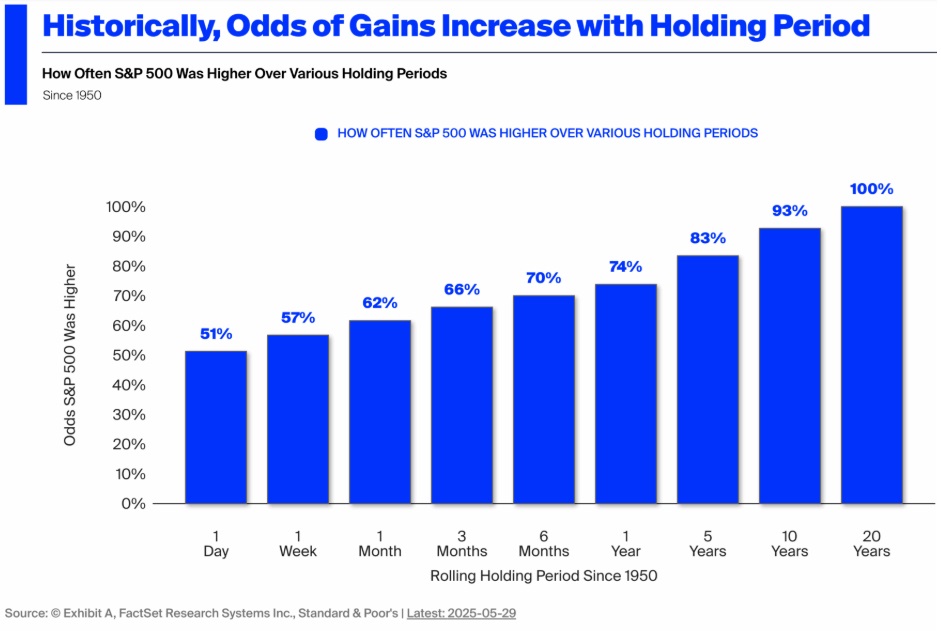

Investing does not guarantee a straight path to wealth and riches. It’s a winding road of ups and downs, and the longer you're on that road, the more likely you are to experience both. As investors, we've all heard the mantra: "time is your friend." And it's true, historical data shows that the longer your time horizon, the better your odds of experiencing gains in the stock market.

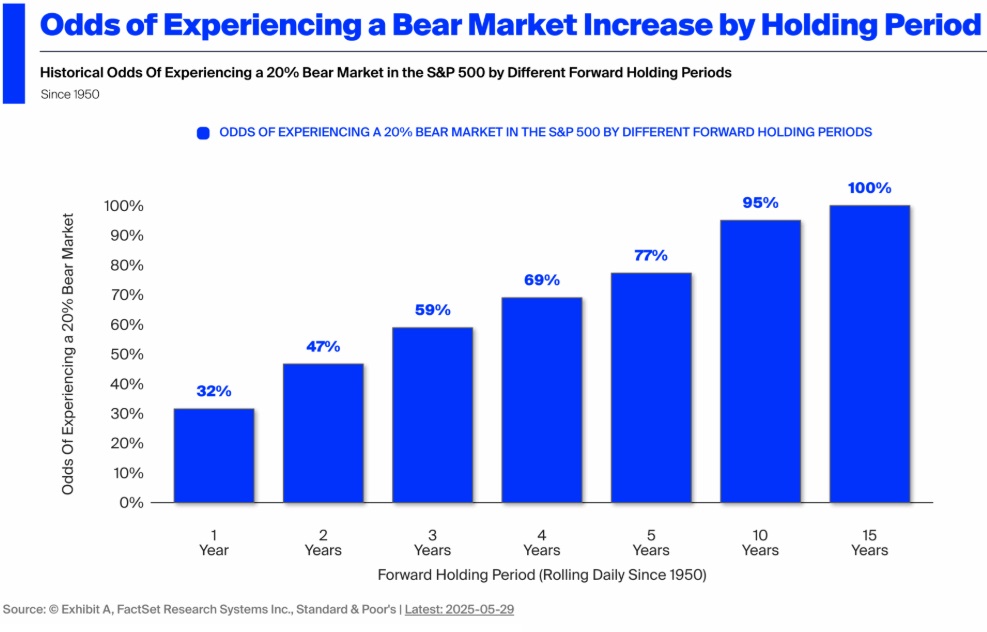

Although markets tend to reward patience; those who stay invested will almost certainly face moments of serious doubt.That’s the paradox of long-term investing. The lows come with the highs. Volatility isn’t a glitch or an accident, it’s a built-in feature of the market.

Data shows that over a 5 year period there is an ≈80% chance of experiencing a “bear market”, which is defined as a loss of 20% or more. But staying invested with the right plan and support system is often what separates the successful investors from the rest.

So how do you stay disciplined when your portfolio takes a dive? One consideration is to work with an advisor who helps you set realistic expectations and guides you through emotional decision-making. When markets dip, fear often drives poor choices. An advisor acts as both a coach and a stabilizer, by filtering out the fundamentals that matter and reminding you that downturns are temporary and often necessary for future growth.

A well-structured, balanced portfolio can also help soften the blow. Aligning your investment strategies with both your goals and your ability to handle risk means you are better prepared for whatever the market throws your way. This by no means eliminates risk, it simply puts it in context. You're not investing to avoid the storm completely. You're investing with the right strategies and support to get through it.

Success in investing shouldn't always be measured by whether or not you dodge every downturn. A more personal and custom benchmark might be a better measure of success. Can you stick to your plan? Are you accumulating the wealth you set out to, even if the path was bumpier than expected? Did you stay patient to benefit from the recovery?

What you have to ask yourself is: Are you working with someone who helps you interpret market risk to see the big picture? And, are you prepared, not just for the rewards of investing, but for the setbacks too?

Because long-term success isn’t about avoiding pain or hardship. It’s about pushing through with a thoughtful plan to get to where you want to be.