Well, we made it through RRSP season (we promise we won’t hold it against the “few” of you who waited until to last minute!). In the next weeks we will also look at TFSA contributions, as we have seen this is perhaps something that hasn’t been used to its fullest.

For anyone looking at their statements or following the market, I have a good note on the “worry” of markets being at an all-time high, and whether it is too late, and/or it's not the right time to put more money into the market. Any of my long-time clients know that I always advocate not being able to “time the market”, and making investments based on objectives over time.

A few things:

- The US and Global economy are at all-time highs in terms of GDP

- The stock markets are widely at all-time highs in terms of earnings and revenues.

Granted it is one point in time, but the power of compounding, and staying invested is what the below is trying to show:

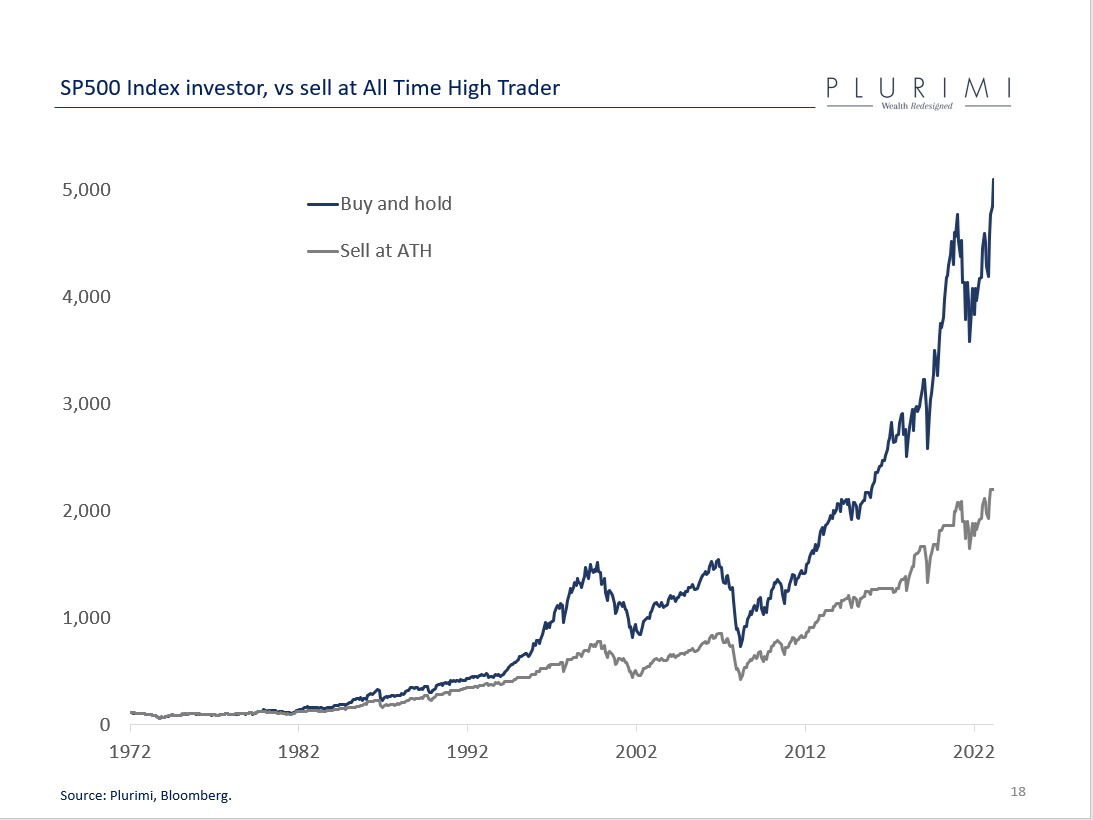

On December 31, 1972, the SP500 was at an all-time high of 118.05. Let's say two equity-orientated investors had different strategies that they put to work on this date.

“Steady-Eddy A” bought the S&P 500 at its all-time high then, and never sold, always remained fully invested.

“Market Guru B” always owned the S&P 500, unless it was at an all-time high at month end. Then she called up her broker, if it hit an all-time high, to take profits, because of an innate belief that they could time the market and/or deemed the market too expensive. The Market Guru took profits, until buying it at back at a lower price below, any level below a month-end all-time high.

On January 1st, 1973 Steady-Eddy A owned the Index, and Market Guru B waited. On 31st January B bought the Index at 116.03 leading to a better entry level. They both followed their respective strategies.

Market Guru B actually stayed ahead for a while, but missed a lot of significant rallies as a result. Today, the S&P500 is up from 108 to 5078 over that time, while the Market Guru B is only at 2198... despite being invested in the S&P for more than >90% of months.

If there is one take-away from this: it's that one of the biggest challenges we all have in investing is establishing the right investment criteria and sticking to them. This doesn’t mean holding anything blindly. Just as the S&P has changed over time in terms of its composition (from a heavy industry group of US-focused companies to a more globally oriented, revenue and growth group, and some of the great technology companies that continue to innovate), so should the underlying securities we hold change.

This year, we have an extra day to make those contributions: right up to the end of day, February 29th. When Julius Caesar created the Roman calendar, he introduced an extra day every 4 years, based on the Egyptian solar calendar. FUN FACT: This year, about 5 million people around the world will be celebrating their birthday on this Leap year, including Superman! So, Avril and I aren’t Supermen: please don’t wait until Feb. 29th at 3:30 to make that contribution!

Have a great weekend.