We recently wrote about the contributions to stock market returns – which showed earnings growth as the primary driver of the S&P 500 gains year-to-date. This week we’re taking a ‘pulse check’ to examine the health of corporate revenue and profit growth. With nearly all S&P 500 companies reporting Q3 2025 results (as of November end), the season wrapped up strong: 83% of companies beat earnings estimates and 76% topped revenue forecasts, both well above historical averages.

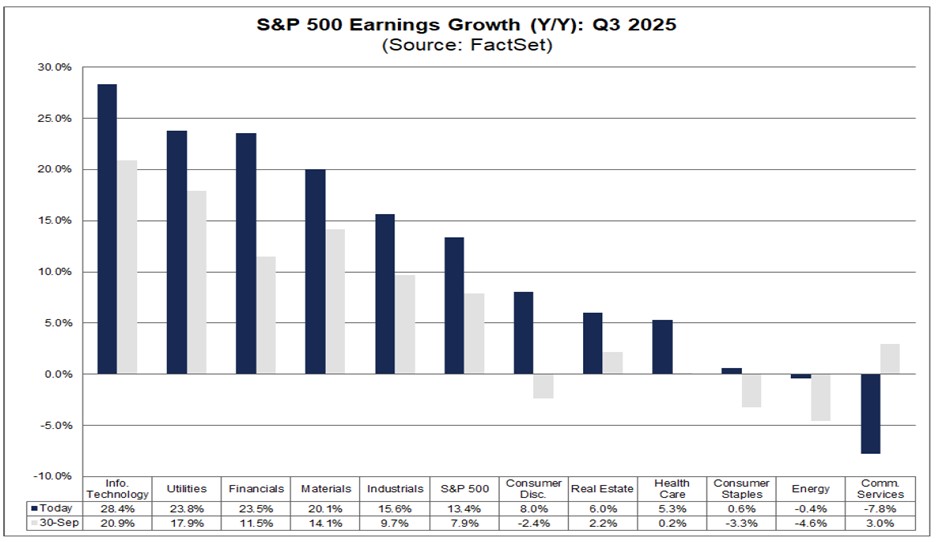

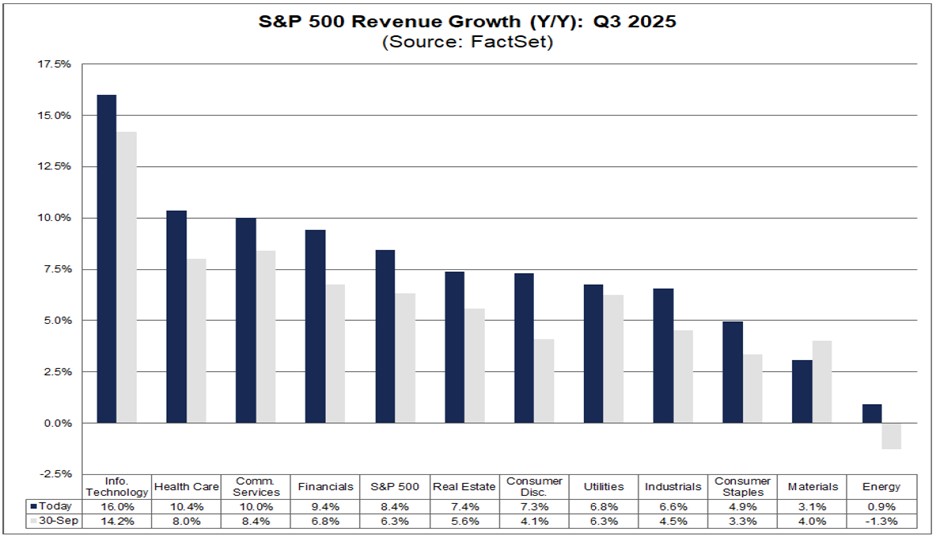

Companies on average reported 13.4% year-over-year earnings growth – the fourth straight double-digit quarter – and 8.4% revenue growth, the best since Q3 2022. Profit margins hit a record 13.1%, signaling companies are keeping more of what they earn.

Growth broadening out

While Tech continued to lead earnings at +28.4%, growth did broaden out to other sectors with Utilities (+23.8%), Financials (+23.5%), Materials (+20.1%), and Industrials (+15.6%) showing healthy gains as well. Communication Services dipped 7.8% due to Meta's one-time tax hit, but excluding it, the sector grew 12%. All 11 sectors grew revenues, with Tech (+16%), Health Care (+10.4%), and Communication Services (+10%) on top.

Looking Ahead for Q4 and beyond.

Of the companies that give forward EPS guidance, 56% of them issued negative EPS revisions for Q4 – which is below the 5-year average of 57%, and 10-year average of 61%. According to Factset data, analysts on average see S&P earnings rising 7.5% in Q4, 11.8% for 2025, and 14.2% in 2026. This level of earnings should provide comfort in market's current health/valuations. With profit margins rising and growth spreading to more sectors, this should bode well for diversified portfolios.