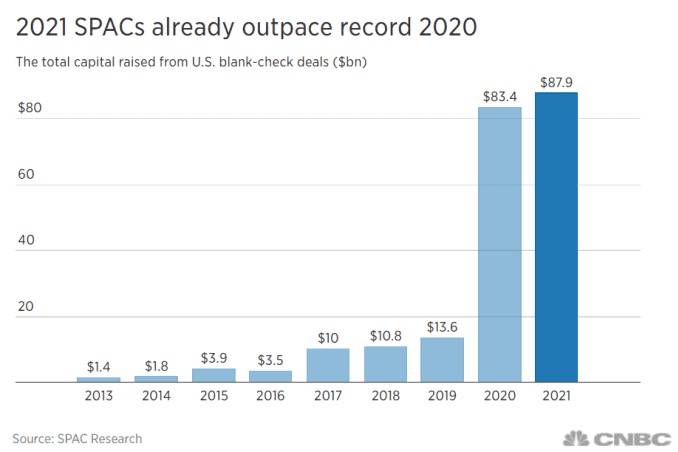

SPACs, Special Purpose Acquisition Companies, have been around for decades, but they’ve only begun gaining traction in 2020. In a year where the Covid-19 pandemic created great uncertainty, private companies looking to raise money and go public used SPACs as an alternative to the IPO process that is traditionally more expensive, more time consuming, and required more in-person marketing. SPACs raised a record $83.4 billion in 2020, with that amount already being surpassed just 3 months into 2021 with $87.9 billion raised.

What is a SPAC?

SPACs are shell companies without any commercial operations. They are formed with the sole purpose of raising capital through an initial public offering (IPO). A SPAC will trade on the stock market with its own ticker symbol. After raising these funds, a SPAC has two years to search for an operational private company to acquire. A private company that agrees to be acquired will thereby receive cash/capital from the SPAC and become a public company since the SPAC that made the acquisition is a public company. Once the deal is closed, the ticker symbol of the SPAC will change to a new ticker symbol that represents the newly acquired company. Examples of popular companies that went public via SPACs include Virgin Galactic, Draftkings, Nikola Motors, and recently WeWork among others.

Generally speaking, the individual founders of the SPAC have expertise in a certain industry and have a key investment thesis focused on that specific sector. Public investors that participate in SPAC IPOs will not have any information about which private companies are being targeted. For this reason, SPACs are sometimes referred to as "blank cheque companies". A degree of speculation is at work here as investors provide capital to a SPAC with hopes that a strong acquisition will be made due to the network and reputation of the SPAC founders. If the SPAC does not complete an acquisition within a 2-year time frame, the SPAC liquidates and must return all raised funds to the investors plus any applicable interest.

Why Should Investor's Care?

SPACs may offer accredited retail investors the opportunity to participate in transactions and deals that are typically reserved for larger institutional investors like private equity funds and hedge funds. However, unlike investing in a true IPO, one is essentially investing in the SPAC founders’ ability to find a strong acquisition target. Although it may seem like a risk-free investment, with funds being returned after two years if no acquisition is completed, there are opportunity costs to having funds locked up for such a long time period. Furthermore, there are no guarantees that the target company will be a success.

There have been many SPAC IPOs that have been met with great exuberance from investors. Even before an acquisition has been announced, some investors have seen prices rise in multiples. This type of price action can only be explained as speculation. However, there are other ways to invest in SPACs that can be more akin to fixed income by making use of the 2-year time frame, where the IPO principal is returned in full if no acquisition is announced. Finally, SPACs also provide arbitrage opportunities if the SPAC price ever falls below the original IPO principal amount. In all, SPACs offer different return profiles depending on one's tolerance for risk.

Alternative investments for retail investors could include SPACs that are professionally managed. There are a variety of managed products out there that include or specialize in SPACs. As always, speak to your advisor about suitability and conduct due diligence on a fund's strategies before investing in these products.