Whether you call it a cottage, chalet, camp, or cabin, it’s more than just a property—it’s a place where your family relaxes, reconnects, and creates memories. For many, the cottage has been part of the family for generations, and the hope is to pass it on for generations to come.

But here’s the challenge: passing down a cottage isn’t always as simple as handing over the keys.

There are important financial and tax considerations—especially when it comes to keeping the property in the family after you’re gone.

The Hidden Cost of Inheritance:

When you pass your cottage along to the next generation, you may also be passing along a substantial tax bill. For some families, this bill is so large that the only way to pay it is to sell the property.

Two common taxes come into play:

- Capital gains tax – The tax on the increase in your property’s value since you bought it

- Probate tax (aka the Estate Administration Tax in Ontario) – A tax on the value of assets passed through the estate

Here’s where it gets tricky:

If you bought your cottage decades ago, chances are it’s worth a lot more today. When you transfer it to anyone other than your spouse—say, your children—the government treats the property as if it was sold at fair market value. This is called a "deemed disposition", and it triggers capital gains tax immediately.

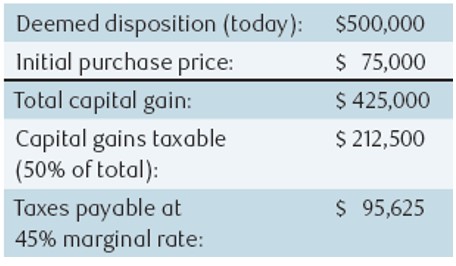

A Quick Example

Imagine you bought your cottage 30 years ago for $75,000. Today, it could be worth as much as $500,000, and the capital gain from that increase could add up to a tax bill of over $95,000—and that’s right now, not years into the future when the value may be even higher.

That’s a hefty sum for your beneficiaries to cover, especially if their savings are tied up elsewhere.

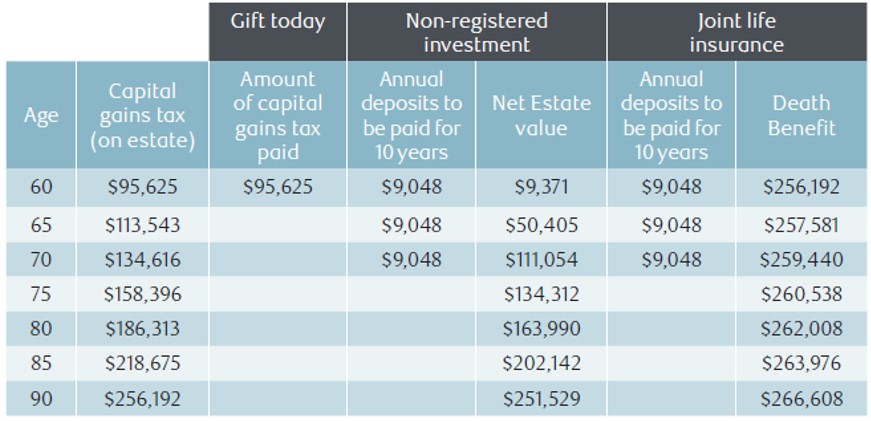

How Insurance Can Save the Cottage

Here’s the good news—by planning ahead you can make that tax bill more manageable. One effective strategy is using life insurance.

By taking out a life insurance policy designed to cover your future capital gains tax, you give your beneficiaries the resources to pay the bill without dipping into their own funds—or being forced to sell the family getaway.

Case Study: The Insurance Solution

In a typical scenario, parents purchase a life insurance policy with a payout that matches the estimated taxes payable on the cottage. When the policyholder passes away, the tax bill is settled using the insurance proceeds.

The result?

- The taxes are paid promptly and in full.

- The cottage stays in the family—debt-free.

- Your heirs keep the memories, not the financial burden

Planning Ahead Protects Memories

The family cottage is irreplaceable—not just for its location or structure, but for the laughter, summer nights, and traditions it holds. Proactive planning ensures that those moments can continue for the next generation without unexpected financial pressure.

If keeping your cottage in the family is important to you, we can help by calculating your potential tax liability and exploring insurance solutions to cover the eventual tax bill.