Social media influencers have become a key agent to promote goods and services, including in the financial services industry. This evolution has given rise to the new coinage “finfluencer” (financial influencer).

Finfluencers represent a new intermediary between the financial markets and consumers. These influencers provide general investment information, promote investment products, and in some cases, make investment recommendations.

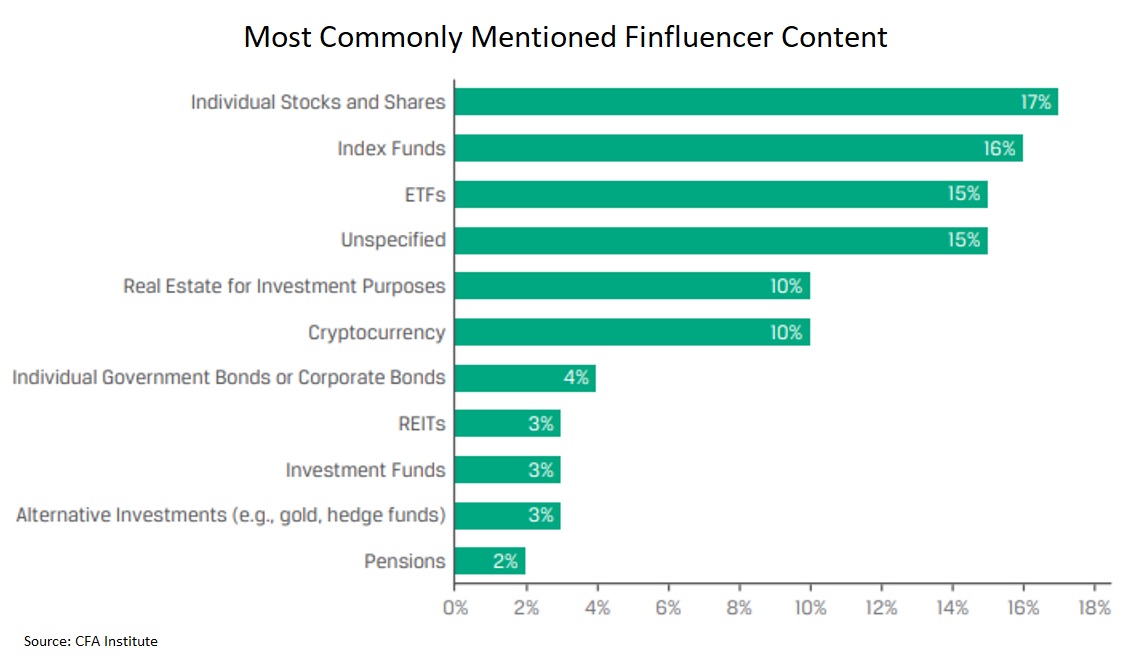

It is unclear whether these perceived ‘experts’ are authorized to conduct regulated activities; but nonetheless, the have become a primary source of investment information – particularly for the younger Gen Z cohort. Younger investors are often attracted by the more engaging content posted by these influencers and not necessarily for the educational component. According to a recent research report conducted by the CFA Institute, called The Finfluencer Appeal: Investing in the Age of Social Media, almost 40% of Gen-Z investors in the United States cited “finfluencers” as a major factor in their decision to invest.

However, this free and rapidly available content often carries risks. Some influencers may be sponsored by firms or brands to generate content or paid to promote certain products, which represents a clear conflict of interest. According to the same research, the report found that only 20% of finfluencer investment recommendations included any form of disclosure such as professional qualifications or potential conflicts of interest.

Despite the risks, there are several factors that have driven this social media trend: lack of formal financial education, limited access to regulated financial advisers, and preference towards digital platforms. Finfluencers are indeed helping to fill these voids.

As social media and finfluencers inevitably grow in importance in fulfilling the needs of some investors, the CFA Institute has made some recommendations for various industry participants, such as regulators, social media platforms, educators, and firms that use finfluencers in their marketing initiatives.

A few of those recommendations are highlighted below:

• Regulators across different jurisdictions should work together to define what constitutes an investment recommendation, so existing laws and regulatory frameworks can be better utilized

• National regulators should engage with finfluencers to help them improve disclosures, identify conflicts of interest, and understand which of their activities may be subjection to regulation

• National regulators should record and report data on complaints against finfluencers to better protect the investing public and take enforcement actions against social media platforms when required

• Social media platforms should implement controls that improve disclosures

• Industry professionals should increase financial literacy initiatives and empower investors to critically evaluate finfluencer content

Financial literacy for new investors is integral to a successful investment experience. We recommend clients and therir family members to speak to their licensed investment advisor to guide them through a balanced market outlook of risks and returns as well as time tested investment strategies.