When you own a principal residence, expenses are for personal use. These expenditures aren’t tax deductible unless they qualify for government tax credit and tax refund initiatives. When you sell your principal residence, it is tax-exempt, and you don’t pay tax on any appreciation above the purchase price.

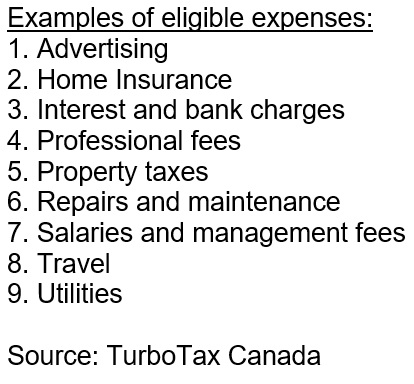

If you own a home and a second property, the second property is considered an investment property. If it is rented out, you can write off certain expenses against the income. If you sell it, any appreciation above the original cost is subject to capital gains tax.

What happens if a parent owns a home and buys a property for an adult child, perhaps due to the insistence of the bank for lending purposes?

If the parent doesn’t charge the child reasonable rent, then expenses cannot be claimed in the tax return.

If the parent later transfers the ownership to the child, there is a deemed disposition for tax purposes. This means the child acquires the property at the fair market value, pays the land transfer tax, and the parent is responsible for any capital gains tax.

If this is the child’s first home, he/she may be eligible for first-time home buyer’s initiatives, such as:

1. Home Buyer’s Plan: The Home Buyers' Plan (HBP) is a program that allows you to withdraw from your registered retirement savings plans (RRSPs) to buy or build a qualifying home for yourself or for a specified disabled person. Currently the HBP withdrawal limit is $35,000. (In the proposed Federal Budget 2024, the Home Buyer’s Plan withdrawal limit increases to $60,000. Budget 2024 also proposes that the first Home Buyer’s repayment is deferred for five years after the withdrawal is made.) See Link for Details

2. First Home Savings Account: A first home savings account (FHSA) is a registered plan which allows you, if you are a first-time home buyer, to save to buy or build a qualifying first home tax-free (up to certain limits). See Link for Details

3. First-Time Home Buyer’s Tax Credit (HBTC): The HBTC allows first-time home buyers who acquire a home to claim a non-refundable tax credit of up to $1,500. See Link for Details

4. GST/HST New Housing Rebate: The GST/HST rebate is available for new home purchases and could reduce upfront costs to help make homeownership more affordable. See Link for Details

5. Land Transfer Tax Refund: Receive a refund, up to a maximum amount, for the land transfer tax for certain jurisdictions. This applies to the very first home purchase which may differ from definitions for first time home buyers in other government programs. See Link for Details

6. Proposed Federal Budget 2024: Eligibility for a 30-year mortgage amortization schedule for first-time home buyers of newly built-homes. See Link for Details

Budget 2024 proposes that the capital gains tax inclusion rate increases to 66.7% from the current 50% for capital gains above $250,000. This may impact real estate sales as it is not uncommon for property appreciation to exceed this threshold.

If you own a property and it is vacant for many months, it could be subject to the federal and municipal taxes, such as:

City of Toronto Vacant Home Tax

City of Ottawa Vacant Unit Tax

Please speak with a qualified tax and legal expert before you purchase a second property and understand the programs in place, rules and tax implications.