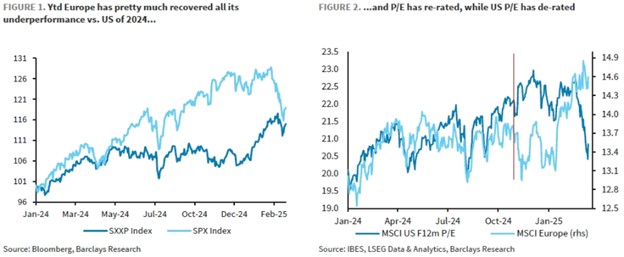

European equities have significantly outperformed U.S. equities so far this year, driven by the unwinding of higher interest rates, improving fundamentals and attractive valuations entering 2025. The MSCI Europe Index’s forward P/E multiple has expanded to 14.6x from 13.3x at the start of the year; sitting slightly above its 10-year average of 14.3x. U.S. equities on the other hand have recently de-rated.

Manageable risks remain:

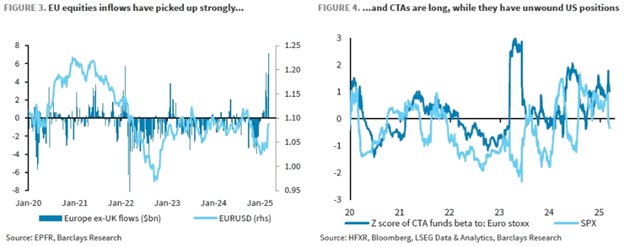

However, the tailwind may be fading as European equity inflows have already seen a meaningful influx. Further, Commodity Trading Advisors (CTAs) – which are mostly systematic traders or trend followers – have already turned long, which could signal limited upside potential ahead.

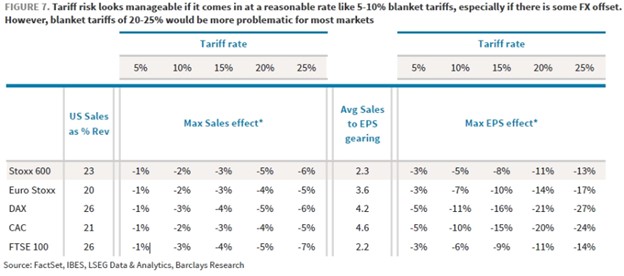

The risk of tariffs also remains a concern for Europe. Barclays suggests that the earnings impact of tariffs in the 5-10% range couple be manageable for Stoxx Europe 600 companies, as U.S. goods exports only account for 23% of their revenues. A favourable FX move (i.e. depreciating Euro against USD) could also dampen the impact. Higher blanket tariffs, around 20-25% as previously threatened by Trump, however, would be more problematic.

Growth levers to pull:

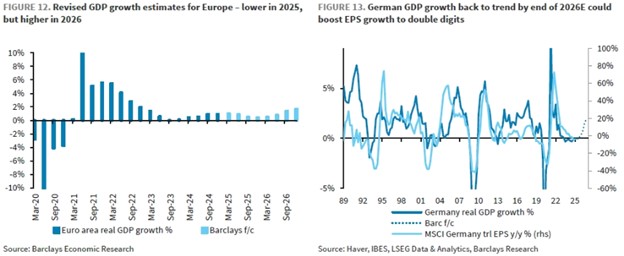

Germany presents a potential area of strength that could enhance long-term growth prospects. German lawmakers recently approved legislation to unlock hundreds of billions of Euros for defense and infrastructure spending. This landmark spending bill is expected to initiate a new phase of deficit spending aimed at stimulating Europe’s largest economy. Barclays’ economists estimate that the increased defense spending could contribute 0.3% to Germany’s GDP in 2026, with infrastructure spending adding 0.2% to GDP the following year. Consequently, they project that German growth could increase by approximately 0.4% in 2026, peaking at 0.7% in 2028.

Additionally, EU members have recommended activating the “National Escape Clause”, enabling the EU to allocate more funds to defense, potentially further boosting real GDP growth. While the implementation of this spending will take time, and the region faces near-term growth headwinds from U.S. tariffs and the rising possibility of a global economic slowdown, the long-term outlook for EU growth is positive. The improving outlook is supported by fiscal stimulus and increased confidence resulting from Europe’s evolving approach on spending.

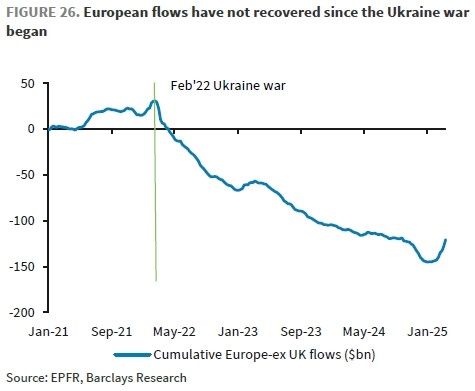

Greater progress toward a ceasefire in Ukraine could further boost investor sentiment toward European equities. The onset of the war in Ukraine triggered substantial outflows from European equities, which have not yet been recovered. This suggests that there remains substantial potential for a continued recovery, particularly when compared to the magnitude of outflows observed in recent years.

Easing across:

Despite this cautiously optimistic outlook, we are not advocating for a significant reallocation towards European equities just yet. However, given the uptick in market volatility, we recognize significant value in expanding exposure beyond North America as a prudent risk management strategy. Even if international equities do not outperform their North American counterparts on an absolute basis, we believe geographic diversification could lead to lower overall risk or higher risk-adjusted returns.