The new year brings a fresh start to investors. A new scorecard is brought out, the shot clock is reset, and the drawing board is wiped clean. If 2024 was going to be anything like 2023, we will be subject to narrative twists that bring about both frustration and jubilee.

If we rewind 365 days earlier, the market felt pretty confident about how the year would turn out. 2023 was to be the year of misery, with the economy plummeting into recession, consumers losing their jobs while running out of savings, and inflation would remain elevated, which would lead the Fed to continue its’ rate hiking campaign. As a result, stocks would face tremendous headwinds with the brunt being felt by growth and technology stocks, thereby continuing the decline that began in 2022. At the time, these prognostications seemed obvious. Afterall, it was unanimous, right?

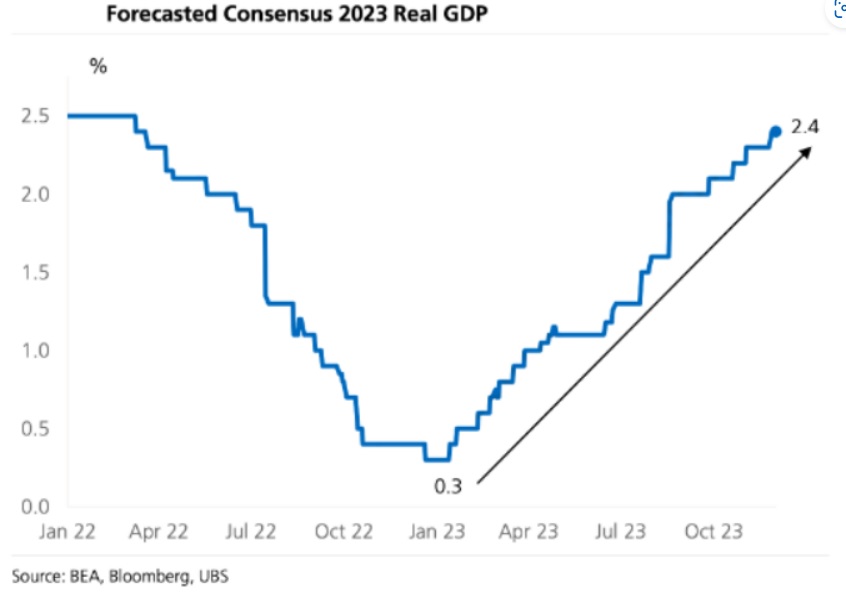

However, as it so often occurs, the actual results were the opposite. Almost immediately after turning the page to the new calendar year, the consensus 2023 GDP forecast experienced continual upgrades. The labour market remained tight and wage gains remained healthy, which allowed consumers to continue spending. Inflation actually declined at a pace much faster than expected, forcing the Fed to acknowledge that they were at the end of the rate hiking cycle. Moreover, with yields beginning to reflect a softening tone from the Fed and with resilient corporate earnings, the stock market, led by no other than the technology sector, staged an impressive recovery.

Stock markets can be extremely humbling. What 2023 taught investors was that one cannot hang their hats on the headlines they read in January or deem the consensus view as gospel. Ultimately, facts change, expectations are challenged and the market narrative can shift. This requires investors to be tactical and humble enough to change their portfolio strategy.

More importantly, the market requires one’s constant participation if long term gains are to be had. Unfortunately, the cost of admission is to accept that there will be uncomfortable drawdowns. With that said, the economy has never experienced the apocalypse that is so frequently predicted by the chorus of doomsayers. We simply have a Fed that is too eager to step-in and a Corporate America that is too nimble for drawdowns to be extrapolated forever. At the same time, waiting for the “dust to settle” before investing is also an impossible task as the market so often never lets you back in with an ‘all clear’ signal. Every tick lower reflects the process of interpreting whether enough changes have been made in corporate and government circles to lead to a better future. The verdict often comes in without anyone noticing, and the pendulum swings back higher before the better future becomes a reality.

Currently, the consensus is less extreme in its’ views compared to last year. Perhaps 2023 has truly humbled the myriad of strategists and market prognosticators. Speak to us at the start of this new year, to review how your portfolio should be positioned in a year, where like in so many years, anything can happen.