November update

Team News is going at the top of my update this month

I’m sad to announce that my Associate Kim Balas has left RBC Dominion Securities at the end of October. She has taken a new job elsewhere which is closer to home. Kim worked with me for over 6 years and I will miss her. She did a great job servicing clients and was very efficient.

I am in the process of hiring a replacement for Kim.

Also joining my team, I am happy to welcome my son Spencer Robertson. Spencer first started with RBC in 2018 as a summer student in this office before moving to a variety of head office roles across RBC. He has worked in the Advice Centre, Enterprise Operations supporting the HSBC merger and most recently, Credit Cards on the buy now-pay later portfolio. Spencer holds a Bachelor of Commerce degree from Dalhousie University where he completed three co-op terms with RBC.

Spencer has completed his course requirements for securities licensing. Outside of work, Spencer is an avid golfer, runner, tennis player and a Leafs fan. Spencer ran his first half marathon in 2023 before completing the Toronto Waterfront Marathon the following year.

Spencer will be helping me with Wealth Management, Portfolio Management, attending client meetings as well as a variety of tasks. Spencer can be reached at spencer.robertson@rbc.com or 905-434-2657

The Markets (as of close October 31, 2025)

The TSX is up 0.8% in October and 22.4% year to date.

The S&P is up 2.3% in October and 16.3% year to date.

The NASDAQ is up 4.7% in October and 22.9% year to date.

From our Portfolio Advisory Group (as of October 30, 2025)

Approaching the one-month point of the U.S. federal government shutdown, the Federal Reserve (Fed) has been forced to make an interest rate decision with only partial visibility into the economy. Meanwhile, signs of weakness in pockets of the Canadian economy prompted the Bank of Canada (BoC) to follow suit with a rate reduction. Although trade tensions remain an overhang, equity markets have been demonstrating resilience, supported by strong corporate earnings and investor confidence in underlying fundamentals. We discuss these themes further below.

Q3 Earnings

The U.S. earnings season is now in full swing, with nearly one-third of S&P 500 companies reporting this week. In the absence of much official U.S. data, corporate results and management commentary have become even more valuable in gauging the health of the economy. So far, earnings have exceeded expectations, with companies surpassing analysts’ estimates at rates above five- and ten-year averages.

With many global equity markets hovering near all-time highs, continued earnings delivery and constructive forward guidance will be key to sustaining upward momentum. Over the past week, investors have focused closely on Big Tech earnings, tracking their capital spending trends and assessing the path forward for AI-related investments. So far, the results have been perceived favourably, lending support to equity markets with tech companies announcing continued investment, collaboration, and innovation.

Interest Rate Cuts

Amid limited economic visibility caused by the ongoing government shutdown, the Federal Reserve opted to trim its benchmark rate by 0.25% this week. With many official reports unavailable, policymakers leaned on alternative data sources and commentary from the business sector to gauge inflation dynamics and consumer demand. The September inflation report—released as an exception due to its role in determining Social Security adjustments—offered one of the few clear signals. While inflation remained above the Fed’s 2% goal, the softer-than-expected reading and steady underlying trends gave officials confidence to ease policy.

Fed Chair Powell cautioned, however, that continued data disruptions could complicate future decisions. He noted that another rate cut in December “is not a foregone conclusion,” stressing the Fed’s need to balance “upside risks to inflation and downside risks to employment” amid an increasingly uncertain data environment.

In Canada, the BoC also lowered rates by 0.25%. Despite a modest uptick in headline inflation, easing business inflation expectations, the removal of retaliatory tariffs, and a tepid labour market provided scope to cut for a second consecutive meeting. However, policymakers tempered expectations of more cuts in the months ahead, noting that persistent trade disruptions could cause structural scars to the economy, potentially making monetary policy a less effective tool in stimulating growth while keeping inflation anchored around its target range.

Trade Frictions

Canada has once again drawn attention from the U.S. administration, as President Trump proposed an additional 10% tariff on Canadian goods in response to a recent anti-tariff advertisement. While details remain unclear, most Canadian exports continue to benefit from USMCA protections, helping cushion the overall impact. Nonetheless, ongoing sectoral tariffs—particularly in steel, aluminum, and autos—continue to weigh on industrial activity and may constrain growth prospects. With USMCA renegotiations on the horizon in 2026, we’ll be paying close attention to how this renewed friction evolves.

In contrast, there was a more positive turn in U.S.–China relations. The in-person meeting between Presidents Trump and Xi Jinping in South Korea this week delivered a temporary but constructive breakthrough. The two countries have agreed to suspend export controls on rare earth minerals and some semiconductors as part of a broader one-year trade truce that will also see the U.S. reduce fentanyl-related tariffs and China resume soybean purchases. While the agreement helps reduce the immediate risk of further tariff escalation, the short duration of the truce means policy uncertainty is likely to persist and could remain a source of market volatility.

