Critical minerals play a vital role in manufacturing numerous everyday items and are essential for national security, economic growth, and the transition to a greener economy. However, the current supply of critical minerals falls short of meeting future demand, and the majority of mining and processing capacity is concentrated in countries that pose geopolitical risks. This situation has prompted efforts to establish secure and resilient supply chains for critical minerals, and these endeavors have important implications for investment portfolios.

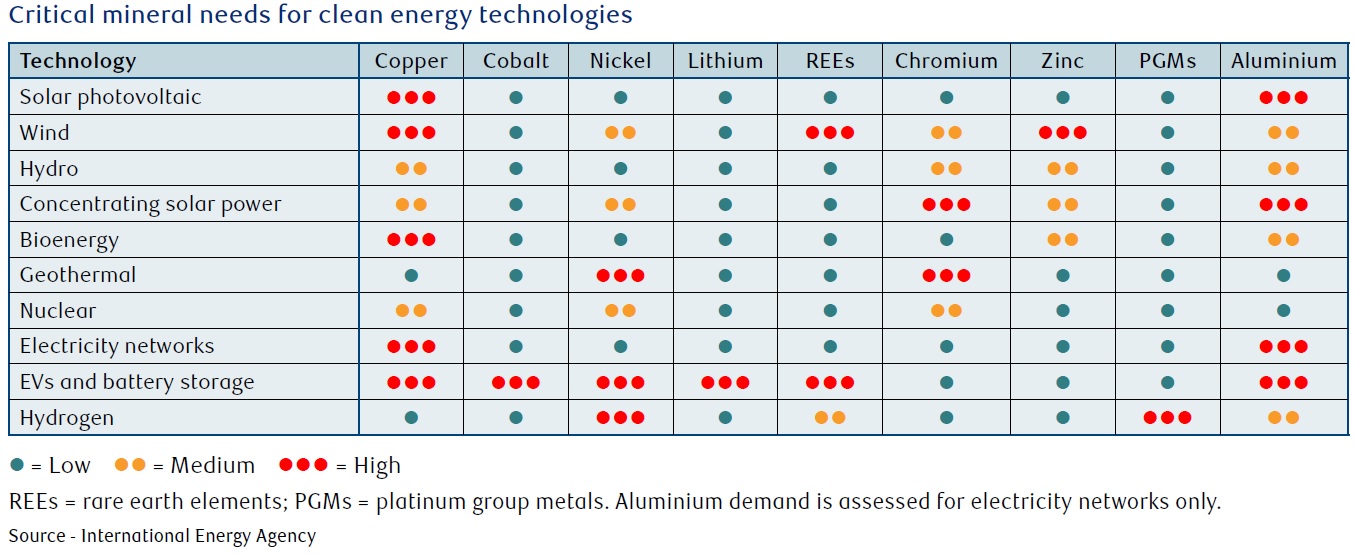

The insufficiency of current supply is a significant challenge. As the demand for clean technologies, such as electric vehicles (EVs), wind turbines, solar panels, and rechargeable batteries, continues to rise, so does the need for critical minerals. According to the International Energy Agency (IEA), by 2040, the greening of the economy alone will require significantly larger quantities of minerals like lithium, graphite, nickel, and cobalt compared to current production levels.

