Executive Summary

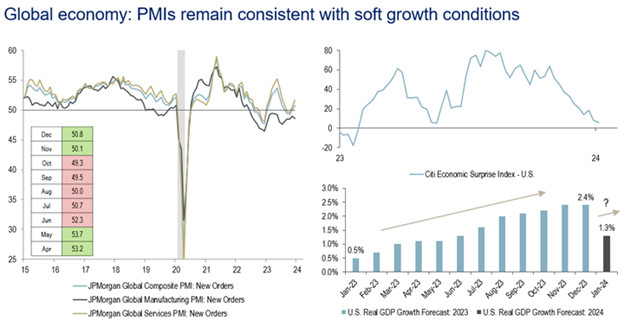

Growth divergences: U.S. economy continues to chug along, with few signs of an adverse impact from accumulated Fed tightening so far, in contrast to the European and Canadian economies which have weakened notably. Persistent weakness in manufacturing relative to resilient services explains the regional divergence to some extent.

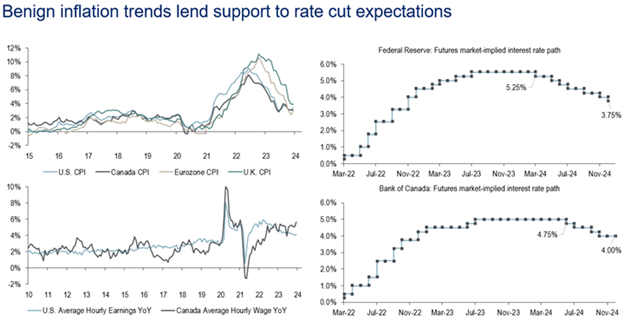

Monetary policy: The long-awaited pivot in policy stance for major central banks seem to be in view as inflation has moderated to palatable levels, but expectations for six Fed rate cuts in eight meetings in 2024 seems aggressive if the economy continues to grow.

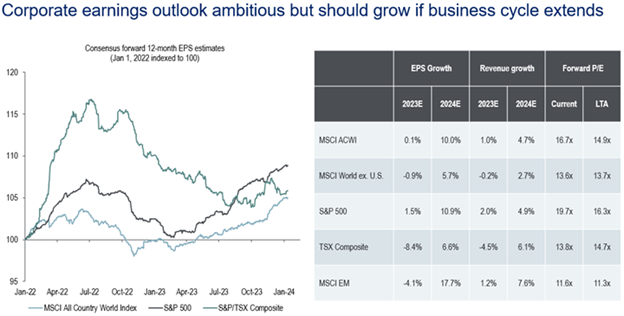

Corporate earnings: Profit trends and margins have stabilized. Markets know full-year estimates are usually revised lower as the year progress. An expanding economy should allow earnings to grow.

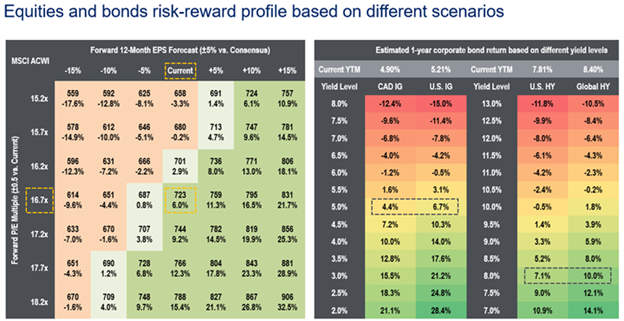

Cross-asset: As equity valuation multiples have already rebounded meaningfully since October, equity markets will likely be more reliant than usual on earnings growth for support. Bond yields have declined October peak, but still relatively attractive all-in yields available.

Macro Outlook

Up and down…

…pretty much describes the last two years in major global equity markets. After what can only be described as dramatic advances off the pandemic lows of Spring 2020, most indexes peaked some 21 months thereafter and did not do much other than digest those hefty gains. Then the prospect that the Fed and other central banks have finished with rate hiking has raised investor hopes. This has fueled a stock market rally that is setting new highs for some of the large-cap indexes.

Source: RBC GAM

Takeaway: The latest readings suggest that the expansion remains intact, tracking the soft-landing consensus, with a modest rebound in services activity helping to offset sluggish manufacturing. However, PMIs remained below their long-run averages in recent months, signaling that the overall growth impulse remains tentative.

