The markets have voted; they don’t like tariffs. Initially, it seemed like markets had widely shrugged off tariffs as a bluff or a mere negotiating tactic. It wasn’t so long ago that markets were at all-time highs. But how quickly the negativity piled on, initially with cancelations of US travel and Netflix subscriptions, eventually culminating to projections of unavoidable economic turmoil. Markets just got bearish so fast.

When volatility and fear suddenly spike, one has to wonder if markets could be over reacting. The large sell off to start last week definitely looked like a market that decided to shoot first and ask questions later. After wiping out all of the market returns since election day, I think it’s worth considering whether we are approaching “peak” fear.

Can it get any worse? Of course it can. The markets despise uncertainty and there’s really no reason why investors should be believe that Trump has it all written down. But forecasts for economic growth don’t normally flip from 2-3% positive GDP to a negative 2-3% decline. As we all know too well, forecasts can be wrong. On October 2022, a Bloomberg survey of economists predicted a 100% chance of a recession within twelve months. That evidently did not transpire, and here we are again hearing claims that a recession is near unavoidable.

Right now, I don’t believe the markets have a recession problem. Rather, we have a “fear of recession” problem. Because of this, it is probably prudent to consider what factors may not be fully appreciated that could lead to an economic resiliency that we have seen before.

1. Neither Canada or the US are manufacturing based economies

All this talk about tariffs is related to goods and products crossing borders. As such, many can envision higher prices leading to decreased demand, and resulting in factories shutting down. However, manufacturing only makes up 9-10% of GDP in both Canada and the US. It is services that account for 70% of Canadian GDP and 77% of US GDP. Hence, the fortunes of North America do not necessarily depend on the industrial segments of our economy.

2. Service sector showing growth despite tariff threats

February “ISM Services” data was released last week and it was registered at a strong 53.5%. A reading above 50 percent indicates the services sector economy is generally expanding; below 50 percent indicates it is generally contracting. This is the 54th time in 57 months that an expansion was recorded in services since the pandemic induced recession of 2020. Services rarely go into contraction and it often takes large negative systemic events like a pandemic and a banking crisis to shake up services. With tariffs not applying to services, one should expect this trend of strength to continue.

3. Who is spending the money?

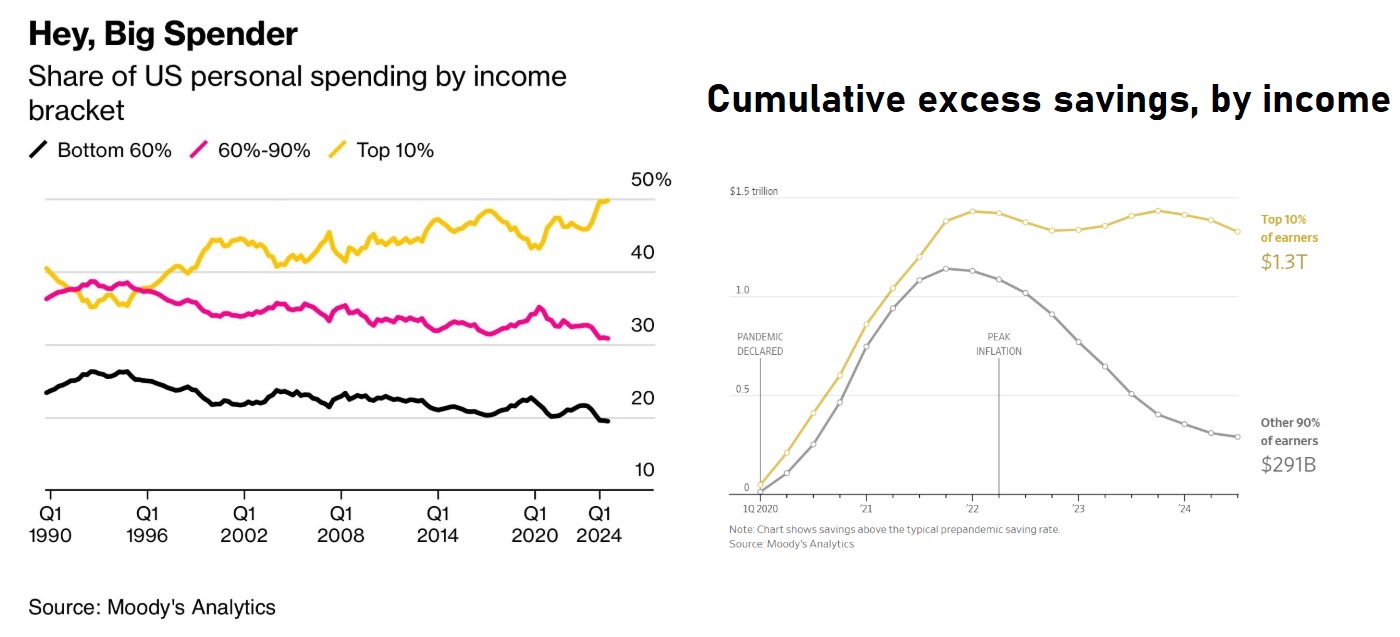

The chart below shows that the top 10% of income earners account for 50% of total spending. The bottom 60% of income earners account for less than 20% of total spending. On an economic impact basis, it is vital that high income earners continue their consumption patterns.

The top 10% of income owners also own 87% of the stocks, so a market correction could delay purchases. However, their ability to spend could prove to be durable as this cohort has also amassed $1.3 trillion in savings. So long as spending endures, the greater the chance the economy remains resilient.

4. Businesses are better prepared than we give them credit for

Last week, a new survey of mid to large sized Canadian comapnies was released by KPMG. It revealed that 2/3rds of businesses responded that they could withstand a tariff war with the United States for more than a year. Many companies have put strategies in place to minimize the tariff impact including moving inventory to the United States ahead of the tariffs. This is not to say that businesses will not reduce headcount or face margin pressures. However, the fortitude of corporate North America is undeniable. They are afterall, survivors. The pandemic, hyperinflation, and neck breaking interest rate hikes were not a walk in the park, but corporate earnings prevailed.

In the short term, markets will continue to reflect the uncertainty related to tariff headlines. Currently, Trump appears open to extending deadlines for tariffs, and will perhaps grant exceptions to specific sectors and products. In investing, what’s important is not whether something is ‘good’ or ‘bad’. Rather, we focus on whether it is ‘better’ or ‘worse’ than expectations. If the impact to the economy is seen as “better than feared”, markets can stage a swift recovery. The ensuing weeks and months will give us a better picture as to whether we have already reached ‘peak’ fear.