The markets are again flirting with new highs, even as the incoming U.S. administration introduced fresh uncertainty. President-elect Donald Trump recently proposed sweeping tariffs: 25% on imports from Canada and Mexico and an additional 10% on Chinese goods. There will be lots of posts and discussions about these tariffs over the next few months and years no doubt. At this point however, we always tell clients that it’s not wise to make rash decisions on things that may or may not occur.

Countries generally use tariffs to protect domestic industries by raising the cost of imports and encouraging consumption of locally produced goods. Tariffs also provide a source of government revenue. However, in practice, the benefits to the country imposing the tariff are often offset by several forces. Ultimately, consumers usually bear the brunt of the costs through higher prices. One relevant example for us is oil. Oil accounts for nearly a third of Canada’s exports to the U.S., and energy makes up a significant portion of the Canadian equity market. If implemented, tariffs could hurt the Canadian economy and its stock market.

This is where we must go back to not acting rash: Canadian oil represents around 20% of U.S. oil consumption, and without clear alternatives, oil prices in the U.S. would likely rise, aggravating inflation-weary consumers.

So far, markets have largely shrugged off the tariff threats. The Canadian stock market has marched higher, while the Canadian dollar has pared back some of its losses following the announcement. Still, the Loonie remains near multi-year lows, reflecting stronger U.S. economic growth and expectations that U.S. interest rates will eventually settle at higher levels than in Canada.

If there is one take-away from this, we shouldn’t view tariffs as an empty threat, but the impact may be less punitive than some may expect. U.S. administration may introduce greater unpredictability, potentially adding to market volatility. may create risks to consider going forward but can also create opportunities as short-term dislocations arise.

I promise all of you that we will be on guard for both as we move into 2025 and beyond.

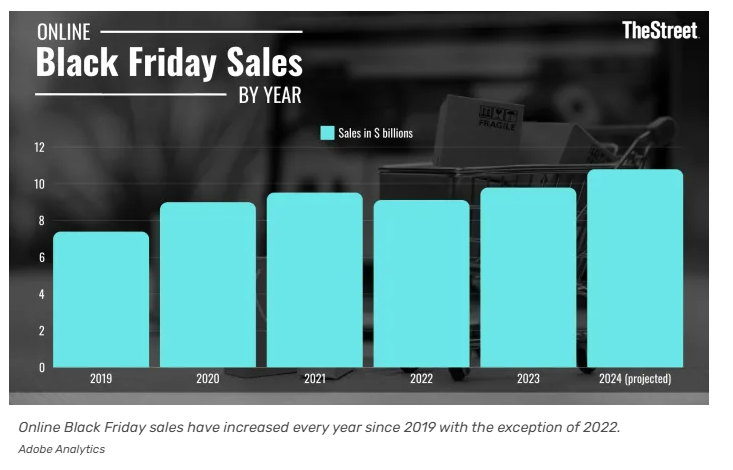

Now that US thanksgiving has passed, and an estimated 50 million turkeys have been consumed, the focus will be on the size of the “Black Friday” sales, where I predict many Canadians will also be partaking. Just to give you an idea of the significance of this day: Canadian Tire’s annual sales are approximately $17 billion Canadian. Black Friday should top $14 Billion Canadian dollars in just 1 day!

Have a great weekend.

Should you have any questions, please feel free to reach out.