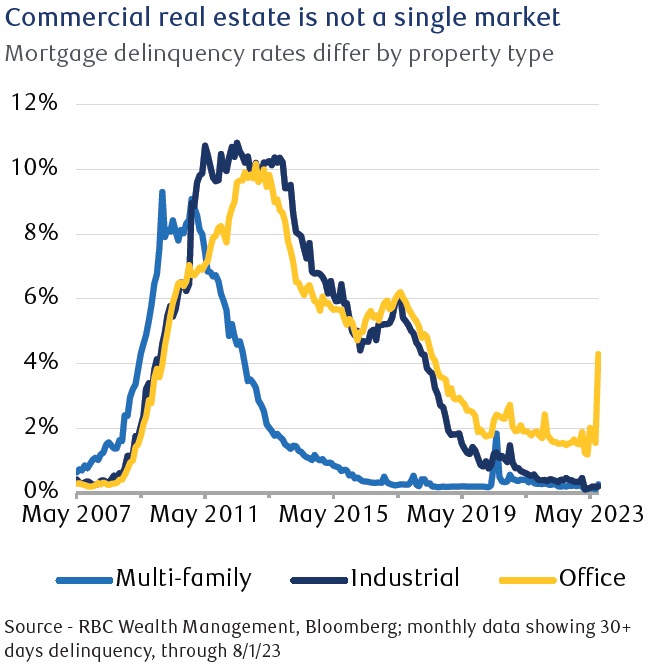

The U.S. commercial real estate (CRE) sector is grappling with a complex web of challenges stemming from the aftermath of the pandemic and rising interest rates. These challenges are reverberating across various property types and regions, with potential repercussions for the broader economy and financial markets.

The CRE landscape is diverse, comprising of different property types, each with distinct supply and demand characteristics. While industrial and warehouse properties have experienced robust demand and stable lease rates, office spaces are having a different experience due to the remote work trend. The prevalence of remote work is driving down office occupancy rates, especially in central business districts, where large office towers are feeling the impact acutely.

The economics of office towers typically hinge on high occupancy rates to cover substantial maintenance costs. However, the pandemic-triggered remote work trend has eroded these occupancy rates, leading to dwindling rental income. Moreover, the upward trajectory of interest rates has compounded the challenges, making refinancing efforts more difficult for property owners. This challenging cycle is exacerbated by tenants who are vacating, which puts further pressure on rental revenues. Attempts to mandate employees back to the office are anticipated to have limited success, as corporations prioritize geographical flexibility to attract talent and continue downsizing office space and costs.

The Case for Resilience

Market adjustments, including price reductions and supply contractions, are becoming customary responses to stabilize the market. While some property owners may face defaults due to excessive debt, new owners have been stepping in with better capitalization to manage properties. However, in some cases, the decline in rental income might render properties unviable under realistic assumptions about demand and rental rates. In such instances, market equilibrium is being restored through the reduction of office space supply. This is reflected in the recent contraction of total office space square footage in the U.S., a phenomenon partly driven by redevelopment efforts that repurpose office spaces for retail, housing, and hospitality.

Despite these challenges, the CRE sector exhibits certain characteristics that contribute to its resilience against broader financial losses. The sheer scale of the CRE market is substantial, estimated at around $20 trillion, however, office space accounts for only $3 trillion of that total. When compared to the estimated $160 trillion in U.S. household assets, the CRE market's challenges appear manageable. Furthermore, investor portfolios generally carry minimal direct exposure to the sector. Even with a substantial allocation to CRE, a complete loss of that holding would only nullify a few months of equity gains in a diversified portfolio.

The banking system’s exposure to CRE is also considered reasonable. The median allocation to CRE loans amongst the largest U.S. banks is relatively modest at 9.3%, with office properties constituting less than 2% of loan portfolios. Additionally, banks typically hold secured positions and would incur losses only if asset values decline significantly. This collective exposure of the banking system, while not negligible, is deemed manageable, with regulatory measures in place to mitigate undue stress.

Potential Risks Around the Corner

However, there are potential risks with broader market implications. Investors who have leveraged their CRE holdings might be compelled to secure additional funds as the value of their commercial securities diminishes. This could trigger a domino effect, prompting the sale of other assets. While this scenario is plausible, the fact remains that CRE holdings form only a fraction of investor portfolios, and most investors are not fully leveraged. This is certainly the case when one sees the record-breaking $5.5 Trillion of money market funds that are held between institutional and retail investors.

Another risk pertains to policy decisions. A proposed increase in lender’s capital requirements could potentially become a risk factor. Declining CRE values could erode current capital ratios, prompting banks to sell assets and drive prices downward, initiating a negative spiral in asset prices. While this outcome is viewed as unlikely, regulators are expected to possess the flexibility to adapt to irrational price swings.

In conclusion, office spaces appear to be singing the “blues” the loudest. However, the sector's inherent diversity, market adjustments, and its relative scale within the broader economy contribute to its resilience. While there are potential risks of broader market implications, the overall outlook suggests that the CRE sector will undergo transformations while finding a way to adapt and weather these challenges. Moreover, despite the trend of remote work, the historical resilience of global cities provides a resilient lens through which to view the ongoing shifts in the CRE landscape.