According to RBC Economics, Canada’s housing prices are the lowest since May 2022. Interest rate cuts have contributed to lower home ownership costs. The government has introduced a stricter immigration policy and restrictions on foreigners purchasing residential properties. Uncertainty regarding trade policies and employment security have led to a drop in transaction volumes as buyers remain cautious on the sidelines.

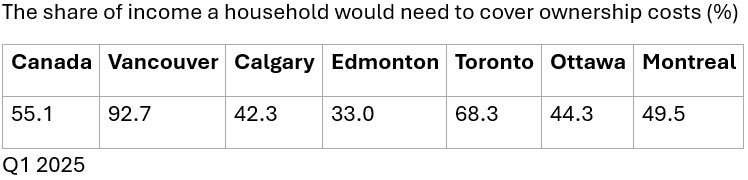

Although lower home prices mean better affordability, prices continue to be out of reach for many prospective home owners and the buying conditions remain challenging in many major markets such as the Greater Toronto Area (GTA) and the Greater Vancouver Area (GVA). The share of income of a household that would need to cover ownership costs remain high and above the average for Canada.

Let’s take a closer look at the Greater Toronto Area (GTA).

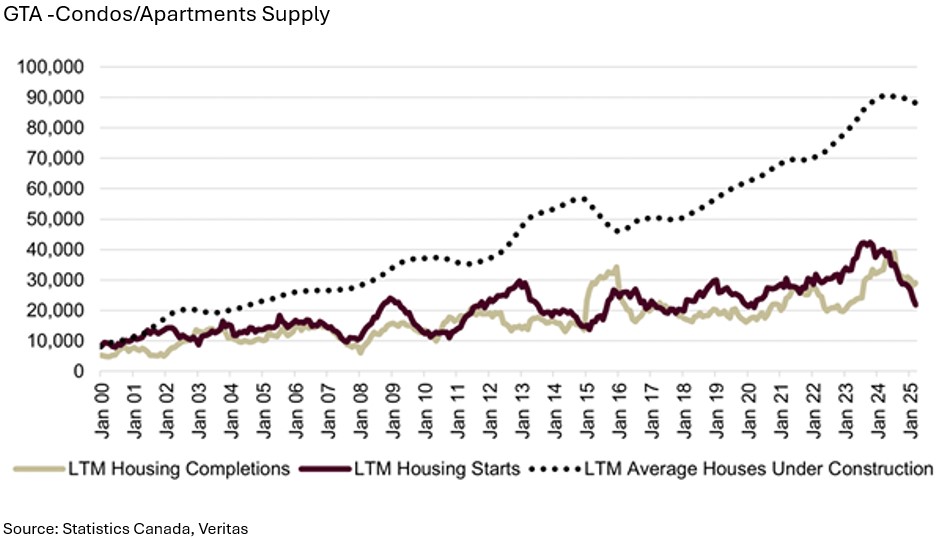

According to Veritas, a Canadian research company, the GTA has a high price elasticity to active listings, making it the most sensitive market in Canada. It estimates that condominium prices will drop due to an excess in supply in the near-term and that the detached housing market won’t be materially impacted by new supply.

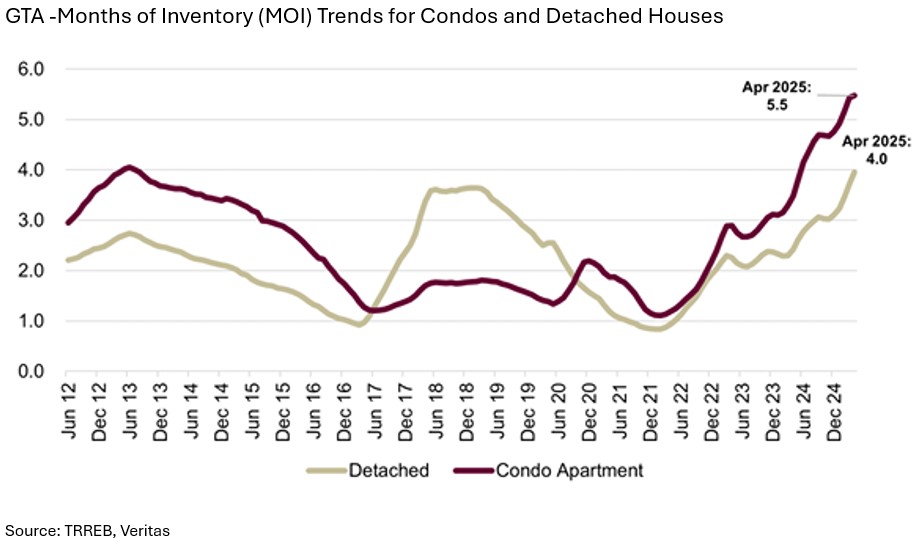

Between January - April 2025, monthly sales volume for condominiums and detached homes have declined by approximately 9% and 22% year-over-year respectively. New listings for these two groups are up 17% and 23% year-over-year respectively over the same period. The combined effects of slower sales volumes and higher listings mean the amount of inventory has increased. The metric, ‘Months of Inventory’ (MOI), measures the number of months it would take to sell all the homes in the market at the current sales pace assuming no new listings are added.

