For Canadians seeking to diversify beyond domestic borders—without juggling multiple currencies—Canadian Depository Receipts (CDRs) offer a simplified solution. These securities trade on Canadian exchanges, giving investors direct access to a curated list of U.S., European, and Japanese companies, all priced and settled in Canadian dollars.

The Mechanics and Appeal of CDRs

Much like their better-known counterpart, the American Depository Receipt (ADR), CDRs represent ownership in foreign-listed companies. The key difference: CDRs come with a built-in currency hedge managed by the issuer.

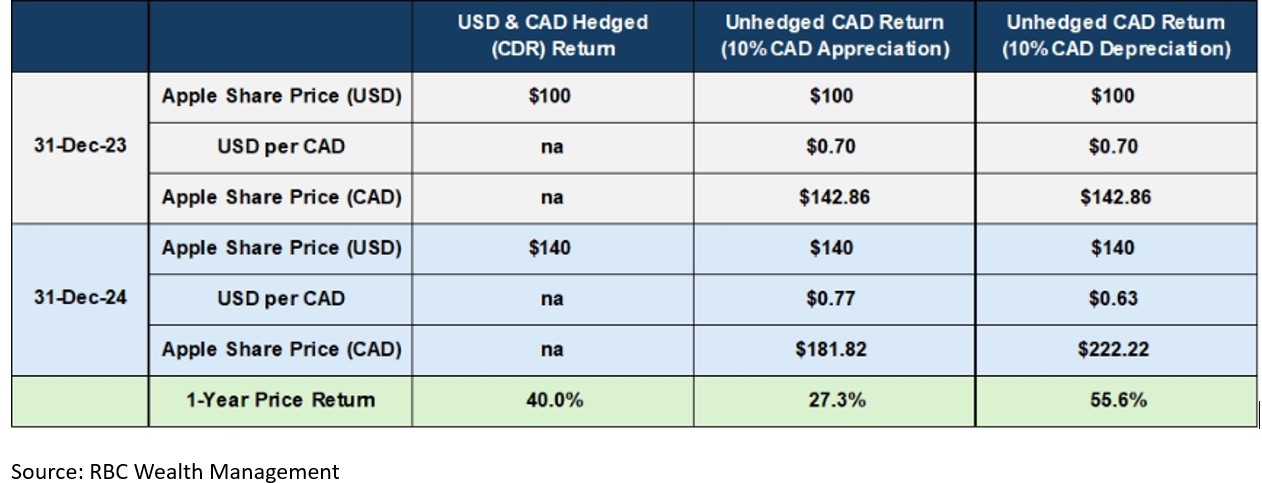

This hedge reduces the influence of currency fluctuations on returns. When the Canadian dollar strengthens, it helps offset potential losses in foreign holdings; when it weakens, however, investors won’t participate in the currency-related upside.

Currently listed on the NEO Exchange, CDRs provide exposure to some of the world’s largest and most stable corporations. The typical entry price for a CDR is around $20, making them far more accessible than the often steep per-share prices of global blue chips like those listed in the U.S.

Another perk? Cost efficiency. CDRs don’t charge management fees like mutual funds or ETFs, though investors do indirectly pay for the hedge management—typically ranging between 60 and 80 basis points per year. And because they’re transacted in Canadian dollars, investors skip foreign exchange conversion fees entirely.

Example of how CDR Currency-Hedging Works:

Potential Frictions to Keep in Mind

No currency hedge is perfect. The “CDR ratio”—the number of foreign shares one CDR represents—is adjusted daily to reflect exchange rate movements. Timing mismatches between markets and rebalancing windows can cause short-term tracking differences, and these small inefficiencies add up over time.

Over the long run, investors may experience slight return slippage due to these costs. Furthermore, while hedging reduces volatility, it also eliminates potential diversification benefits that come from foreign currency exposure. Historically, major currencies like the U.S. dollar, euro, and yen tend to offset declines in their home markets when measured in Canadian dollars—a natural cushion that CDRs’ currency hedging removes.

Example of CDR “Slippage"

Other Practical Considerations

Although the 60–80 basis points may feel high, the accessibility CDRs offer—fractional ownership of premium global equities—can justify the cost. Dividends are paid in Canadian dollars but remain subject to foreign income tax treatment. This means they’re taxed as regular income if held in taxable accounts, without the dividend tax credit benefit.

Liquidity, like with ETFs, depends on the trading volume of both the CDR and its underlying stock. Even with low trading volumes, tight bid-ask spreads can support efficient execution. Applying ETF trading best practices, such as using limit orders, would be a prudent approach.

Bottom Line

CDRs are an inventive addition to the Canadian investor’s toolkit. They offer a straightforward, Canadian-dollar-based path to global diversification, “fractional” access to expensive stocks, and a built-in currency hedge. For those seeking international exposure without the complexity of foreign currency management, CDRs can serve as an efficient and accessible solution. See the full directory of CIBC CDRs and BMO CDRs.