If you lose your job or are retiring, your employer may offer severance pay, commonly known as a retiring allowance. This amount can be paid out in a lump-sum or over many years based on your length and position at the company. Please keep in mind that the retiring allowance can be only one part of the severance package. Other features can include extended benefits and incentives.

The retiring allowance usually includes the following: 1) pay from unused sick leave, and 2) amounts received when employment is terminated (i.e. wrongful dismissal). It does not include amounts such as salary, pension benefits, and payment for unused vacation.

Upon receiving the retirement allowance, it is important to distinguish the eligible and non-eligible portion as they are treated differently from a tax perspective. The eligible portion can be directed to an RRSP or registered pension plan (RPP) to defer taxes without using your RRSP contribution room. The non-eligible portion can also be directed into a registered account to defer tax but it would count towards your RRSP contribution room. Therefore, it is important to ensure you have sufficient unused RRSP contribution room.

The eligible portion usually includes years of service before 1996 and calculated based on the lesser of the following:

1) Amount received as retiring allowance; and

2) The sum of a) $2,000 for each year or part of a year you worked for the employer before 1996 and b) $1,500 for each year or part of a year you worked for the employer before 1989 in which you earned no pension or deferred profit sharing plan (DPSP) benefit from employer contributions. In short, if you were not a member of a pension plan or DPSP before 1989, you will likely be eligible for the additional $1,500 per year.

All other amounts are considered non-eligible portions.

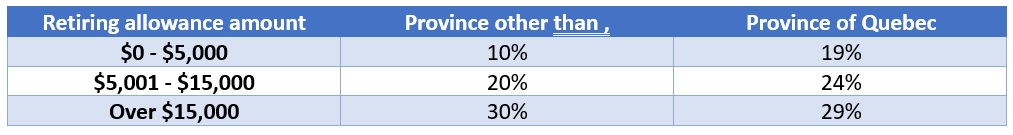

Any amount not directed to a registered account is treated as income and taxed at your marginal tax bracket. The employer has a responsibility to withhold taxes, but your final tax liability will be determined when you file your taxes. The amount of tax withheld is based on the table below:

The process of withholding taxes acts as a credit towards your taxes payable. If your tax liability is greater than the withholding tax, you will need to pay more taxes. If your tax liability is less than the withholding tax, you will be entitled to a tax refund.

Factors to keep in mind

- For the non-eligible portion, your employer may be willing to defer payment to future tax years. This will be beneficial if you do not have unused RRSP contribution room or the total income of a future tax year is less than the current year.

- The eligible portion does not have to directly go into a registered account. If you chose to have the amount paid to you directly, you still have the option to transfer it into a RRSP or RPP without impacting your RRSP contribution room as long as the transfer is made within 60 days from the end of the year in which you received it. Keep in mind that your employer would have had to withhold some funds. To get the full offsetting deduction, you will need to find other sources of funds to contribute the gross eligible portion.

- For the non-eligible portion, your employer may be willing to contribute the gross amount of retiring allowance into your RRSP or spousal RRSP without withholding taxes. They will most likely need proof that you have available room (i.e. notice of assessment). Seek your employer to see the types of options available to you.

- If you are 72 or older and have received a retiring allowance, you will not be able to contribute to your RRSP since all RRSP account must mature by the end of the year you turn 71. If you have a younger spouse and have unused RRSP contribution room, you can direct it into a spousal RRSP.

- Retiring allowance is not considered earned income so it is not used to calculate future RRSP contribution limits.

It is important to have a plan in place to maximize the potential of your retiring allowance. There isn’t a one size fits all solution as the type of strategy depends on cash flow needs, age, marginal tax brackets etc. Speak with one of our advisors as we can provide a plan that fits your needs.