Warren Buffett, widely regarded as the greatest investor of all time, will step down as CEO of Berkshire Hathaway Inc. at the end of this year (but will remain as chairman). At 94 years old, the ‘Oracle of Omaha’ is currently the oldest CEO of any major company in the world. So this is certainly an inevitable outcome. However, the announcement of his retirement on May 3rd was still seen as a surprise; sending Berkshire shares down about 5% the next trading day, resulting in a market value loss of around $59 billion – clearly demonstrating investors’ perceived importance and value of Warren Buffett to the company.

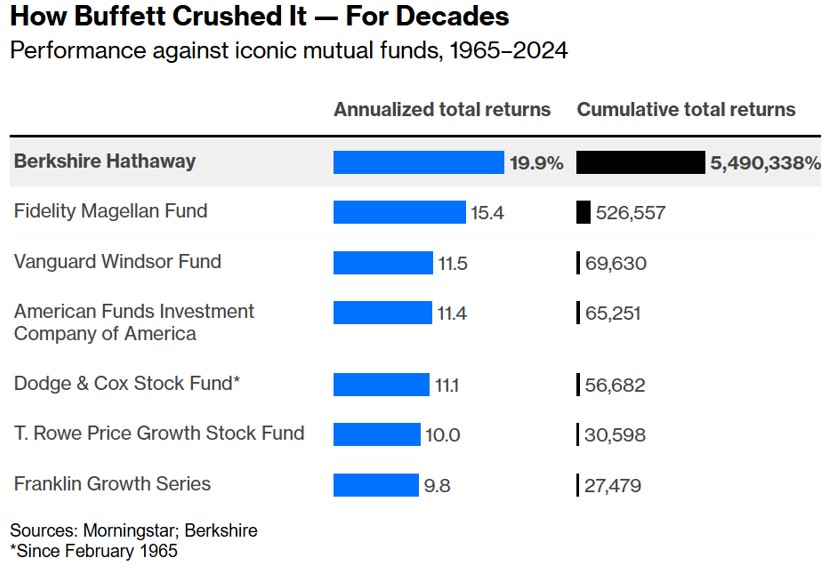

Many have opined on Buffett’s legacy, but to see his performance in numbers more profound - as the saying goes “numbers don’t lie”. His six-decade tenure produced investment results so extraordinary that raw numbers alone fail to capture their significance. To truly grasp the scale of Buffett’s achievement, it’s useful to see how Berkshire’s returns have compounded into immense wealth for shareholders—far outpacing even the best-performing mutual funds and the broader market.

Buffett has long benchmarked himself against the S&P 500 Index—a standard most active managers struggle to beat. He didn’t just outperform it; he trounced it.

Typically, a simple line chart would suffice to illustrate a money manager’s record against the market. But Buffett is no typical investor. His outperformance is so vast and sustained that on a regular chart, the S&P 500 barely registers. The same holds true for indexes designed to reflect value or quality investing—strategies Buffett favors.

His success wasn’t driven by a handful of lucky bets. He won consistently. In recent years, however, a long bull market and Berkshire’s immense size have made it harder to find investments big enough to move the needle.

Buffett describes his approach as buying high-quality businesses at fair prices—a combination of value and quality investing, both of which have historically outperformed the market. He also benefited from the leverage of Berkshire’s insurance operations, which helped boost returns. Yet, even adjusting for those advantages using financial data back to 1987, Buffett still comes out on top – which shows that Buffett, himself was the ‘secret sauce’.

Though he’s best known as a stock picker, Buffett is also a masterful capital allocator. He’s shown discipline in holding cash when valuations are high, and boldness in deploying it when markets are down—always waiting for what he calls a “fat pitch."

Aside from celebrating Warren Buffet’s accomplishments, we believe these charts and figures offer insight to investors looking to increase their chances of success:

- Investing takes time – stay invested: “time in the market” vs “timing the market

- Periodic rebalancing is prudent – favouring low-cost passive investments does not negate the value of active asset allocation

- Stick to fundamentals; stay rational and resilient - "The more sophisticated the system gets, the more the surprises can come out of left field. That's part of the stock market, and that's what makes it a good place to focus your efforts if you've got the proper temperament for it and a terrible place to get involved if you get frightened by markets that decline and get excited when stock markets go up….I know people have emotions, but you've got to check them at the door when you invest." – Warren Buffett