Source: RBC GAM

Disinflation continues with more in the pipeline. Inflationary pressures eased markedly over the past year on account of lower energy and goods prices and normalizing prices in services categories. Real-time rent measures suggest the key drivers of core inflation are likely to maintain a downward trend in the coming months.

Markets expect a monetary policy pivot. Emboldened by sharply lower inflation and the Fed’s recent “dovish” commentary, markets have priced in a generous dose of monetary policy easing this year. For the Bank of Canada, futures markets have priced in just over 100 bps of cuts through December, with the initial rate reduction expected to come at the June meeting, followed by three more 25-bps cuts by December.

But wages remain an area to monitor. While labour markets conditions have started to loosen—underscored by slower job gains and declining job openings—wage growth remains quite strong because of steady demand for workers and could be an area that garners policymakers’ attention.

Another question worth considering is what kind of rate cuts are we going to get? Risk assets are perceiving the consensus view of multiple rate cuts this year as unambiguously good news. But rate cuts come in two flavours: disinflation-driven and recession-driven. The latter kind would be negative for risk assets.

Takeaway: With the U.S. economy still proving resilient and firm wage growth, the market may be overestimating the number and pace of rate cuts in 2024.

Source: RBC GAM

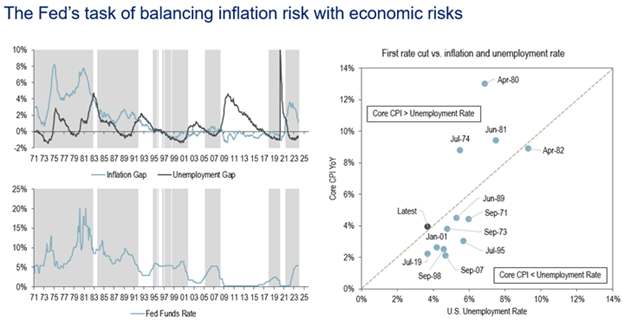

Fed may be reluctant to cut rates meaningfully without prominent labour market weakness. As mentioned earlier, waiting too long carries the risk of the economy succumbing to the burden of onerous credit conditions and potential job losses (i.e., keeping the recessionary window open), while cutting too soon (or by too much) comes with the risk of stoking a reacceleration in demand and price pressures.

The monetary policy tradeoff of unemployment vs. inflation. The right chart shows the timing of the first Fed rate cut going back to 1970. The observation here is that it’s historically unusual, though not unprecedented, for the Fed to start easing monetary policy when inflation is still higher than the unemployment rate.

Source: RBC GAM

Earnings growth expected to reaccelerate through 2024. After stagnating in 2023, profit growth is forecast to pick up materially over the next few quarters with global earnings projected to grow roughly 10% this compared to 2023, led by U.S. large-cap companies.

Source: RBC GAM

Earnings delivery taking on added importance for equities. Given valuations already seem to reflect expectations of a reacceleration in profit growth over the coming year—the MSCI All-Country World Index currently trades at nearly 17x forward earnings vs. the long-term average of around 15x—additional equity gains will probably have to be driven more by earnings growth in the near term than by further multiple expansion.

Source: RBC GAM

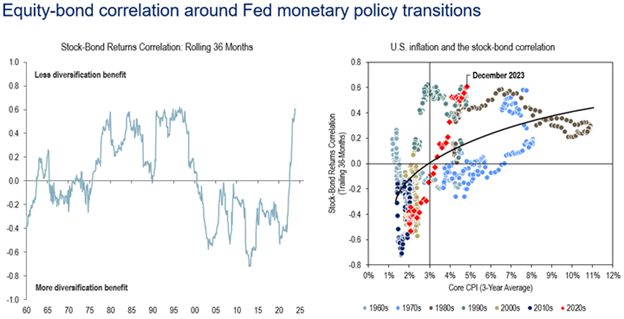

Can bonds reprise their role of diversifier for equity risk? The reversal of two decades of mostly negative equity-bond returns relationship has been a major development over the past two years for balanced investors. A pivot in monetary policy stance towards easing and higher starting yields should improve the diversifying properties of bonds moving forward, though history suggests that it is crucial for inflation to settle around the Fed’s 2% target.

Takeaway: As inflation falls and monetary policy tightening ends, that should alleviate the co-movement in stock and bond prices. Moreover, even if markets transition to a positive stock-bond correlation regime in the coming years, portfolios can still benefit from fixed income (e.g., the 1990s). Higher yields today should help reduce bond price volatility and improve returns, both of which can provide ballast for portfolios.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.