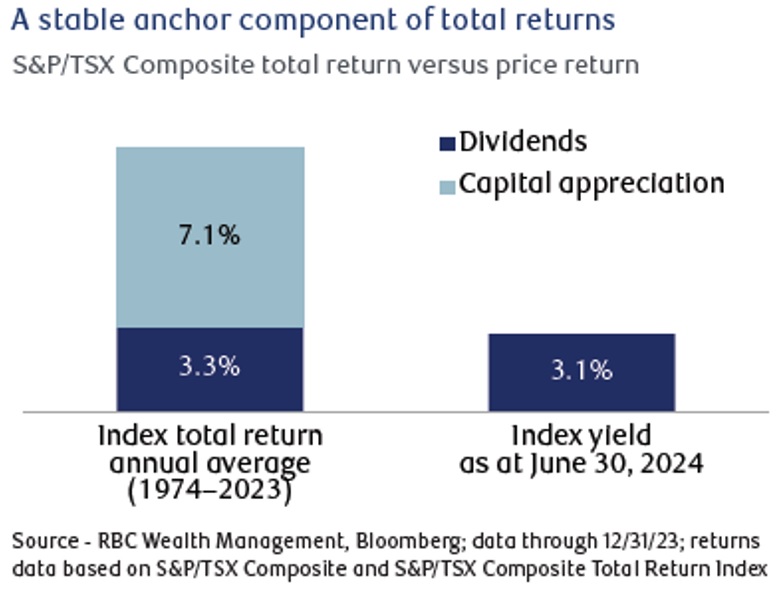

With stock markets making new all-time highs, investors have understandably focused more on capital appreciation as a source of returns. While average dividend yields may seem paltry relative to the annual price gains we’ve seen in some stocks, one should not overlook its contribution to overall returns over time.

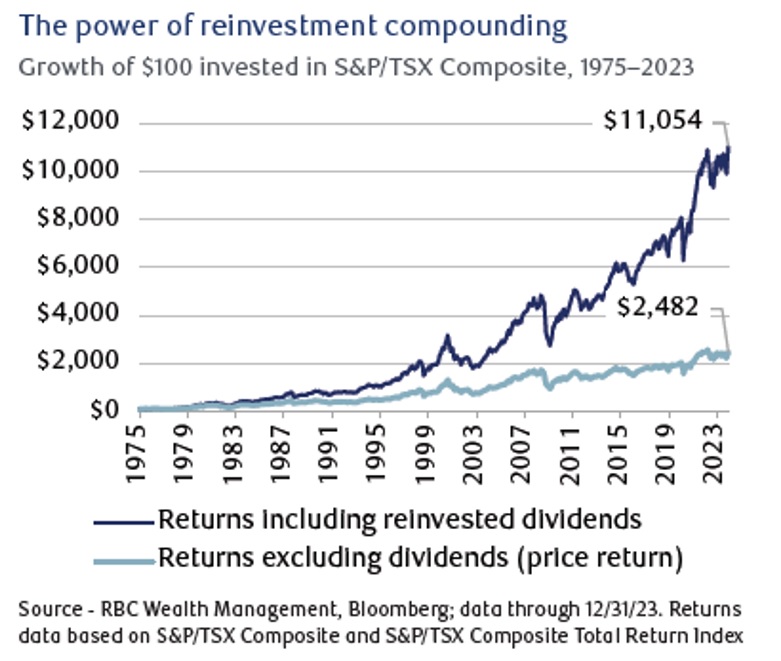

In the last 50 years, dividend income has accounted for an average of 32% of the annual total return for the S&P/TSX Composite. The effect of dividends on equity returns can be further enhanced by reinvesting them. By using these payouts to buy more shares, investors can take advantage of compounding, boosting total returns in the long run.

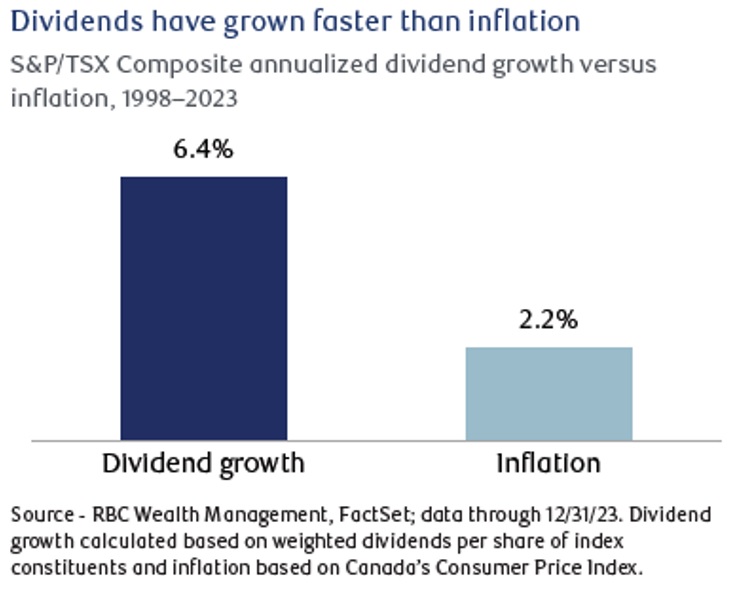

Additionally, dividend-focused investing has historically outperformed inflation. Since 1998, dividends in the Canadian stock market have grown at an annual rate of about 6.4%, compared to 2.2% for inflation.

