For years, we believed investors could safely ignore U.S. government debt when building their portfolios. Despite persistent warnings about runaway deficits, the market results seemed to condone this unconcerned stance: equities performed well, core Treasury bonds remained resilient, and any portfolio positioned for a collapse in U.S. assets due to debt concerns would have underperformed significantly. But today, the facts have changed—and so our view has also adjusted.

The Luxury of Ignoring U.S. Debt Is Over

While we still believe it’s a mistake to make investment decisions based on speculative narratives around U.S. default risk, we no longer think it’s prudent to completely dismiss the implications of rising debt. In our view, debt dynamics have reached a tipping point that warrants closer investor attention.

Key reasons for this shift include:

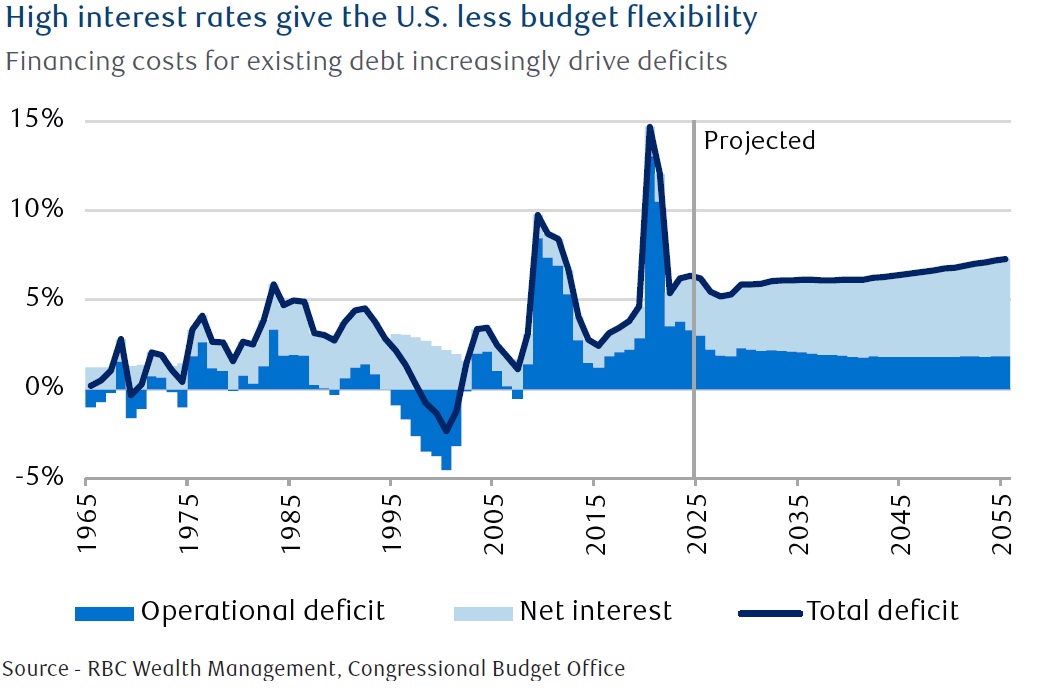

Unsustainable Fiscal Trajectory: Pre-COVID deficits averaged 2.6%–4.7% of GDP. Post-COVID, we’re seeing sustained deficits exceeding 6.5% of GDP—on top of public debt already above 100% of GDP.

No Political Will for Fiscal Discipline: Despite promises across both parties, we’ve seen consistent prioritization of spending initiatives and tax cuts over debt reduction, regardless of political control.

Markets as the Likely Catalyst: The more time passes without policy action, the more likely it becomes that markets—not politicians or voters—will force change via higher yields, falling equity prices, or a weaker dollar.

Shrinking Foreign Appetite for Treasuries: With reports of slowing demand for US Treasury Bonds from foreign centreal banks and potential legal headwinds (e.g., Section 899 tax risk), the U.S. could see diminished demand from international investors—leading to higher financing costs.

What This Means for Portfolios

Despite our rising concern, this is not a call to flee U.S. Treasuries or equities. Rather, it’s a reminder to adjust exposure thoughtfully and diversify strategically.

Bonds: Caution, Not Exit

We believe Treasuries will still play a key role in portfolio resilience, particularly in recessionary scenarios or Fed rate-cutting cycles. The U.S. government remains fully capable of servicing its debt, given its ability to issue dollars. However, it may be wise to:

- Reassess how far out on the curve investors go, particularly with 30-year Treasuries.

- Seek additional yield as compensation for duration risk.

- Prepare for potential volatility as markets begin to price fiscal risks more seriously.

Equities: Diversify Without Abandoning the U.S.

The U.S. remains one of the most dynamic and innovative economies globally—rich in resources, talent, and technology. But even strong economies aren’t immune to fiscal pressures. Elevated government spending has helped fuel corporate profits. If spending slows abruptly or debt concerns spook markets, earnings may face pressure.

We don’t advocate abandoning U.S. equities—but investors should broaden their horizons, incorporating global diversification to cushion against potential U.S.-specific volatility.

Timing Remains Uncertain

While we believe a market reckoning over U.S. debt is inevitable, we are not predicting it’s imminent. History has shown that debt concerns can simmer for decades without triggering a crisis—Japan being the most cited example.

But we’re no longer in the clear. The longer debt is left unaddressed, the more painful the eventual correction is likely to be—for investors, taxpayers, and the economy alike.

Final Thought: From Theoretical to Tangible Risk

We’ve moved past the stage where U.S. debt was a theoretical concern with little market impact. We are now entering a more uncertain, volatile phase where debt dynamics may begin to influence asset prices, risk premiums, and investor behavior in more meaningful ways.

This isn’t the end of U.S. fiscal dominance—but it may be the beginning of an era where debt finally matters.