With inflation trends continuing its downward trajectory, more attention has been put on the strength of the labour market. One of the catalysts for the August pullback were fears that that labour market was showing weakness. Afterall, the labour market has been adding fewer jobs than expected, wage growth has been waning and the unemployment rate appears to be steadily rising. Without any imminent government intervention in the form of rate cuts, the fear is that the economy could be heading towards a recession. That being said, our team believes it is still pre-mature to come to this conclusion as discussed in a previous blog.

With the unemployment rate in focus, investors have seen it steadily rise from 3.7% in January to 4.3% in July. History has shown that when unemployment picks up momentum, it generally does not stop without any external support or stimulus to the economy. That being said, we believe investors should discern the reason why unemployment is rising, as the details do impact the overall context of the economic environment.

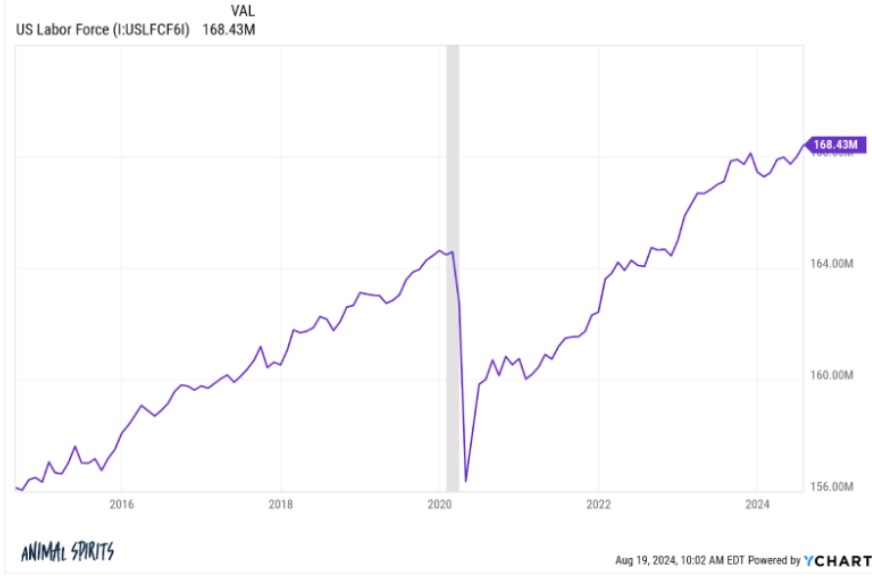

As shown below, the labour force has increased meaningfully. In other words, the supply of labour has increased. The reasons for this increase can be attributed to immigration policy, new entrants into the workforce and those re-entering the workforce (potentially lured back by higher wages). The increase in the supply of labour could be interpreted by some as a ‘positive’, as only a robust and resilient economy would result in an increased labour force participation.

Ultimately, those job seekers will not secure employment immediately. There will be time needed to absorb these workers and hence, the increase in the unemployment rate should be expected. However, this rise in unemployment feel less ominous than if it were due to a decrease in demand for labour or from mass layoffs. There has been no clear evidence of this thus far. Hence, we feel comfortable keeping our eye on the variables influencing unemployment and look for further weakness in the consumer and corporate earnings before we sound the alarm for a recession.