Takeaway

With corporate earnings season off to a broadly positive start and central banks moving to support growth, the foundation for cautious optimism in equity markets appears to be intact. The combination of interest rate cuts and resilient earnings reinforces our view that maintaining an “invested but selective” stance remains appropriate. We continue to monitor the evolving policy landscape closely, balancing opportunity with vigilance in a still-uncertain environment

Wealth Management

Canada’s new government will release their first budget on Nov 4, 2025. Our firm will be publishing an article following the release which I will be sharing.

Tis the Season – many clients are charitably minded and want to make a meaningful impact for causes important to them. At this time of year, there are different opportunities to include charitable giving as this may be beneficial for client’s year end tax planning. This can help offset large capital gains – and the capital gains can be from selling a second property or securities. In the last 3 years we have experienced strong growth in many equities, particularly the tech stocks.

Often charities will have brokerage accounts for people to donate securities in kinds – I do hold a charitable account for a local charity and we often see donations of securities in kind coming in this time of year.

We have a charitable gift program here at RBC Dominion Securities where clients can set up their own charitable gift fund as part of their financial plans. These funds are managed by us and administered by Gift Funds Canada, which is an independent non-profit charitable organization registered as a public foundation with the CRA. I have attached an overview and happy to discuss on an individual basis.

Currently the Federal tax credit on the first $200 of donations is 15% - any excess donation over $200 will result in a tax credit of 29%. For donation of securities in kind you may benefit from the elimination of the capital gain accrued on the security plus the donation tax credit.

In the Community & Client Events

I attended “This is Lakeridge Health 2025” event in October. It was nice to hear Cynthia Davis, CEO of Lakeridge Health talking about their progress and goals for our Health Care.

I also attended Ontario Shores Journeys of Hope. This was a wonderful night out to learn about their music therapy program and we were entertained with some very talented artists.

We are hosting an in person business owners succession planning event on Nov 12 from 5- 8 pm in Ajax. Topics to be covered include

- Tax planning strategies on the sale of a business

- What to expect during the sale of a business

- Strategies for preserving family harmony throughout the process

- The role of advisors and why they’re key in a sale

- Best practices and common mistakes

We are also holding a virtual event on Navigating the cyber universe on Monday Nov 10 at 2:30 – the invitation was sent out last week and if anyone missed it, please email me.

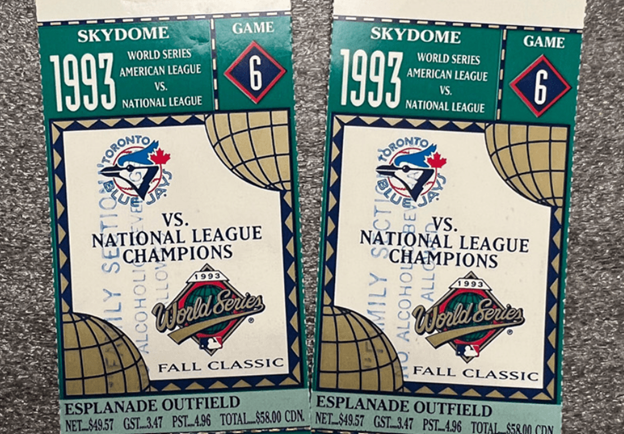

I would be remiss if I didn’t mention the Jays; what an exciting yet disappointing finish to a great season. Here are some interesting facts;

1993 vs 2025

Last time the Toronto Blue Jays were in the MLB World Series was 1993. In 32 years, the fan experience has also evolved.

Tickets

1993: Fans bought tickets by mailing in cheques or waited in line for over 12 hours to purchase them. Prices ranged from $32 for 500-level seats to $58 for ninth-row 100-level seats.

2025: Fans raced to get into the online cue in Ticketmaster and purchased tickets starting at $500 for 500-level seats and $750 for 200-level seats. Ticket prices skyrocketed into the thousands.

Concessions

1993: Hot dogs sold for $2.99 and beer for $4.75 – a baseball combo for decades.

2025: During the regular season fans enjoy Loonie Dog Tuesday and Dugout Deals when looking for the cheapest offers. During the World Series, standard hot dogs cost closer to $10, and a domestic beer is sold for around $15.

Bank branches are closed on November 11 for Remembrance Day but the markets are open.

Until next month…..

Karen L Robertson, FCSI, FMA, CIWM, CIM | Senior Portfolio Manager | RBC Wealth Management | RBC Dominion Securities Inc. | 17 King Street East, 3rd floor Oshawa, ON L1H 1A8 | T. 905-434-8048 | T. 1-800-267-1522 | F. 905-436-5068 | www.KarenLRobertson.com| | My Linked In Profile

Please note that we cannot accept trading instructions by email for regulatory reasons. Please call us to discuss any transactions in your account.

Team members:

Spencer Robertson

spencer.robertson@rbc.com or 905-434-2657

RBC Dominion Securities Inc.