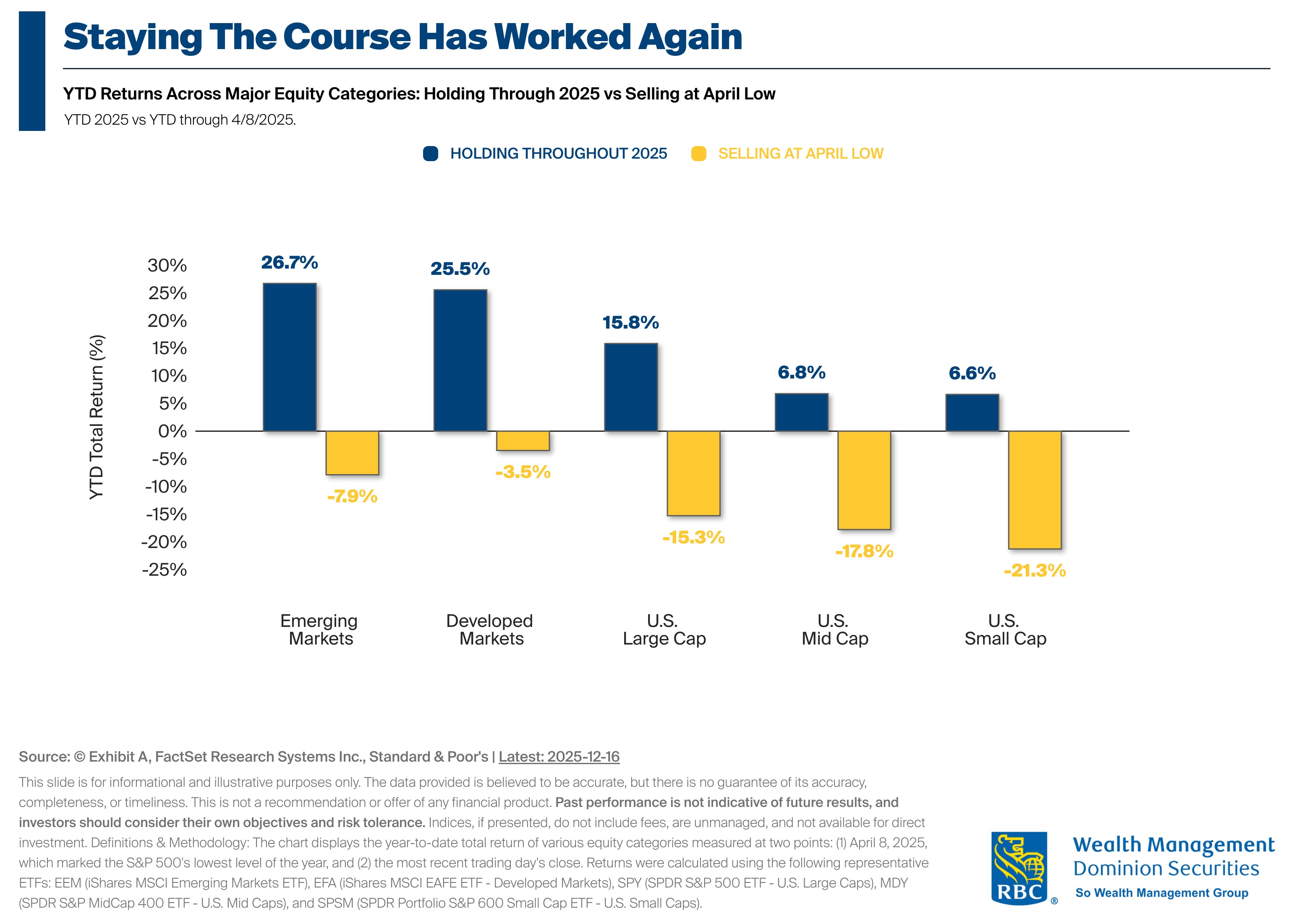

Measuring Market Resilience: The chart compares year-to-date returns across major equity categories for two scenarios: investors who held throughout 2025 versus those who sold during April's market panic.

A Look at the Recent Data: Investors who stayed the course have been rewarded in 2025, with all categories of equities generating strong returns relative to their drawdowns in mid April.

Investment Implications: The data underscores the stark difference in investment outcomes this year for those who sold at the April lows vs those who have stayed invested.

2026 is shaping up to be another year with major headline risk. Levels of uncertainty are high with mid-term elections, central bank interest rate policy, renegotiating of trade deals, concerns of overspending on AI, and early signs of weakness in the labour market. Volatility is the cost of admission for investors who want to participate in what has been strong returns based on continued strength in corporate earnings and a resilient economy. Investors are to be reminded that the best plan of action for 2026 may be to just stay the course.