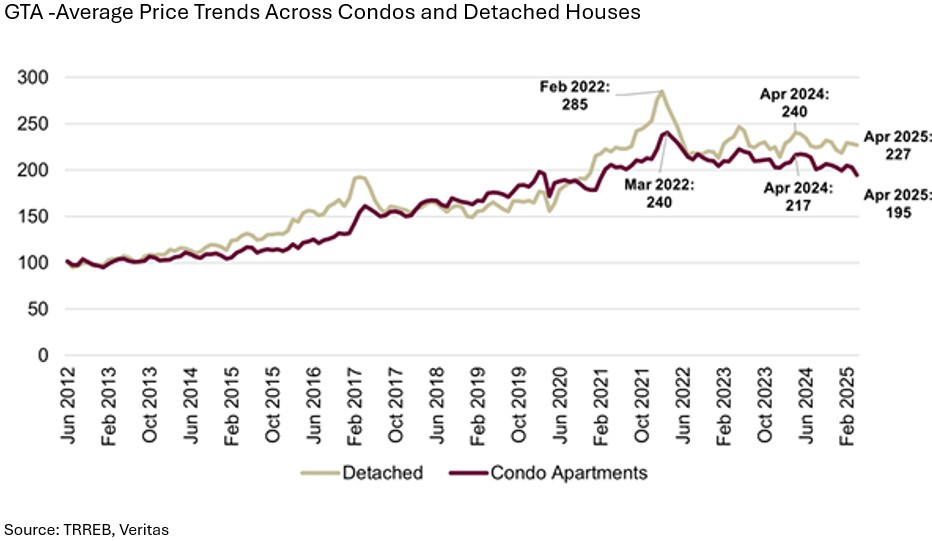

Although the average condominium and detached housing prices have dropped below the peak in May 2022, they hover around the pre-pandemic level and remain high for many prospective buyers.

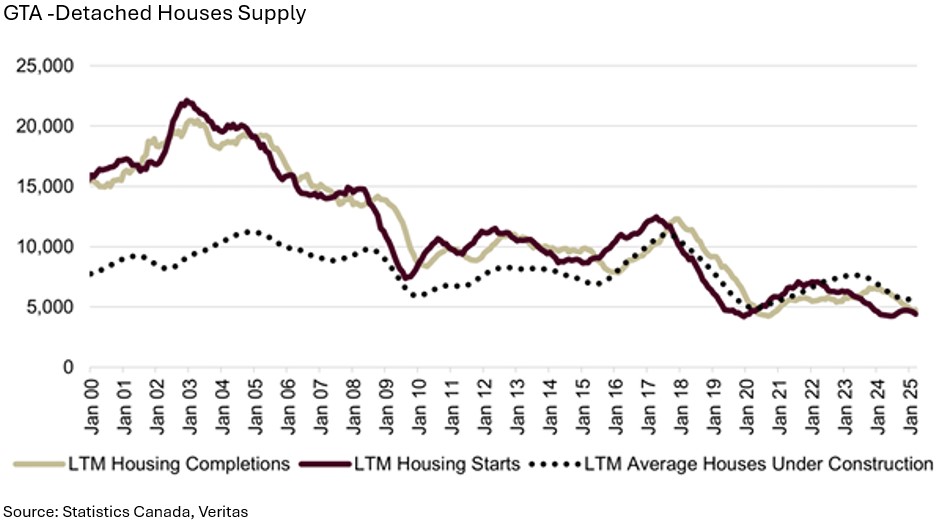

The next two charts show the last twelve months (LTM) supply for condominiums and detached homes. There is a significant number of condo units under construction which could further oversupply the market and lead to price drops. While this may not be good news for existing owners, the affordability stress may ease for new buyers.

What could stimulate the demand in the housing market? Perhaps it is interest rate cuts and further price decreases from oversupply. Having employment remain strong and a stabilization of international trade policies could also boost demand. Or perhaps a more relaxed policy in immigration and foreign ownership of residential properties could bring buyers back. The future is unknown, however, we have seen that housing affordability is a key issue to voters, and politicians may actually welcome this cooling off period. It is reasonable to believe, the incentive is lacking for politicians to encourage a return to the high prices of the previous housing bull market.