In recent years, the concept of making money in the stock market has been perceived as relatively straightforward. All you had to do was buy one or all of the "Magnificent 7" – a group of dominant technology companies consisting of Apple, Alphabet, Amazon, Microsoft, Meta, Nvidia, and Tesla. By doing so, they would have generated substantial returns. However, this approach has not been effortless as it seems. It has taken tremendous perseverance.

The Magnificent 7, also known as the 'Mag 7', has driven much of the US stock market's performance over the past 15 years, leading every significant innovation. As a result, investing in these companies has been a popular choice among investors. For instance, a $7,000 investment in Mag 7 stocks at the start of 2010 would be worth approximately half a million dollars today.

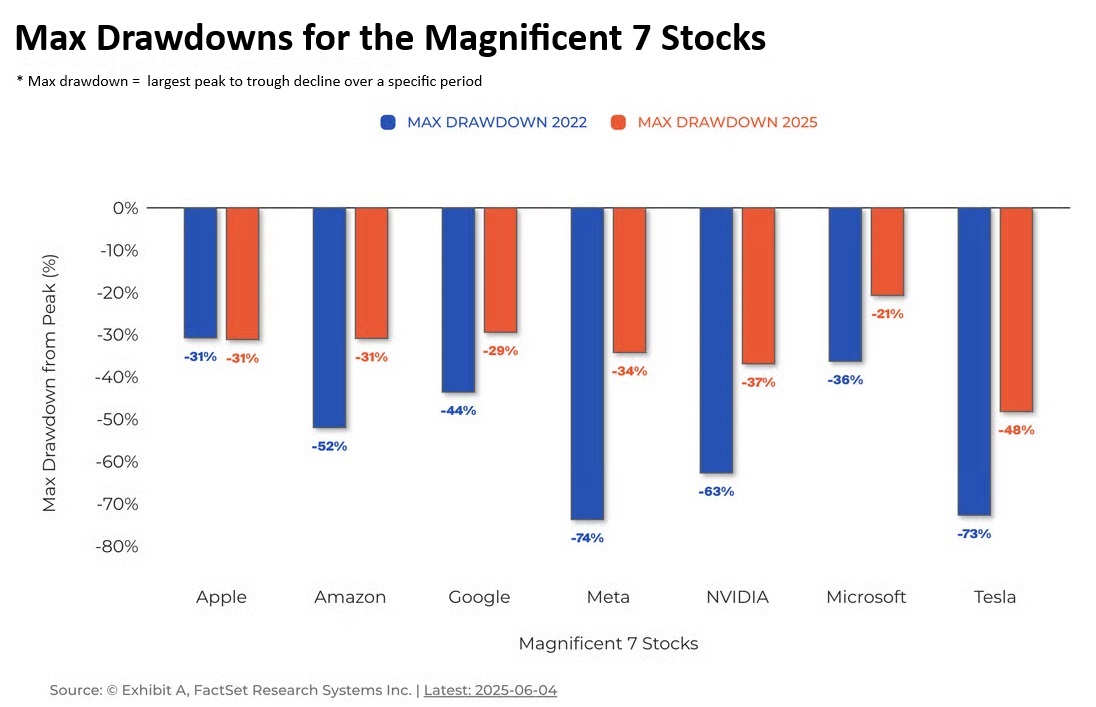

Despite the substantial returns generated by these companies, the journey has been tumultuous. Bear markets in technology, termed “tech wrecks”, are commonplace with seven such downturns over the last ten years! In 2022, the average maximum drawdown for Mag 7 stocks was -53%, with Meta and Tesla experiencing dizzying drawdowns of -74% and -73%, respectively. This makes 2025 look like a walk in the park, even though the Mag 7 still experienced an average drawdown of -33%. Are you feeling confident yet?

The risks associated with buying and holding individual stocks are not unique to the Mag 7. According to a recent report by Morgan Stanley, the average maximum drawdown for stocks analyzed between 1985 to 2024 was -80%! This translates to a $10,000 investment declining to $2,000. Even more surprising was that 40% of such investments never fully recovered. These statistics highlight the inherent risks of investing in individual stocks, which can be daunting for even the most seasoned investors.

So, how can investors continue to benefit from company specific outperformance despite these risks? The answer lies in diversification. By spreading investments across a range of companies and asset classes, idiosyncratic risks can be spread out. Moreover, valuations matter. Investors need to employ a disciplined strategy beyond just buying what has been going up. You are never going to be able to time the sale of a hot stock perfectly, so a disciplined rebalancing schedule is needed. Finally, avoid anchoring your price target to previous highs. Just because it reached those levels before is meaningless if the fundamentals of the company or sector has changed. The market does not care what price you bought it for and whether you are at a loss. Therefore, work with a portfolio manager or advisor to review whether anything structural has changed in the investment thesis.

In conclusion, there is no one-size-fits-all approach to investing in the stock market. The best investment strategy is one that aligns with an individual's risk appetite and personal investment goals. By working with a professional to identify your objectives and to set a suitable balanced portfolio, you can navigate the ever-changing market with greater confidence.