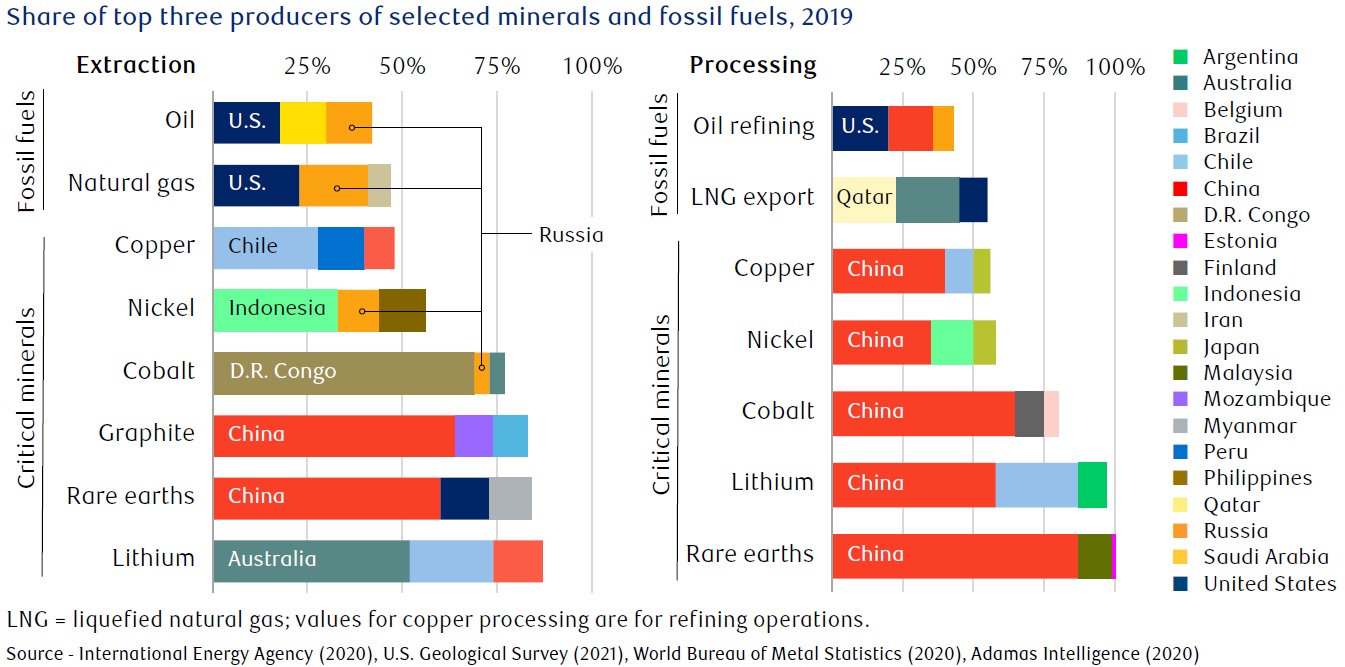

The concentration of mining and processing capacity in geopolitically risky countries further exacerbates the supply chain challenge. Geographical concentration makes these supply chains vulnerable to disruptions, resource nationalism, and the whims of authoritarian regimes. Countries with significant control over critical minerals may impose conditions on their use, manipulate prices, or restrict exports, creating uncertainty and potential disruptions in supply. As reported by the International Energy Agency, investments toward developing critical minerals surged last year by 30% to exceed $40 billion. This outpaces the 20% increase in investments that were made in 2021. This investment was led by China, which raises concerns that Beijing will extend its control of the market for certain materials.

To address the challenge of securing resilient supply chains of critical minerals, several strategies are being pursued:

1. Exploration and diversification: Countries are investing in exploration efforts to discover new deposits of critical minerals within their own territories. By reducing reliance on imports and diversifying supply sources, they aim to enhance the stability and security of their supply chains.

2. Reshoring and friend-shoring: There is a growing trend of relocating mining and processing operations back to the home country or to allied nations. This helps mitigate the risks associated with geopolitical instability in foreign supplier countries.

3. International partnerships: Collaborative initiatives are being established among countries to coordinate efforts and share resources for securing critical mineral supply chains. Partnerships such as the Minerals Security Partnership, involving G7 countries and the European Union, aim to provide financing, attract investment, and engage in diplomatic efforts to ensure stable supply sources.

4. Technological advancements and alternative materials: Research and development focus on finding alternatives to critical minerals or developing technologies that reduce their usage. For example, efforts are underway to create cobalt-free batteries for EVs and explore battery recycling to recover critical minerals from used batteries.

The drive to build secure and resilient critical mineral supply chains carries implications for various stakeholders. Mining companies and suppliers of mining equipment stand to benefit from the increasing demand for critical minerals. Additionally, transportation companies, such as railways, may experience growth as supply chains are reshaped. That being said, it is important for investors to consider the cyclicality and volatility of equity prices in these sectors, as well as the potential negative impact of economic recessions. Although opportunities exist for long-term investors seeking to build their exposure to resources, diversification and investing in well-established and diversified businesses can mitigate risks associated with resource nationalism and geopolitical uncertainties. Speak with your advisor to review the commodity and geographic exposure your holdings provide.