Versatile Strategies

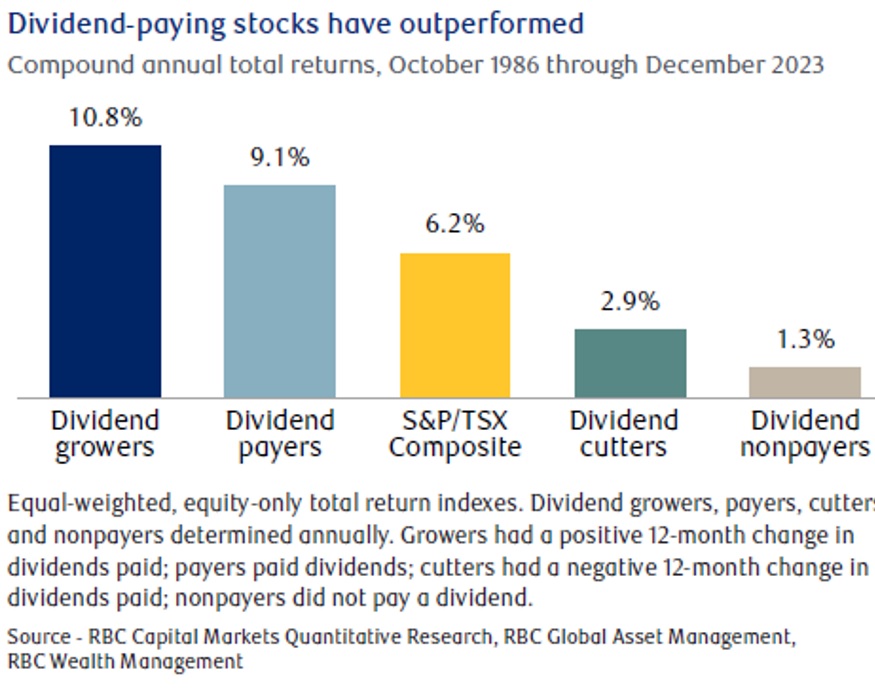

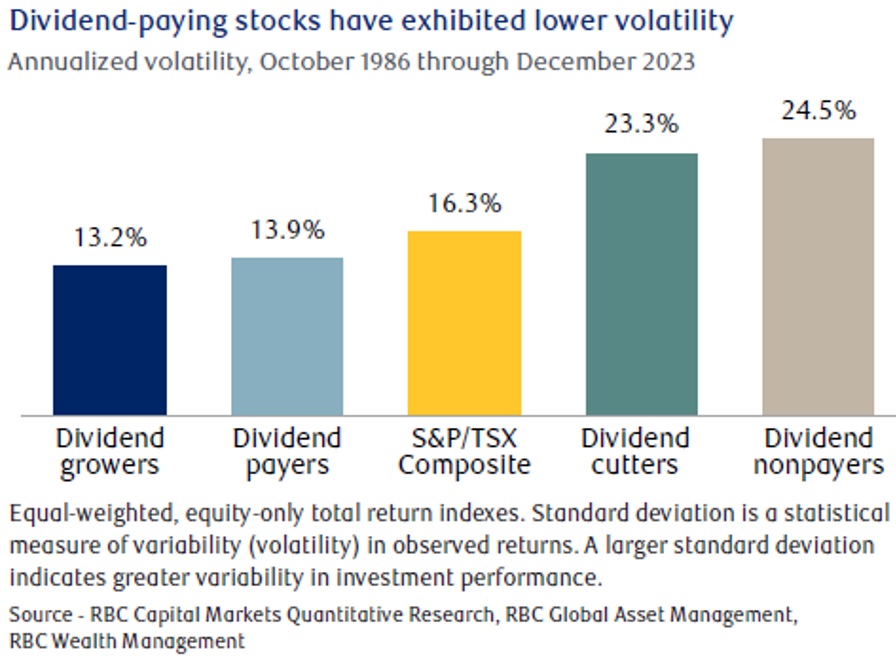

Dividend-paying stocks also provide strategic flexibility and have historically outperformed the broader market with less volatility (as shown in the charts below). The relative stability of dividends can help protect portfolios during times of economic uncertainty and market fluctuations, delivering returns even when stock prices decline.

Depending on investment goals, there are two main approaches to consider: dividend yield and dividend growth. Strategies focused on dividend yield typically target stocks that offer high dividend payouts to meet income needs, while those centered on dividend growth emphasize stocks with higher potential for increasing dividend distributions.

Both approaches have their advantages and can work well together. A balanced strategy that combines above-average current yield with the potential for future income growth allows investors to take advantage of opportunities across the entire range of dividend-paying companies.

Intrinsic Discipline

Investing in companies that are committed to consistent and/or growing dividends naturally help investors seek out important qualities, such as stronger profitability and higher earnings quality. A reliable dividend policy signals management’s confidence in the stability and sustainability of cash flows and future growth prospects. Moreover, it fosters greater capital discipline and risk management awareness within management teams, enhances focus on selecting investment projects, and helps maintain a strong balance sheet.

Like any investment strategy, dividend-oriented portfolios can face significant short-term fluctuations. However, several strategic guidelines can enhance the resilience and quality of these portfolios over time. The selection process for dividend payers/growers should carefully assess business fundamentals, valuations, balance sheet strength, cash-flow generation vs. capex, and long-term returns on capital. Additionally, a well-structured dividend portfolio should aim to balance the appeal of current dividend yields with the potential for dividend growth and the long-term sustainability of payouts, ensuring adequate diversification across sectors and industries.