1. Artificial Intelligence requires patience

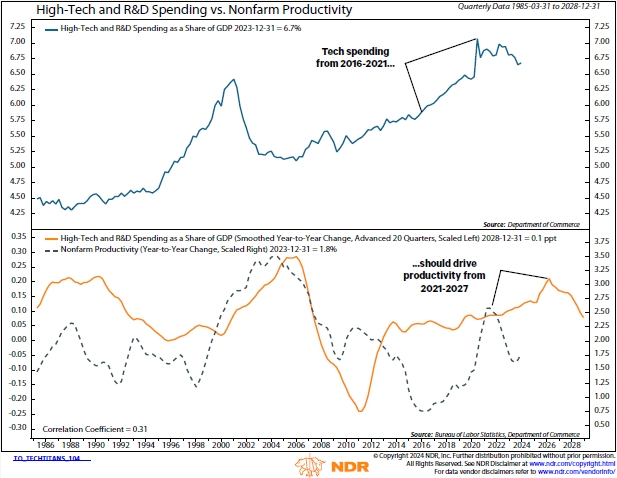

High end technology and spending on research and development tends to have a positive correlation with productivity, but with a five-year lag (see exhibit below), according to Ned Davis Research. The range of positive outcomes are expected to be broad, such as augmenting worker skills, freeing up resources to alternative uses, and improving access to educational or health care services. Conversely, it could also displace workers, cause structural unemployment, or erode job quality without sufficient control. Nevertheless, most experts believe AI will provide productivity gains but will be several years before we see economy-wide boosts in productivity.

2. Deglobalization prioritizes security over efficiency

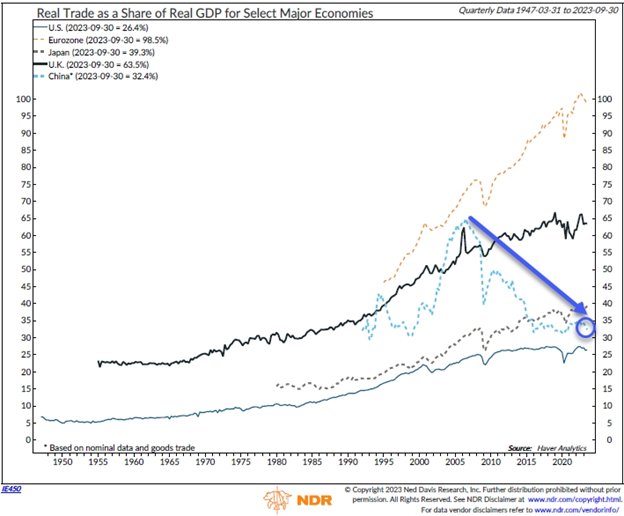

Over the past 30 years, globalization has allowed economies to benefit from their natural comparative advantage and has been a significant driver of disinflation, however, it left global supply chains vulnerable to external shocks, and the COVID pandemic exposed the risks associated with relying on a single supplier in the production process. The result was widespread inventory shortages and a surge in inflation, so to protect against future episodes, countries have begun to diversify their supply chains. So far, this has mostly meant reducing trade with China (see exhibit below), and the result of ongoing ‘protectionist’ government policies may lead to untapped comparative advantages that could drive costs higher for consumers and drag down productivity growth.

