The current bull market has been characterized as one that is driven by Artificial Intelligence and the "Magnificent 7". For those underweight the mega cap growth stocks, it can leave investors feeling disconnected from the market’s gains. While the S&P 500 continues its impressive surge, questions arise about the sustainability of this rally without more meaningful participation from other styles and sectors. Over the last couple weeks, “market breadth” has improved with a rotation that favors dividends, value and smaller cap stocks. Time will tell whether this “catch up” rotation will persist or if mega cap technology stocks will resume its dominance. Thus far, the first half of 2024 has shown two emerging trends.

Dividend Yield Trends

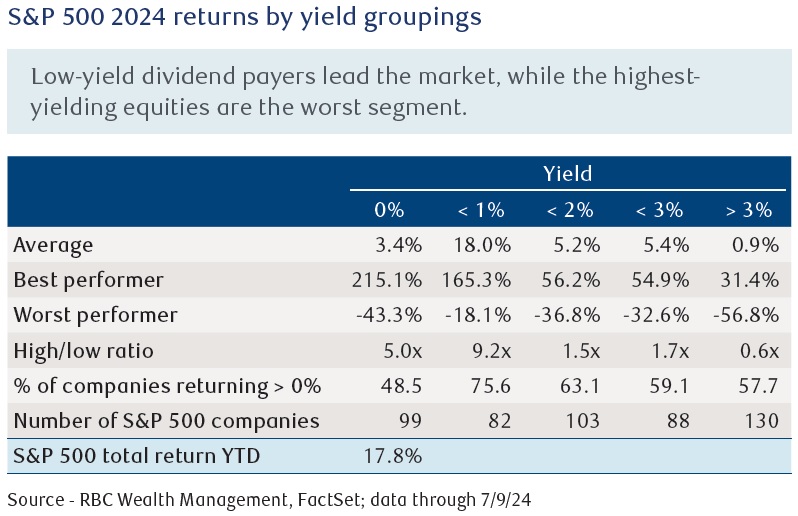

A notable observation is the relationship between low dividend yields and market outperformance. High-yielding equities are underperforming their lower-yielding counterparts. As the chart below shows, stocks yielding less than 1% have earned an average of 18%, which is much larger than the 0.9% average performance of those companies yielding more than 3%. Interestingly, the “no-yield” (0%) segment has become one of the worst-performing segments, rising only 3.4% year to date. That said, it should be of note that there are still “no-yield” stocks that have individually outperformed; the best increasing by 215%.

Earnings Estimate Revisions

Another consistent driver of outperformance has been higher earnings estimate revisions. Companies with rising 2024 earnings estimates have outperformed those with declining estimates. For example, stocks with earnings estimates that declined by more than 10% fell 5.1% year-to-date, while those with estimates rising by more than 10% saw average gains of 26.6%.

By connecting the dots between dividend yield and earnings estimate revisions, it becomes evident that the top-performing stocks in the S&P 500 typically exhibit below-average dividend yields and above-average earnings estimate revisions. The top 10 performing stocks in the S&P 500 have returned an average of 94.7%, significantly outperforming the S&P500’s 17.8% gain. These outperformers have an average dividend yield of 0.7%, about half that of the market, and an estimated average 2024 earnings growth of 17.0%, which is seven times higher than the market average.

Implications for Future Investments

Understanding recent market movements can provide valuable context for future investment decisions. Currently, the market is characterized by narrow leadership, low-dividend outperformance, and a favorable macroeconomic backdrop of slowing inflation and manageable unemployment. As these factors evolve, high-quality equities that have been underperforming may benefit.

The Dividend Aristocrats, a group of S&P 500 companies that have increased their dividends for 25 consecutive years, serve as a proxy for these underperforming high-quality stocks. This basket of companies are experiencing its worst multiyear performance stretch on record. 2023 marked the worst year of underperformance for the Dividend Aristocrats compared to the S&P 500, and 2024 is on track to be the second-worst year. Notably, four of the five worst years for the Dividend Aristocrats have occurred since 2019. This unprecedented stretch of underperformance suggests that high-quality stocks may be poised for a rebound when the investment landscape shifts.

Historically, the Dividend Aristocrats have delivered strong performance during and after economic slowdowns. Their fundamental thesis is supported by attractive valuations compared to the broader market and business models that have resiliently weathered economic volatility. Despite the current narrow market, it is crucial for investors to remain disciplined and consistent in their investment strategies, identifying future opportunities as the investing landscape inevitably changes.