For those of you who might have members of household or extended family or friends dying to see Taylor Swift in Toronto for one of her 5 dates in November, I wish I had good news. I’m trying, but like a disciplined investor, I’m not going to overpay. I thought I’d share a story about trying to get tickets for “Tay Tay” as the cool kids call her.

I share season tickets for the Blue Jays with a few colleagues. Thinking my “status” would give me an edge: I called the Blue Jays and said: “I’d like to inquire about renting a suite for any Taylor Swift concert date, how much would that cost?”. They kindly got back to me quickly: “Mr. Kingsmill, we would be delighted to provide you with the following wonderful opportunity. You can commit to buying box games, 7 per year for the next two years, at $35K per year to watch the Blue Jays. Then, lucky you, Mr. Kingsmill, if you agree to this, we will sell you a suite for Taylor Swift that will “only” cost another $20,000”.

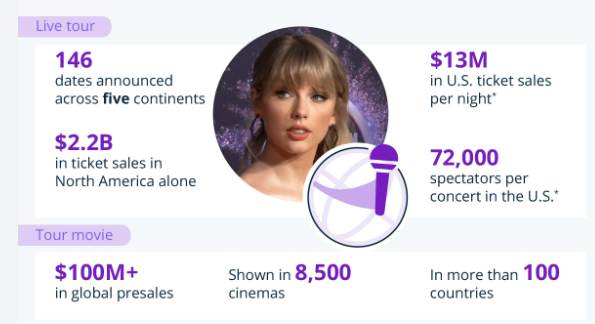

I might have to take a trip to Europe to satisfy the family obligations. Retail tickets for shows on Swift's record-setting Eras Tour in North America and Europe sold out almost instantly. Many then popped up on resale sites just as quickly. On StubHub, the cheapest seat to a Toronto concert in November right now is listed at $2,822. Yet the cost to get in the door in Stockholm this weekend is just a fraction of that price — $83.

While buying Taylor Swift tickets isn't the same as buying stocks or bonds: there is a similarity, in that the price that one is willing to pay, is its value of the ticket in the open market. This is just like the market: nobody cares what price you paid when you're trying to sell a stock or a bond…

This blog of course can’t make stock recommendations, but if Taylor Swift was a stock: it would likely be “top performer”, pardon the pun…

It’s a long weekend in Canada: US markets will be open Monday, but not in Canada. No predictions, just everyone enjoy the extra day off.

JK