One of the main components when we start working with a client, not to mention the on-going updating and considerations that go into this, is what percentage of our investments should be “fixed”, i.e. not subject to the ups and downs of the market, and what percentage of our investments are we willing to have participate in the upside and downside of the market.

For the last few years: GIC’s could be locked in for an over 5% rate, for one year. Today, for conservative buy-and-hold to maturity GIC’s and bonds, investors can expect average returns of 3.5 – 4.5%. This is simply the interest being paid on the instruments.

In the recently updated 6th edition of Jeremy J. Siegel’s “Stocks for the Long Run”, the author makes the case that the reasonable annualized return expectations going forward for stocks, bonds, and bills is 8%, 5%, and 4% respectively. So, fixed-income is not just an insurance lever, but does contribute to our client’s risk-adjusted long-term return goals.

When we do planning for clients long term, we always use a “conservative” rate of return. Its easy to get carried away when the markets are doing as well as they are now. But we are all investing for our unique goals: saving up to buy a house, pay for children’s education, grow our future retirement savings, drawing down from our investments as income, taking money out for all kinds of life expenses, gifting, or estate and legacy purposes.

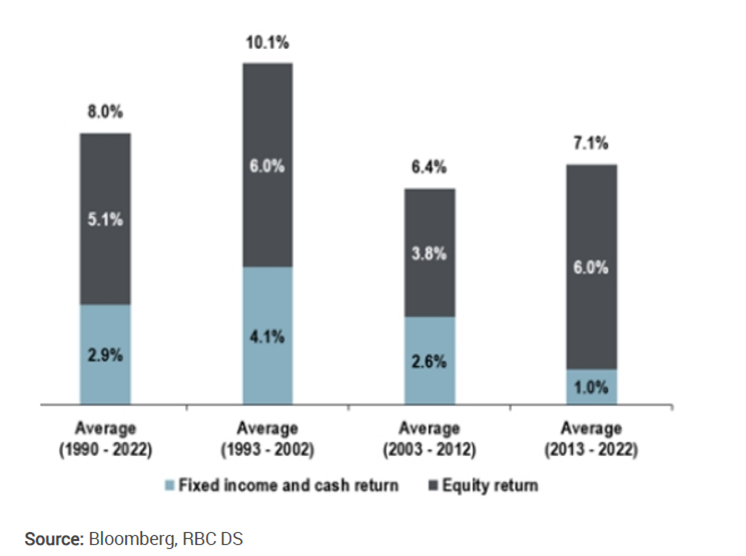

This graph illustrates, that to the extent we need a balanced return, equities do the “heavy lifting” indeed, but there needs to be degrees of certainty in the investments, according to each of our unique situations:

I’m a few weeks late, for the start of “red October”, which of course is Baseball playoffs in the US. I can make one guarantee: The winner of the World Series will be known before the winner of the US election. (Game 7 of the World Series is Nov. 2nd, the US election Tuesday Nov. 5th). I’m predicting a classic Dodgers vs. Yankees World Series. LA, with Ohtani, will be crowned World Series Champs. I won’t be making any US election predictions, but next week’s post will have more commentary on this.

Have a great weekend.