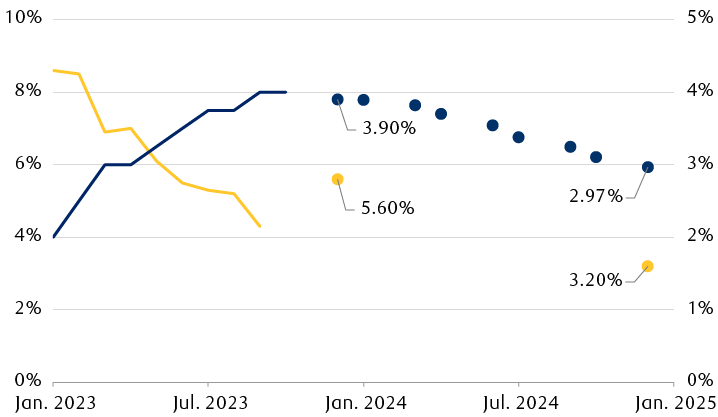

European markets expect around 100 basis points of policy easing in 2024

The line chart shows historical values and future estimates of the European Central Bank (ECB) deposit rate and the euro-area inflation rate, starting in January 2023. The last historical data point for inflation is 2.9% in October 2023, and the last data point for the deposit rate is 4% in October 2023. The chart also shows the ECB staff inflation forecasts for 2023 and 2024 at 5.6% and 3.2%, respectively. Market-implied estimates for the ECB deposit rate are shown dropping to 3.90% in December 2023 and 2.97% in December 2024.

Note: Inflation projections show European Central Bank (ECB) September 2023 staff forecast.

Source - Bloomberg, European Central Bank (ECB); data as of 11/14/23

Structural issues need tackling. The pandemic and the war in Ukraine have compounded the bloc’s long-standing structural issues such as its heavy regulatory burden, and the lack of cooperation among EU innovators and companies. These issues conspire to undermine the effectiveness of the EU single market, in theory a seamless amalgamation of 27 national markets with 450 million people.

In her 2023 September State of the Union speech, European Commission President Ursula von der Leyen identified competitiveness as a key priority. Task force recommendations are due in March 2024. The challenge is to preserve the freedoms of movement of capital, goods, and services while competing with the U.S. and China.

Following the June 2024 European Parliamentary elections, it will fall on the next European Commission to implement any recommendations to improve competitiveness and the state of the internal market. The buy-in of national governments will be an important test of their commitment to improve competitiveness.

Fiscal reforms. Moreover, previous EU rules limiting national budget deficits and indebtedness were suspended over the past three years. This was to facilitate financial support for the corporate sector from Brussels and national governments. Financial aid was aimed at supporting the economy reeling from the pandemic and the war, and at accelerating the green transition for domestic reasons and as a response to both the U.S. Inflation Reduction Act subsidies and China’s generous support of its industries.

Discussions to reform the fiscal rules have been ongoing as there is a broad consensus within the EU that more fiscal flexibility is required. Those discussions are likely to drag into 2024. We believe the rules will eventually be watered down though they will likely still require some fiscal tightening for most countries.

European equities are trading below long-term average valuations

STOXX Europe ex UK Index 12-month price-to-earnings ratio

The line chart shows the 12 months forward price-to-earnings (P/E) ratio for the STOXX Europe ex UK Index over the past 10 years. The ratio has been below the historical average of 15.1x forward earnings since March 2022, and is currently at 12.8x. The ratio has seldom been below 13x forward earnings in the time period shown.

Source - Bloomberg

Remaining Underweight, for now. We continue to recommend an Underweight position in European equities as weakening macro and earnings momentum remain headwinds for the region’s ability to outperform. Consensus earnings forecasts are at risk of being downgraded, particularly among cyclical stocks and sectors.

However, we are watchful for any green shoots and signs that the euro area’s relative economic growth momentum is improving. This would be a key catalyst to increase allocations. The combination of inexpensive valuations and an eventual improving economic backdrop could prove an attractive combination in the months ahead for European equities, especially given their out-of-favour status.

Until then, against the backdrop heading into 2024, we would remain highly selective. For the patient investor, we believe particularly attractive opportunities exist in Industrials supported by structural tailwinds such as decarbonization, semiconductor equipment manufacturer and mission-critical software providers within Technology, and luxury goods stocks that have pulled back in recent months to more attractive valuation levels. Health Care remains our preferred defensive sector, relative to Consumer Staples and Utilities.

European fixed income

Opportunities exist beyond the cloudy macroeconomic outlook.

