Our Senior Portfolio Manager, Richard So, recently reviewed the likelihood of a recession in his most recent blog, Afraid of a Recession (Again?!). Our team believes that investors will benefit from strong fundamentals but should be prepared for volatility. In short, long term investors should use any pullbacks to add to equities. This philosophy is also supported by the current trends in the market:

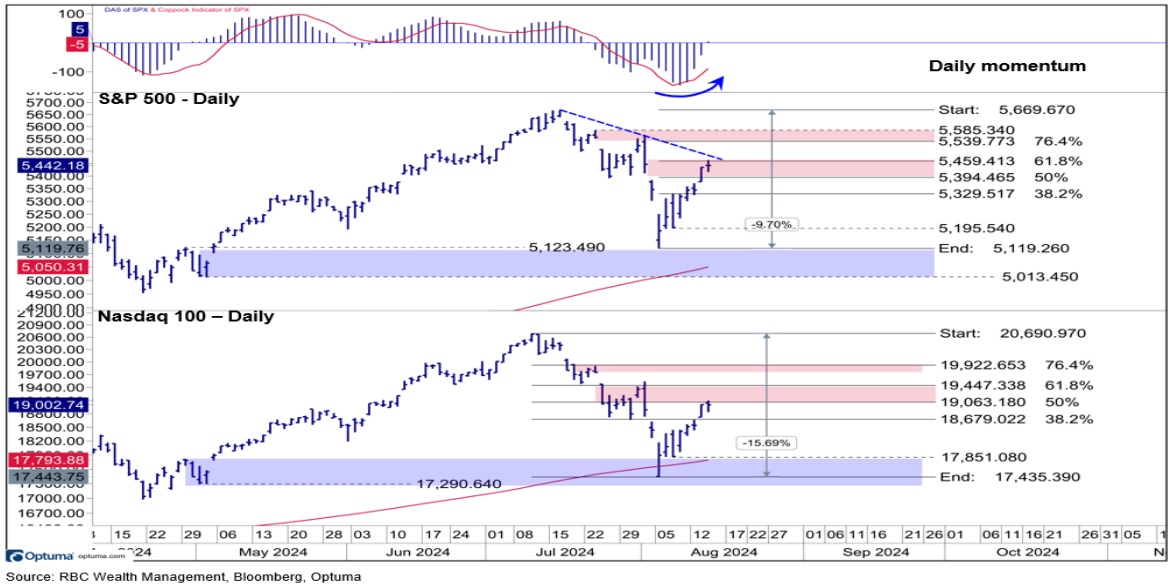

S&P and Nasdaq 100 uptrends have been dampened but are not broken. The speed of the July/August correction was fast but the actual trends have remained positively intact. Afterall, the market are showing signs of bottoming near the 40-week/200-day moving average which are still in an upward trend themselves. For the markets to show a negative sign, it will need to break to lower lows (ie. April Lows). Until this occurs, the markets remain in a bullish uptrend.

S&P and Nasdaq 100 are nearing resistance levels. The markets signaled an oversold condition after the pullback, which presented a higher opportunity for a rebound. That said, with a swift relief rally underway, investors should expect some resistance and be prepared for sideways trading.

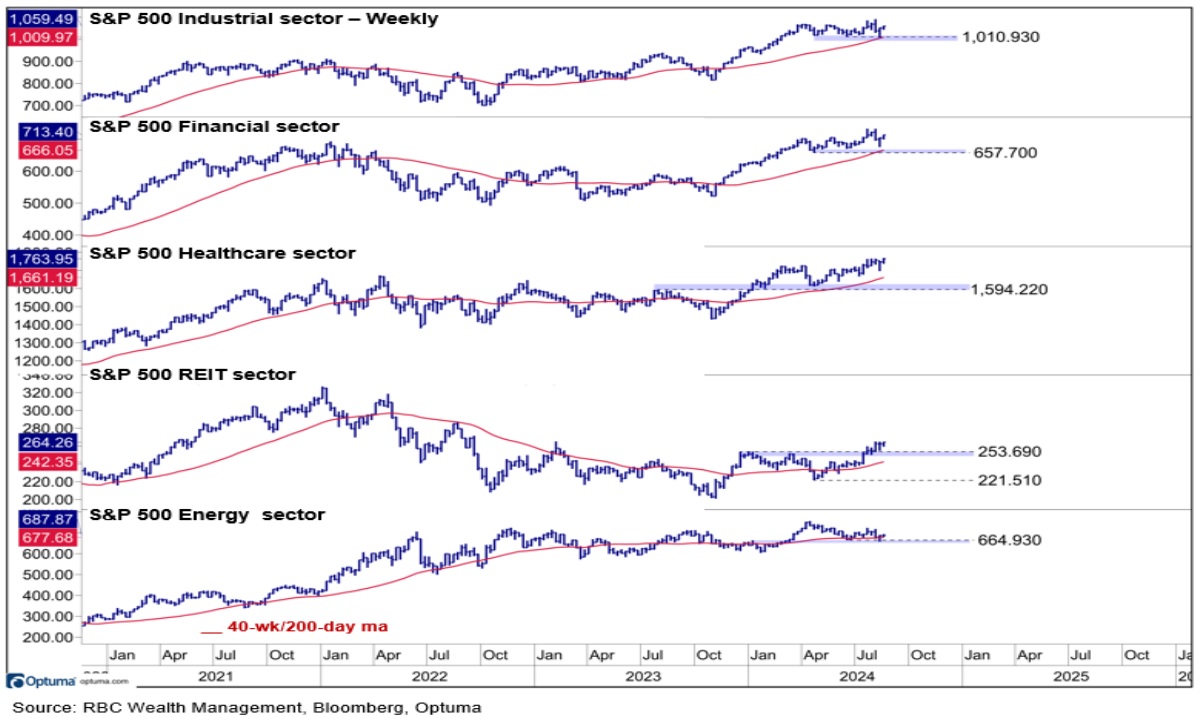

S&P 500 sector trends remain positive. The more influential sectors in the S&P 500 (industrials, financials, healthcare, REIT, and energy) are within key support levels. This is a positive sign as they have traded sideways and held support at their 40-week/200-day moving averages.

Technology has maintained market leadership and there are those questioning if they can continue to lead this rally. But the other influential sectors mentioned above are showing positive signs which provides opportunities for investors to diversify their portfolio exposure and potentially prolong the market rally. Specifically, industrials and financials remain in bullish trends with the potential to breakout.

In short, investors should be aware of potential short term volatility, however, both fundamental and technical indicators signal that markets can remain in a bullish trajectory.