3. Shifting demographics points to tighter labor markets

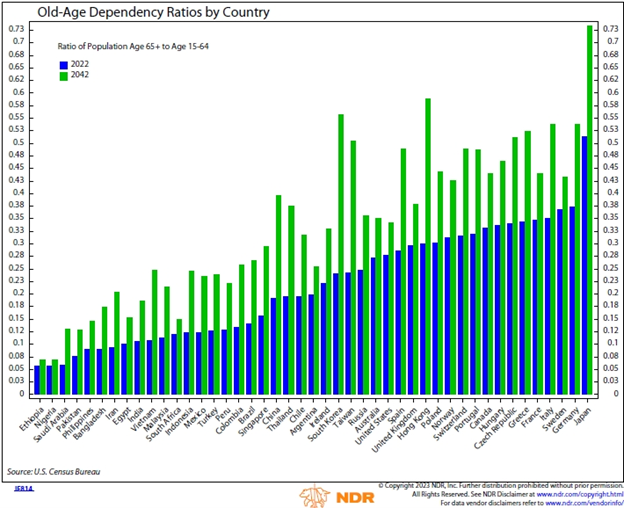

Aging demographics are expected to persist in most developed and some emerging markets in the coming decade, as the population dependency ratio (population age 65+ / population ages 15-64) is projected to increase globally (see exhibit below). Experts believe this could impose strains on government budgets and potentially manifest into slower labor force growth. Reduced aggregate demand also tends to come alongside an aging population, which puts downward pressure on GDP growth.

4. Burdensome debt servicing puts upward pressure on interest rates

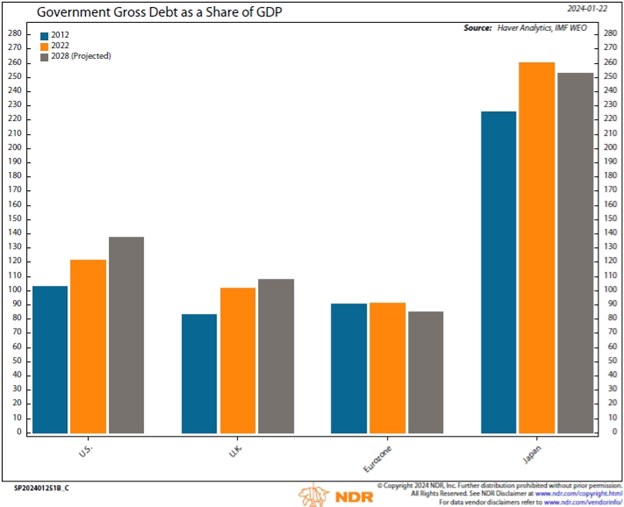

The global economy recovered relatively quickly from the COVID-19 pandemic, largely thanks to government stimulus that was injected into households to support demand, but as we know from economics – there is no free lunch. The IMF expects government debt to GDP ratios will remain elevated through to 2028 (see exhibit below) and is particularly more pronounced in the U.S., where there appears to be little appetite for policy to contain the budget deficit and debt growth. Net interest payments on U.S. debt as a percentage of total government outlays is projected to rise to 14.5% by 2033, from 12% today, according to the Congressional Budget Office (CBO), and that can have some implications including: 1) reduced future government spending, 2) upward pressure on interest rates and bond yields, and/or 3) higher inflation.

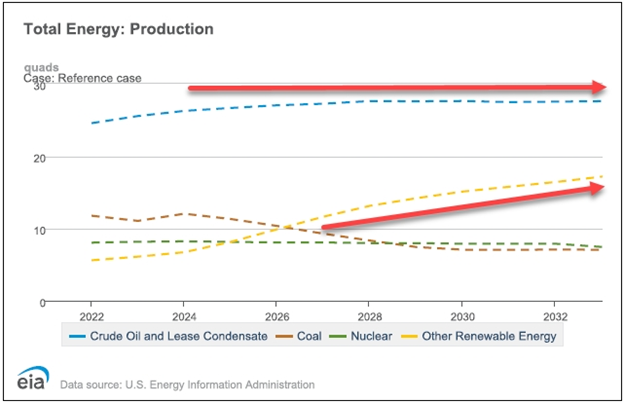

5. Clean energy transition will be a costly necessity

The transition to renewable energy resources will continue over the next decade, though progress is likely to be uneven across world economies as fossil fuels are expected to remain an integral energy source (see exhibit below). For some regions, the transition to clean energy is more critical, such as the Eurozone who currently depend more on imported oil and natural gas as their main energy sources. The transition period will likely be associated with higher commodity prices, stemming from reduced mining investment, and could result in headwinds for central bankers to keep a lid inflation.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.