The European Central Bank (ECB) thinks that, if interest rates are maintained at 4% for a long enough time, inflation will be brought back to target. Though ECB President Christine Lagarde has labelled rate cut discussions as “premature,” the market is pricing in about 100 basis points of policy loosening commencing next March through December 2024.

Our base case is no cuts in H1 2024. The risk to our view is an uptick in inflation from rising energy prices, which could prompt the ECB to hold rates at 4% for longer. Alternatively, a further deterioration in economic activity could ultimately cool inflation faster than the central bank expects, bringing rate cuts into view sooner that we anticipate.

The risk of a recession in the eurozone has increased, in our view, with economic activity data pointing to stagnation. All measures across manufacturing and services have fallen further into contraction territory. RBC Capital Markets forecasts 2024 growth in the region to teeter on the edge of recession and to reach a paltry 0.1% year-over-year growth.

The ECB’s process of reducing assets on its balance sheet, also known as quantitative tightening (QT) of the Asset Purchase Programme (APP) is underway with no reinvestments of maturities, while reinvestments from the Pandemic Emergency Purchase Programme (PEPP) are set to continue through the end of 2024. Under the scenario of PEPP reinvestments continuing, we expect the demand for European government bonds to absorb supply next year given the attractive level of yields.

The high allocations in Italian and Spanish bonds within the purchase programme have supported spreads thus far. However, Italian bond spreads have widened recently against German Bunds due to an increase in QT, the growing risk of a rating agency downgrade, and fiscal deficit concerns. The International Monetary Fund forecasts debt will be around 140% of GDP in 2028—worsening by more than 8% from its prior forecast. The European Union’s fiscal deficit rules are supposed to be back in force in January 2024, and discussions about reforming these rules are ongoing. The return of fiscal rules, which had been suspended since the onset of COVID-19, could increase bond volatility in nations that are close to or above the fiscal limits. Against this backdrop, we prefer Greece over Italy for lower-rated nations, and we balance the allocations across core nations such as Germany, Belgium, and Netherlands. We are biased to add to sovereign positions and duration as the economic outlook is set to deteriorate further, thus benefiting longer duration and sovereign positions.

Credit markets have been resilient despite QT and the ECB holding nearly 33% of the eligible corporate bond universe. However, if the pace of corporate bond reduction increases, spreads could widen. On a one-year basis, credit spreads look wider, but nearer fair value over a five-year period. While spreads look compelling, we are loath to chase these levels as higher financing costs as well as lower corporate earnings are impairing corporates’ fundamentals.

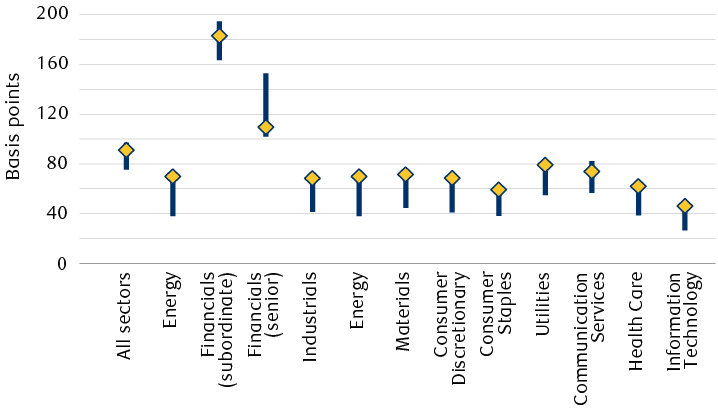

Most corporate credit sectors are near the top of their six-year ranges

Euro investment-grade all cash bond sector indexes’ month-end option-adjusted spreads

The chart shows the current month-end option adjusted spreads (OAS) by sectors for the euro bond market index, and the maximum and minimum values for each sector from November 2022 through November 2023. The current spreads for most sectors are close to the tops of their 12-month ranges. Senior bonds in the Financials sector are an exception, being currently near the bottom of their range.

Source - RBC Wealth Management, Bloomberg; data as of 11/14/23

Thus, we remain cautions and maintain our up-in-quality bias, preferring investment-grade over high-yield credit for now. The yield compensation for interest rate risk in high-yield versus investment-grade debt has narrowed meaningfully and is close to decade lows. Therefore, on a risk-reward basis, we favour investment-grade bonds given the recession risks. Yet, we acknowledge there will likely be an opportunity to allocate to high yield when spreads meaningfully widen.

We believe the theme for 2024 is to remain selective and defensive and focus on issuer fundamentals. In particular, we favour non-cyclical over cyclical issuers, senior ranking bonds issued by banks, the Utilities sector, and Telecommunication Services industry.

View the full Global Insight 2024 Outlook here